After years of Big Tech stocks dominance, 2026 is rewarding investors who did the opposite.

Fund managers who reduced exposure to large technology stocks are outperforming at the strongest rate since 2007, according to data from Goldman Sachs. Nearly 60% of large-cap mutual funds are beating their benchmarks this year, helped by weak returns from megacap tech names.

Market Rotation Is Changing the Rules

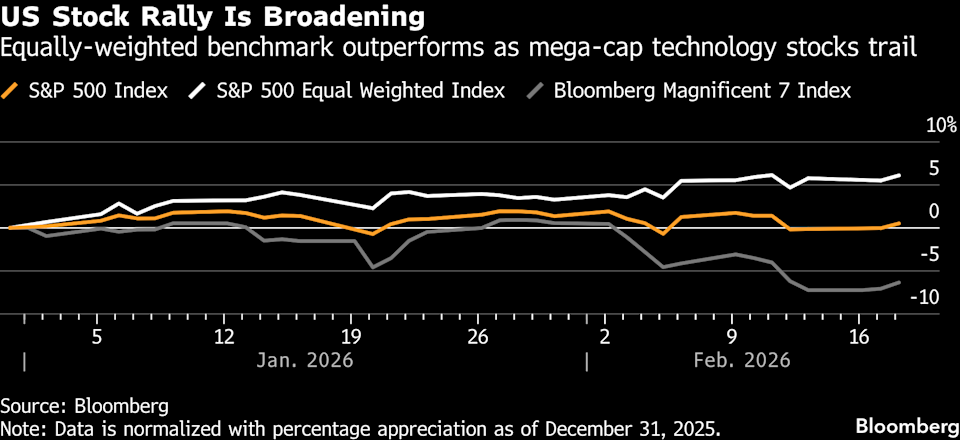

The S&P 500 has been mostly flat early this year, but beneath the surface leadership has shifted dramatically:

- Tech sector down more than 4%

- Energy and materials up 15%+

- Consumer staples up about 13%

- Financials and discretionary stocks lagging

This widening gap between winners and losers, known as dispersion, has climbed to the 93rd percentile since 1980, creating ideal conditions for active managers to outperform.

Breadth Is Expanding

Roughly 66% of S&P stocks trade above their 100-day average, and the equal-weight S&P index recently hit a record. That signals gains are spreading beyond the handful of megacap companies that drove markets for years.

Historically, broader participation has been one of the strongest drivers of active fund success.

Why Tech Is Losing Momentum

Several forces are weighing on tech leadership:

- Concerns that AI could disrupt software and professional services

- Valuation worries after years of outsized gains

- Investors rotating into cheaper cyclical sectors

- Rising uncertainty over interest-rate policy from the Federal Reserve

The tech-heavy Nasdaq Composite is down about 1.5% this year, while value sectors have rallied.

Strategists at JPMorgan say the shift is actually healthy because it reflects a broadening recovery rather than dependence on a small group of stocks.

Investors Are Repositioning

Data tracked by Bank of America shows clients have poured money into consumer staples at the fastest pace since 2008 while selling tech in most recent weeks.

Active funds are now most overweight industrials and financials and most underweight information technology. Cash levels have dropped to record lows near 1.1%, signaling investors remain risk-on but selective.

The market is not abandoning tech entirely, but leadership is shifting. For the first time in years, diversification away from megacap technology stocks is not just defensive. It is outperforming.

Related: From ‘Buy America’ to ‘Bye America’: Is Wall Street Losing Its Global Edge?