Investor anxiety over a potential AI bubble is fueling a sharp rise in trading of specialised credit derivatives tied to major technology firms, as markets look for ways to hedge against the risk that heavy borrowing could strain balance sheets.

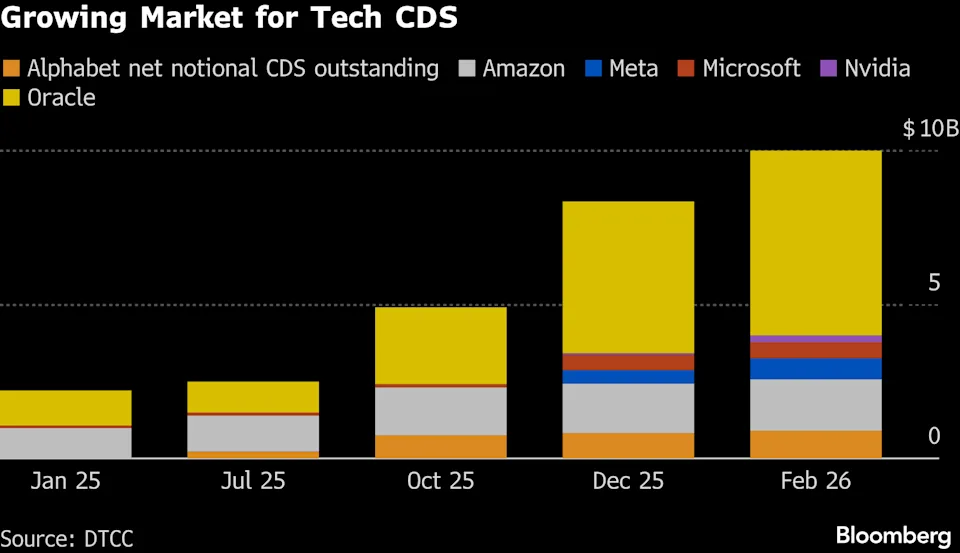

Data from the Depository Trust & Clearing Corp. shows that single-company credit derivatives linked to top tech borrowers have quickly become some of the most actively traded contracts in US credit markets outside the financial sector. A year ago, many of these instruments barely existed.

Activity has accelerated especially for debt tied to Alphabet Inc. and Meta Platforms, with roughly $895 million and $687 million in outstanding contracts respectively. Trading tied to Oracle Corp. has also been active for months.

Analysts say the surge reflects growing concern that Big Tech borrowing could balloon as companies race to dominate artificial intelligence. Investors estimate global AI build-out costs could exceed $3 trillion, much of it financed through debt.

“This hyperscaler trend is enormous,” said Gregory Peters of PGIM Fixed Income, noting investors are increasingly reluctant to remain unhedged against potential credit deterioration.

Banks themselves are also buying protection. Institutions underwriting massive loans for data centers and AI infrastructure are hedging exposure while they distribute those loans, according to executives at Bank of America.

Borrowing is expected to accelerate. Morgan Stanley estimates hyperscaler debt issuance could reach $400 billion in 2026, up sharply from about $165 billion in 2025. Alphabet alone plans up to $185 billion in capital expenditures this year.

Still, not everyone sees danger. Some hedge funds, including those tied to Saba Capital Management, are selling credit protection instead, betting that trillion-dollar tech giants will remain stronger than the broader corporate credit market even in downturn scenarios.

Others remain cautious. Portfolio managers at Aegon Ltd. warn that the sheer scale of potential borrowing could eventually pressure credit quality if returns from AI investments fail to keep pace.

Wall Street is not abandoning the AI boom, but the rapid growth of derivatives tied to tech debt signals that investors are increasingly preparing for the possibility that the sector’s spending race may carry hidden financial risks.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Russia–US Dollar Return Shock: Did One Headline Reset Global Markets?