The stock market struggled as stronger-than-expected economic data raised concerns about the Federal Reserve’s interest rate path. November job openings reached 8.1 million, surpassing the 7.7 million forecasted by economists, according to FactSet. Additionally, the ISM Services PMI for December came in at 54.1, above the expected 53, signalling strength in the services sector, regarding Barrons.

The positive economic indicators sent bond yields higher, with the 10-year Treasury yield rising to 4.681%, its highest level since April, and the 30-year Treasury yield hitting 4.908%, its highest since November 2023. The 2-year Treasury yield also climbed to 4.306%, reflecting the market’s anticipation of prolonged monetary tightening.

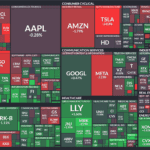

As a result, the S&P 500 fell 0.3%, reversing early gains, while the Nasdaq Composite dropped 1%, driven by declines in tech stocks sensitive to higher rates, including Tesla. Meanwhile, the Dow Jones Industrial Average, which is less reliant on Big Tech, rose slightly by 85 points, or 0.2%.

Analysts noted that the strong data reduces the likelihood of the Fed resuming rate cuts anytime soon. Tom Essaye of Sevens Report Research remarked, “The market is becoming increasingly sensitive to data that supports the Fed holding or even delaying further rate cuts.” The rising yields and stronger dollar are acting inversely to stock prices, adding to the market’s challenges.

Despite signs of strength, some data, such as a decrease in the quits rate to 1.9%, suggest mixed signals in the labor market. Investors are now awaiting Friday’s non-farm payroll report for additional clarity on inflation and labor market trends, which could further influence the Fed’s policy trajectory.

The latest developments leave markets balancing between resilience in economic indicators and the fear of prolonged monetary tightening, creating a challenging landscape for stocks.