Bitcoin (BTC), the world’s leading cryptocurrency, has extended its rally, soaring above $65,500 and reaching an intra-day high of around $66,000. This surge is linked to growing optimism about Donald Trump’s potential victory in the November election and the upcoming trading of spot Ether ETFs.

Bitcoin Price Soars: Factors Driving the Bullish Trend

At the time of writing, the global crypto market cap stands at $2.37 trillion, up 3.44% in 24 hours. Bitcoin’s rise is supported by reduced selling pressure from Mt. Gox’s BTC sales and net positive BTC ETF inflows, indicating strong demand.

Northern Data AG’s €214 Million Capital Raise

European Bitcoin mining firm Northern Data AG plans to raise €214 million by issuing 10.7 million new shares at €20 each. This funding will expand its cloud platform and data centres in Europe and the U.S., bolstering its Bitcoin mining and AI capabilities.

US Dollar and Federal Reserve Rate Cuts Impact on Bitcoin

The US dollar remains strong despite expected interest rate cuts by the Federal Reserve. Fed Chair Jerome Powell hinted at potential rate reductions to lower borrowing costs, which could make Bitcoin more attractive as the dollar weakens.

Bitcoin Price Prediction

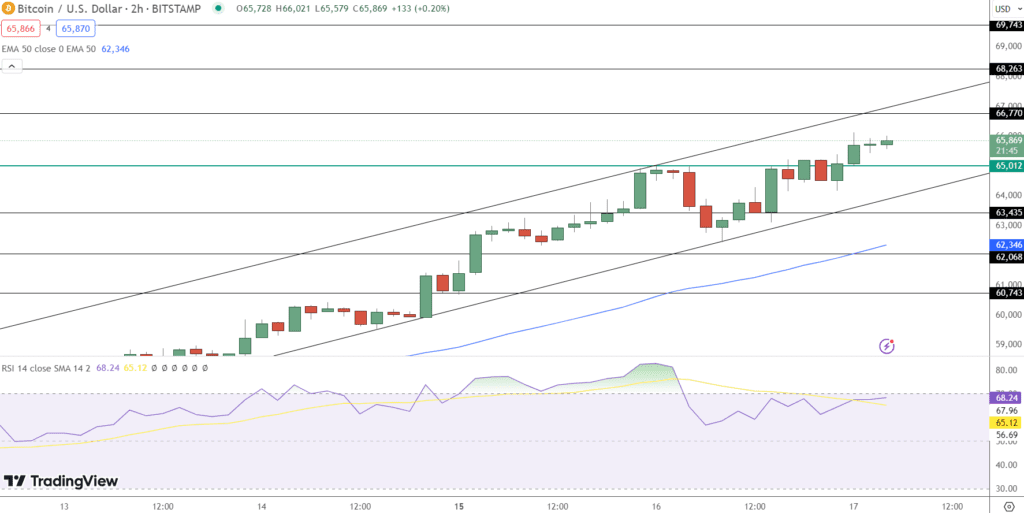

Currently trading at $65,870, Bitcoin shows a strong bullish trend. Key resistance levels are at $66,770, $68,260, and $69,740, with support at $65,010, $63,440, and $62,070. Technical indicators suggest continued upward momentum.