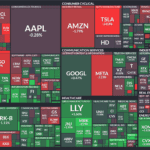

Asian shares dropped on Monday, reflecting investor caution following Wall Street losses and rising concerns about global interest rate hikes. As reported by Yahoo Finance, the downturn underscores the persistent volatility in global markets as economic uncertainty looms.

Key Developments

1. Asian Market Performance

- Japan’s Nikkei 225: Declined by 1.2%, impacted by weak tech stock performance and concerns over U.S. interest rate hikes.

- Hong Kong’s Hang Seng: Fell by 1.4%, driven by losses in property and tech sectors.

- China’s Shanghai Composite: Dropped 0.8%, with investors worried about slowing domestic growth.

- South Korea’s KOSPI: Lost 1%, reflecting a broader sell-off in semiconductor and automotive stocks.

2. U.S. Market Influence: Wall Street’s weak close on Friday weighed heavily on Asian markets. The S&P 500 fell 0.7%, while the Nasdaq dropped 1.2%, driven by concerns over higher interest rates and mixed economic data.

3. Interest Rate Concerns

- Global Rate Hikes: Central banks in the U.S., Europe, and Asia have signaled the possibility of further interest rate hikes to combat inflation.

- Impact on Stocks: Higher rates have increased the cost of borrowing, pressuring corporate earnings and valuation expectations.

Sector Performance Highlights

| Sector | Performance | Reason |

|---|---|---|

| Technology | Declined across Asia | Weak semiconductor demand and rate concerns. |

| Real Estate | Sharp losses in China | Ongoing property market struggles. |

| Consumer Goods | Mixed results | Resilient domestic spending in some regions. |

Market Outlook

Short-Term Trends: Investors are closely watching U.S. economic indicators, including jobs and inflation data, to gauge the Federal Reserve’s next moves. Asian markets may remain under pressure if global rate hike expectations persist.

Long-Term Opportunities: Despite current volatility, analysts point to long-term opportunities in emerging markets, particularly in technology and green energy sectors.