Coinbase CEO Brian Armstrong unexpectedly turned his Q3 earnings call into a real-life meme economy — resolving over $84,000 in prediction market bets by blurting out a list of crypto buzzwords seconds before the call ended.

When an Earnings Call Becomes a Betting Jackpot

During Thursday’s Q3 earnings call, Armstrong paused mid-discussion to mention several key crypto terms — “Bitcoin, Ethereum, blockchain, staking, and Web3” — all of which were listed in ongoing Kalshi and Polymarket prediction markets that speculated on which words he’d say.

His impromptu comments instantly resolved the bets to “Yes” across both platforms, handing out roughly $80,000 on Kalshi and $3,900 on Polymarket in winnings.

“I was a little distracted because I was tracking the prediction market about what Coinbase will say in their next earnings call,” Armstrong joked. “Just want to make sure we get those in before the end of the call.”

“Spontaneous,” Armstrong Says — But Market Shock Follows

The Coinbase CEO later clarified the incident on X (formerly Twitter), saying it was completely spontaneous after someone from his team dropped a link to the market in their internal chat.

“lol this was fun — happened spontaneously when someone on our team dropped a link in the chat,” Armstrong posted.

While most traders celebrated, others raised questions about the ethics of participating or responding to markets tied to corporate communication, even if done jokingly.

Prediction markets are designed to crowdsource probabilities around real-world outcomes — but as this incident showed, a single insider remark can instantly distort results, blurring the line between fun and fairness.

Crypto Fans Loved It

Reaction online was overwhelmingly amused.

On Polymarket, one user wrote:

“HAHAHAH THE GOAT BRIAN.”

Another added:

“Thanks for the free money, boss.”

Kalshi traders similarly thanked Armstrong for the “gift,” with many calling it one of the most entertaining corporate moments of 2025.

Coinbase Q3 Results Overshadowed by Viral Moment

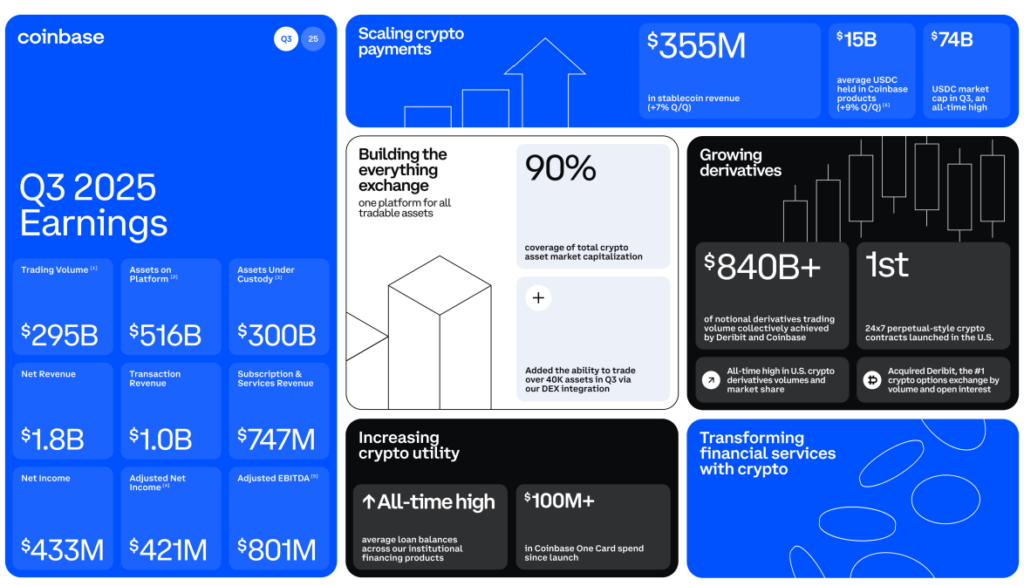

The buzz came after what was otherwise a solid earnings report for Coinbase.

The company posted $1.9 billion in revenue, up 55% year-over-year, and $432.6 million in net income — marking another profitable quarter amid a broader crypto rebound.

Coinbase also increased its Bitcoin holdings by 2,772 BTC, bringing its total to 14,458 BTC, according to BitcoinTreasuries.net, putting it back among the top 10 corporate Bitcoin holders globally.

Market Manipulation or Just Humor?

While most interpreted Armstrong’s move as lighthearted, some legal and trading experts noted that this kind of action — however innocent — highlights a potential gray area for companies as prediction markets become more mainstream.

Unlike traditional stock or options markets, Kalshi and Polymarket allow users to wager on real-world outcomes, from political events to corporate behavior.

That opens new ethical questions if insiders — or their spontaneous remarks — directly influence those results.

Coinbase’s Q3 earnings call may have closed with a laugh, but it also exposed how easily crypto’s playful culture collides with real financial consequences.

In a market where memes move billions, even a CEO’s offhand comment can become an $84,000 event.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.