Pay with cryptocurrency has become increasingly popular as more merchants accept digital assets like Bitcoin, Ethereum, and stablecoins. From online purchases to physical stores, cryptocurrency is creating a new way for consumers to make payments securely and quickly. Here’s how to navigate the process of paying with cryptocurrency and the tools you need to get started.

Setting Up a Digital Wallet for Payments

The first step in paying with cryptocurrency is to have a digital wallet, which acts like an electronic bank account to store, send, and receive digital currencies. Digital wallets come in two main types: hot wallets (online) and cold wallets (offline).

- Choose a Wallet Provider: Several popular providers like Coinbase Wallet, MetaMask, and Trust Wallet make it easy to set up and use crypto wallets. Hot wallets are ideal for everyday transactions, while cold wallets offer additional security for larger holdings.

- Add Cryptocurrency: Transfer or purchase cryptocurrency through your wallet provider. You can buy assets like Bitcoin or Ethereum directly through exchanges like Binance or Coinbase and transfer them to your wallet.

- Ready for Transactions: Once funded, your wallet is ready for transactions. Use the wallet’s interface to generate a unique address for each payment, which you can scan or copy to complete a purchase.

Pay With Cryptocurrency by Using QR Codes

QR codes are commonly used for in-store cryptocurrency payments, allowing a seamless process where buyers scan a code and send funds directly from their digital wallet.

- Scan the Merchant’s QR Code: Merchants who accept cryptocurrency will often display a QR code at checkout. Using your wallet’s app, scan the code to open the payment page.

- Select Currency and Confirm: Choose the cryptocurrency you want to use (e.g., Bitcoin or Ethereum) and confirm the amount.

- Authorize the Transaction: Confirm the transaction through your wallet app, which will then transfer funds to the merchant’s wallet.

The transaction is processed on the blockchain, usually taking just seconds or minutes depending on the currency and network speed. The entire process is straightforward, making it ideal for quick payments in stores that accept crypto.

Crypto Payment Gateways: Online Purchases with Cryptocurrency

For online purchases, many e-commerce sites use crypto payment gateways like BitPay, CoinGate, and CoinPayments. These services integrate into checkout pages, allowing customers to pay with cryptocurrency.

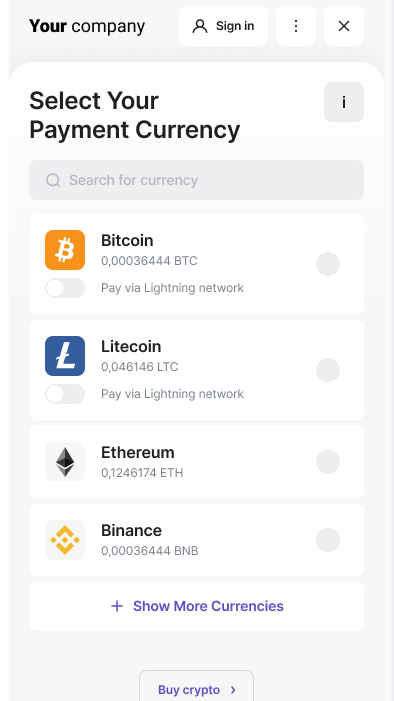

- Choose the Crypto Option at Checkout: If a website supports crypto payments, select the option to “Pay with Cryptocurrency” at checkout.

- Select a Payment Gateway: After selecting the crypto option, choose the payment gateway you prefer, such as BitPay or CoinGate.

- Follow the Gateway Instructions: Once in the gateway’s interface, choose your currency, enter your wallet address, and confirm the payment. Most gateways provide a QR code or wallet address for easy scanning.

These payment processors convert your crypto into fiat currency or stablecoins if the merchant prefers, reducing price volatility concerns for both parties.

Crypto Debit and Credit Cards

Crypto cards are one of the easiest ways to pay with cryptocurrency anywhere that accepts traditional card payments. Companies like Crypto.com, Binance, and Coinbase offer cards linked to your crypto balance, enabling you to spend your digital assets directly.

- Get a Crypto Card: Sign up for a crypto card from providers like Crypto.com, which allows you to load cryptocurrency and convert it at the point of sale.

- Load Your Crypto: Deposit cryptocurrency into your card’s linked account, either from your existing wallet or by purchasing directly.

- Pay with Your Crypto Card: Use the card as you would a regular debit or credit card. The card automatically converts your crypto to fiat currency (e.g., USD or EUR) during the transaction.

Crypto cards provide flexibility and let users access their crypto for everyday purchases at millions of retail locations worldwide, wherever major card networks like Visa or Mastercard are accepted.

Paying with Cryptocurrency in Peer-to-Peer (P2P) Transactions

For person-to-person transactions, such as paying a friend, using cryptocurrency is simple and fast through P2P wallets.

- Send Funds Directly to the Recipient’s Wallet: Request the recipient’s wallet address or scan their QR code.

- Select the Amount and Currency: Enter the amount you wish to transfer and select the cryptocurrency.

- Confirm the Transaction: Once confirmed, the funds transfer instantly to the recipient’s wallet, typically within minutes.

P2P payments are commonly used for freelance work, remittances, or quick transfers between friends, and offer lower fees than traditional bank transfers.

Common Types of Cryptocurrency Used for Payments

When paying with cryptocurrency, it’s essential to understand the types that are commonly accepted and their unique properties.

- Bitcoin (BTC): Bitcoin is the most widely accepted cryptocurrency for payments, making it a reliable choice for transactions in both online and physical stores.

- Ethereum (ETH): Ethereum is popular for its smart contract capabilities and is accepted on many platforms, especially in decentralized applications (DApps).

- Stablecoins (USDT, USDC): Stablecoins are pegged to fiat currency values, reducing volatility, and making them ideal for everyday transactions.

Benefits and Challenges of Pay with Cryptocurrency

Paying with cryptocurrency offers several advantages, but it also comes with some challenges that users should consider.

| Benefits: | Challenges: |

| Lower Transaction Fees: Cryptocurrency payments often involve lower fees than credit cards or bank transfers, especially for international payments. | Volatility: Prices can fluctuate, affecting the value of transactions. |

| Privacy: Cryptocurrency offers more privacy since transactions do not require personal banking information. | Limited Acceptance: Not all merchants accept cryptocurrency, though acceptance is growing. |

| Fast International Payments: Cross-border transactions with cryptocurrency are generally faster and less expensive than traditional banking systems. | Transaction Irreversibility: Once sent, crypto transactions are final and cannot be reversed. |

Storing Receipts and Tracking Payments

When paying with cryptocurrency, it’s helpful to keep a record of your transactions for budgeting or tax purposes. Wallet apps typically provide transaction history, showing each payment’s date, time, amount, and recipient.

- Use a Transaction Tracker: Many wallets offer built-in tracking features or transaction histories.

- Download Records: Some platforms allow users to export transaction history for easy record-keeping.

- Tax Considerations: Some jurisdictions require tax reporting for crypto transactions, so having a record can be essential for compliance.

Using cryptocurrency for payments is becoming easier and more accessible, with tools like digital wallets, payment gateways, and crypto cards supporting the trend. By understanding how these methods work, you can confidently use cryptocurrency for various purchases, whether online, in-store, or person-to-person.

Related articles:

- What are some benefits of using cryptocurrency as a method of payment?

- What is cryptocurrency mining? A Beginner’s Guide to Getting Started

- What is Cryptocurrency Solana (SOL) and How Does It Work?

- How to Buy Solana Meme Coins and Create Your Own on Solana

- How to Sell Bitcoin: A Step-by-Step Guide for Beginners

- Which are Best FREE Crypto Exchanges & Apps in 2024

Sources:

- https://www.investopedia.com/ask/answers/100314/what-are-advantages-paying-bitcoin.asp

- https://help.coinbase.com/en/how-to-make-a-payment

- https://www.moonpay.com/learn/bitcoin/how-to-pay-with-bitcoin

- https://swissmoney.com/how-to-pay-with-bitcoins