President Donald Trump has announced plans to impose tariffs on imported automobiles starting around April 2, 2025. This move is part of a series of trade actions aimed at protecting domestic industries and addressing perceived trade imbalances. The proposed tariffs are expected to have significant implications for the automotive industry and the broader economy.

Details of the Tariff Announcement

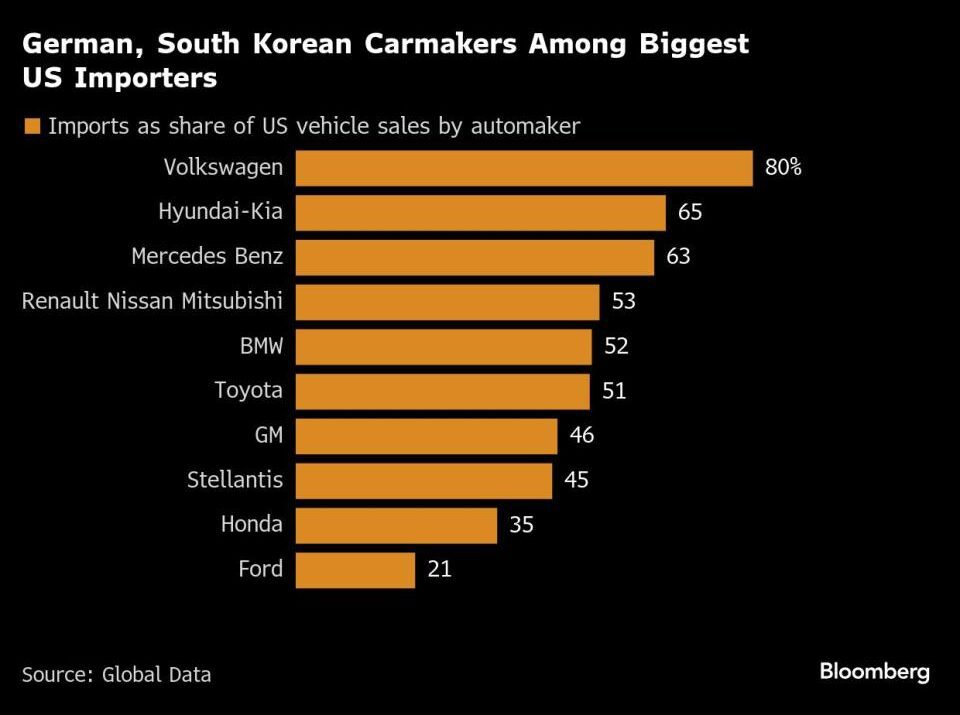

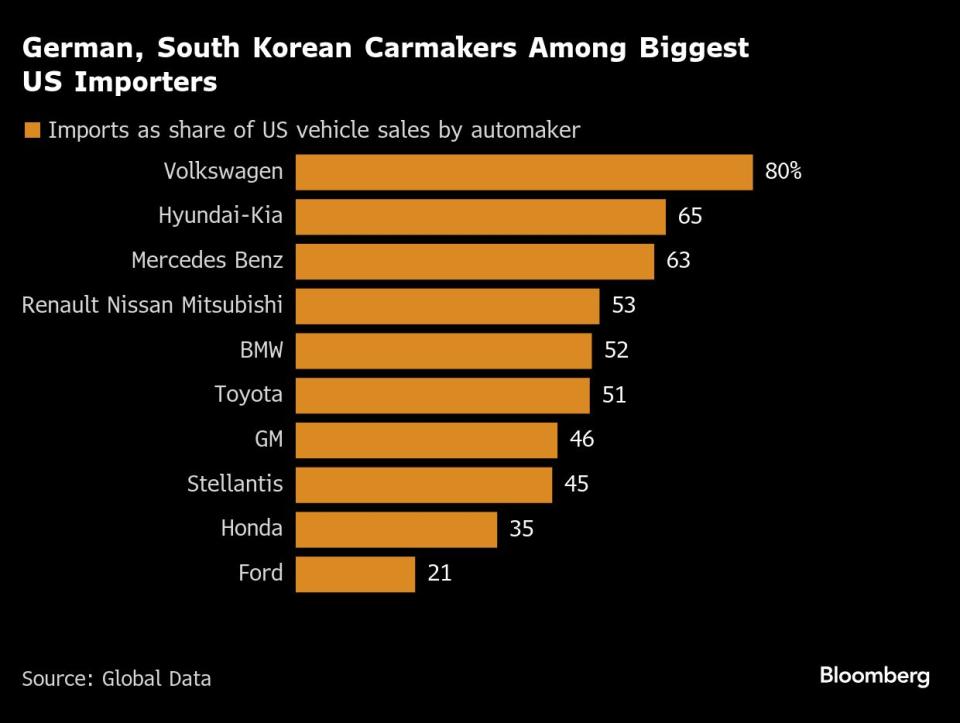

During a recent Oval Office ceremony, President Trump indicated that the tariffs would target imported cars, with specifics on affected countries yet to be disclosed. Major automobile exporters to the U.S. include Mexico, Japan, Canada, and South Korea. The President emphasized that these measures aim to level the playing field for American automotive manufacturers, citing disparities such as the European Union’s 10% tariff on U.S. vehicles compared to the U.S.’s 2.5% tariff on European cars.

Potential Impact on the Automotive Industry

The introduction of auto tariffs could have far-reaching effects on both domestic and international car manufacturers:

- Increased Production Costs: Automakers relying on imported components may face higher production costs, leading to potential price increases for consumers. Ford CEO Jim Farley has expressed concerns, stating that such tariffs could introduce significant costs and chaos into the industry.

- Supply Chain Disruptions: The global nature of automotive supply chains means that tariffs could disrupt the flow of parts and vehicles across borders, affecting manufacturing efficiency and timelines.

- Market Uncertainty: The announcement has already led to uncertainty in the markets, with potential implications for stock prices of major automakers and related industries.

Broader Economic Implications

Beyond the automotive sector, the tariffs could influence the broader economy:

- Trade Relations: Imposing tariffs may strain relationships with key trading partners, potentially leading to retaliatory measures and escalating trade tensions.

- Inflationary Pressures: Increased costs for vehicles and parts could contribute to broader inflation, affecting consumer purchasing power and overall economic growth.

Market Response

Following the announcement, shares of major automakers have shown varied reactions. For instance, Ford Motor Co. (F) is currently trading at $9.48, reflecting a slight increase of 0.013% from the previous close. General Motors Company (GM) stands at $48.37, up 0.0099%. Investors are closely monitoring these developments, as the full impact of the proposed tariffs will unfold in the coming weeks.

As the April 2 implementation date approaches, stakeholders across the automotive industry and the economy at large are assessing the potential impacts of the proposed auto tariffs. The situation remains dynamic, with ongoing discussions and potential negotiations that could influence the final outcome.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

The stock market just won’t crack. Bulls say it’s time for a breakout to new highs

Schwab reports GME stock price above $40,000 in latest glitch: Naked short-selling manipulation?

Javier Milei just DESTROYED market: Are meme coins officially DEAD?

Trump’s 25% Tariffs on Steel & Aluminum: What It Means for Stocks