President-elect Donald Trump is expected to designate Bitcoin as a U.S. reserve asset via an executive order on his first day in office. The proposed move could involve a substantial purchase of Bitcoin under the Dollar Stabilization Act, with speculation centring on the acquisition of 200,000 BTC annually over five years. This policy, proposed in the 2024 Bitcoin Act by Senator Cynthia Lummis, aims to accumulate 1 million BTC, or 5% of Bitcoin’s total supply, and hold it for at least 20 years.

- Jack Mallers, CEO of Strike, anticipates a significant Bitcoin purchase on “day one” of Trump’s presidency, reinforcing the administration’s pro-crypto stance.

- Perianne Boring of The Digital Chamber suggests Bitcoin’s price could exceed $800,000 by 2025 due to increased demand and Bitcoin’s capped supply.

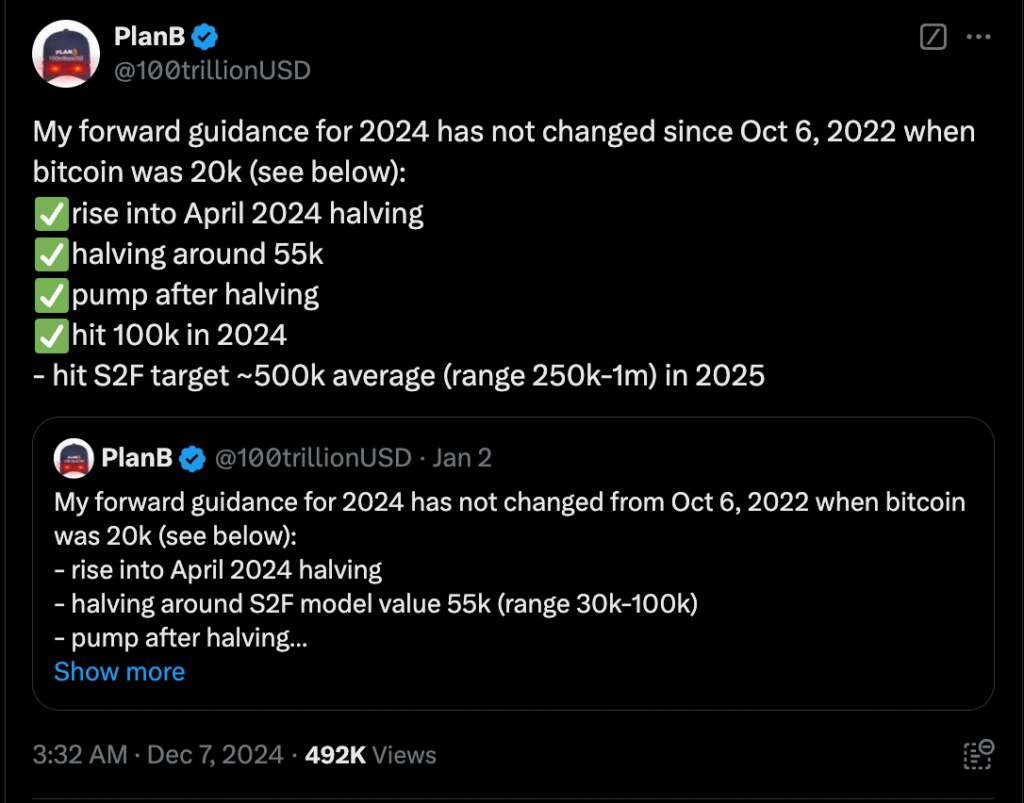

- PlanB, the creator of the stock-to-flow model, predicts Bitcoin to average around a $500,000 valuation across 2025. However, he said that the price may go as high as $1 million.

- BlackRock advocates for 1-2% portfolio allocation to Bitcoin, aligning with potential demand from institutional investors and global reserve managers.

- If global reserve allocations reach 2%, Bitcoin’s price could theoretically hit $900,000, according to BlackRock executives.

Such a policy could trigger a domino effect, encouraging other nations to consider Bitcoin reserves and significantly boosting BTC’s market valuation.