📢 Gold Demand Hits Record High in 2024! According to the World Gold Council (WGC), global gold demand reached an all-time high by the end of 2024, fueled by strong central bank purchases, which surged significantly in Q4 2024.

What is happening with gold?

Gold is telling us something: Amid the DeepSeek volatility, gold quietly hit a record high, now up +35% in 12 months.

Today, gold prices are surging toward $2,900/oz with YTD gains nearly DOUBLING the S&P 500’s return.

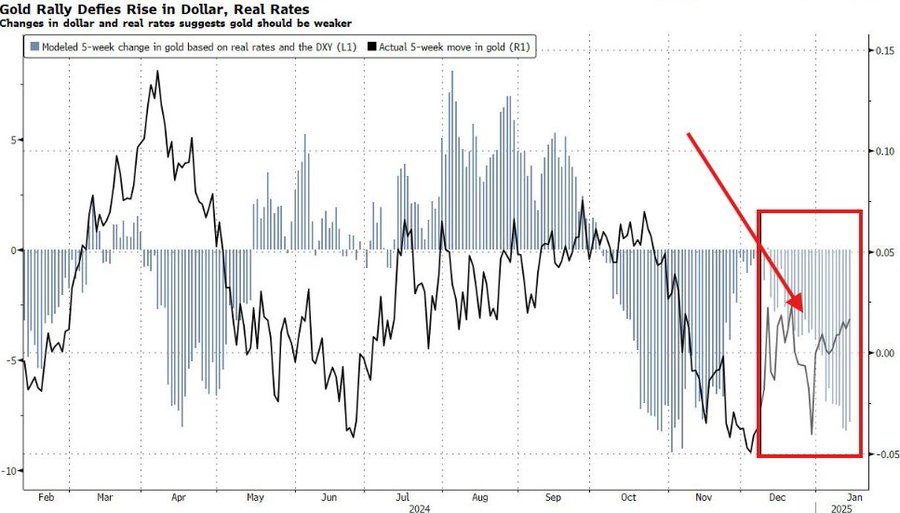

Gold prices have risen in a straight-line higher, even as volatility shook the S&P 500. In fact, even as the US Dollar hit a new 52-week high and the 10-year note yield broke 4.80%, gold surged. Historically speaking, gold should be down sharply. The opposite is happening.

The last 12 months have been exceptionally strong for both the 10-year note yield and the US Dollar, $DXY. Meanwhile, gold has gained 5 TIMES the return of $DXY and soared with interest rates. Gold is a zero-yield asset which historically FALLS in high rate environments.

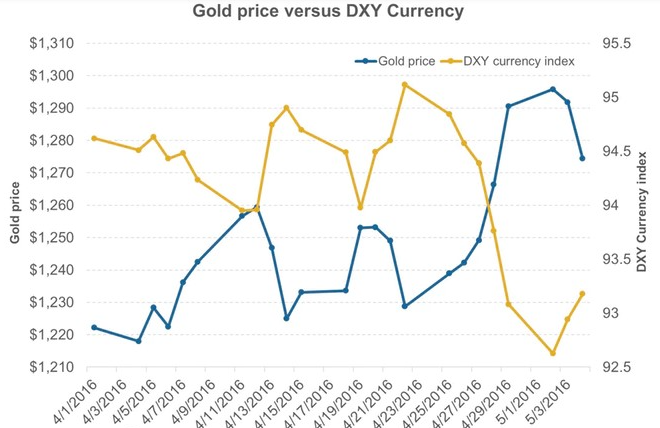

As seen in this chart from 2016, the US Dollar, $DXY, and Gold typically move inversely. A stronger US Dollar makes buying gold more expensive for foreign investors. Even with inverse indicators rising, gold continues to make record highs. Gold is pricing-in uncertainty.

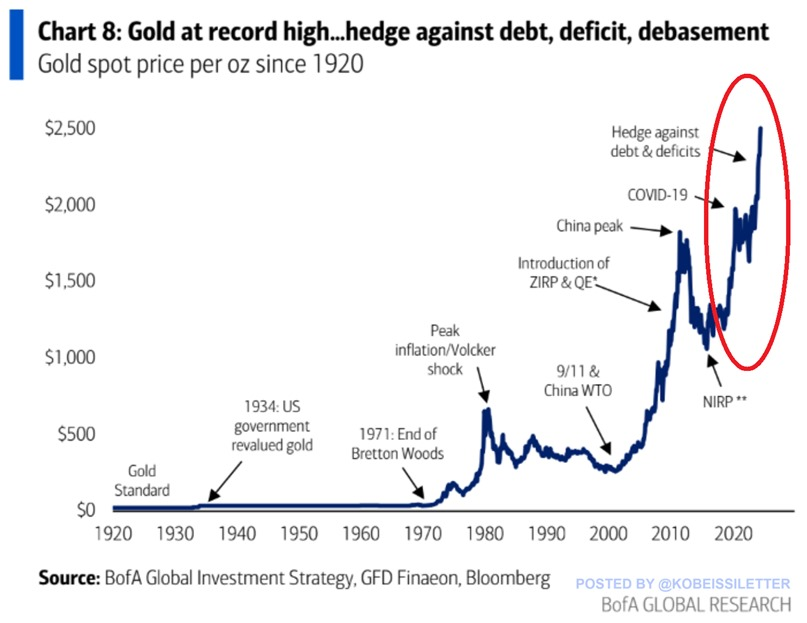

As China deals with deflation, the US deals with inflation and record deficit spending. Deficit spending has driven bond yields higher, due to the need to issue more government bonds. So, even with higher yields, gold is pricing in more inflation and a deficit spending crisis.

Gold’s relative strength is only getting stronger as we approach tomorrow’s Fed meeting. Broader equity market volatility is pushing gold prices higher along with uncertainty around rates. Due to rising deficit spending, gold is becoming THE global safe haven trade.

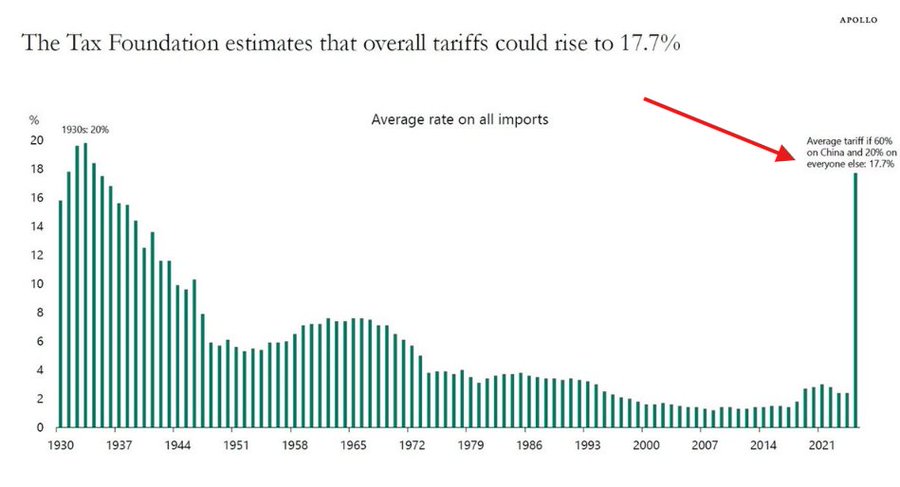

Furthermore, markets are pricing-in the trade war that has likely already begun. The Tax Foundation estimates that if 60% tariffs are imposed on China and 20% on everyone else, the average tariff rate will increase to 17.7%. Inflation would jump by ~0.5 percentage points.

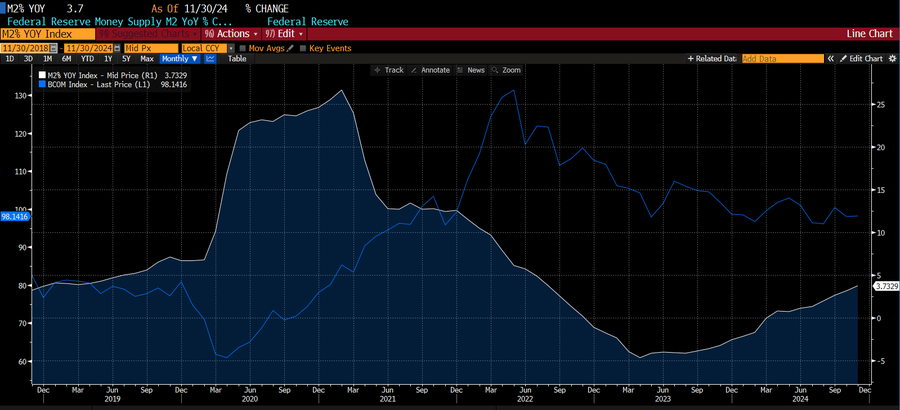

Lastly, US money supply growth now at a fresh 27-month high. This has driven ALL commodities higher and added more fuel to the inflationary fire. And, if the US Dollar Index begins to finally pull back, foreign investment in gold is set to rise.

We expect macroeconomic factors impacting gold to drive equity, bond, and commodity markets this year. Markets are already off to a volatile start.

2024 marked the best year for gold since 2010. As seen below, inflation adjusted gold prices are now at levels now seen since the 1970s.

Source: TKL

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

What Analysts Think of Amazon Stock Ahead of Earnings: Prediction

Trumpiverse: Ranking Trump’s Inner Circle

Is AMD is next Intel? An In-Depth Analysis

Is Palantir Proving to be the Dark Horse AI Stock?

Here is why stock market will be HIGHLY tradable: More volatility is coming

Markets are in one of their greatest trading environments of all time. Want to capitalize on it?

Has a new era begun? Investors have never been so optimistic…

Does Billionaire Warren Buffett Know Something Wall Street Doesn’t?

Earnings Calendar for This Week For Biotechs, Pharma And Econ, Plus Amazon And Alphabet