Now that the split has taken effect, will Nvidia’s stock ever get back to where it was?

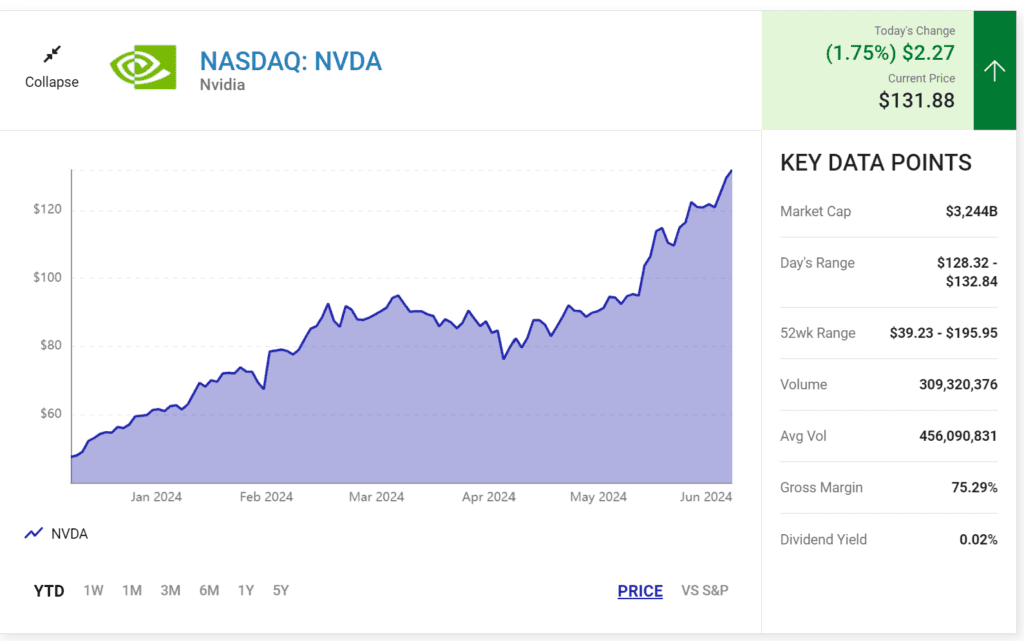

Nvidia (NASDAQ: NVDA) shares are nearing a $3 trillion valuation, making it the third-largest company globally. The semiconductor giant, a leading provider of AI chips, recently saw its stock rise to $1,200 per share, marking a 700% increase since the release of ChatGPT-3. However, the company initiated a 10-for-1 stock split, making shares more accessible by lowering the price to around $130 each.

Impact of the Stock Split

While the stock split doesn’t change the overall value of investments, it makes Nvidia shares more accessible to smaller investors. This strategic move could boost the stock’s appeal, similar to Apple’s trajectory, which saw significant growth after its valuation milestones.

Nvidia’s Stock Future Growth Prospects

Nvidia’s growth might slow down, with the AI market projected to grow at a compound annual rate of 28.5% through 2030. This suggests Nvidia could reach its previous high of $1,200 per share in about nine years. However, this assumes consistent market growth and Nvidia maintaining its valuation relative to earnings.

Nvidia’s Stock Challenges and Competition

Nvidia currently dominates the AI chip market with an 80% share, benefiting from substantial profit margins. However, competition from Intel, Advanced Micro Devices (AMD), and major tech companies like Alphabet, Microsoft, and Amazon could challenge Nvidia’s market position. These rivals are investing heavily in developing their own AI hardware, which could reduce Nvidia’s market dominance.

Nvidia’s future remains promising, with the potential to reach $1,200 per share again, but likely not as quickly as in the past three years. A decade-long timeline for this growth seems more reasonable, reflecting a robust, albeit slower, trajectory. Investors should temper expectations and focus on sound investment decisions amidst the AI market’s evolving landscape.