Starting and growing a business requires capital, and understanding how to fund your business is crucial for success. Whether you’re launching a startup or expanding an existing company, there are numerous ways to secure the necessary funds. This guide explores the most effective strategies for funding your business, helping you navigate the complex landscape of financing.

Traditional Financing: How to Fund Your Business

Traditional financing methods remain popular choices for entrepreneurs looking to fund their businesses. These options provide access to significant capital but often come with requirements such as credit checks, collateral, and detailed business plans.

- Bank Loans: One of the most common ways to fund a business is through bank loans. Banks offer various loan products tailored to business needs, including term loans, lines of credit, and equipment financing. To qualify, you typically need a solid credit history, a detailed business plan, and sometimes collateral. Interest rates and repayment terms vary, so it’s essential to compare offers from different banks.

- Small Business Administration (SBA) Loans: The SBA offers government-backed loans that are designed to support small businesses. These loans are known for their favorable terms and lower interest rates compared to traditional bank loans. SBA loans include options like the 7(a) loan program, which is popular for general business funding, and the 504 loan, which is used for purchasing real estate or equipment.

- Credit Cards: Business credit cards can be a convenient way to fund your business, especially for managing short-term expenses. They offer flexibility and can help build your business credit score. However, they typically come with higher interest rates than other forms of financing, so it’s important to use them wisely and pay off balances quickly to avoid accumulating debt.

- Personal Savings: Many entrepreneurs start by using their own savings to fund their businesses. This method requires no approval process or interest payments, but it comes with personal financial risk. Using personal savings can be a good option if you have sufficient funds and want to maintain full control of your business without external obligations.

How to Fund Your Business Through Equity Financing

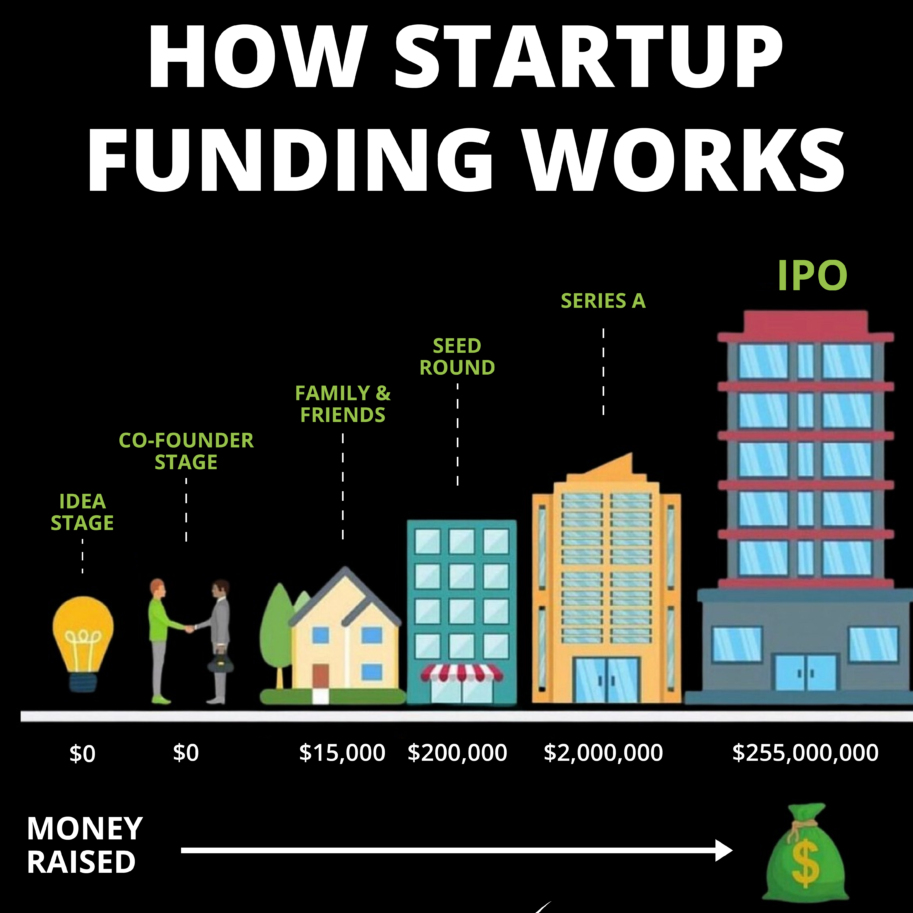

Securing investment from individuals or firms is another effective way to fund your business. Equity financing involves exchanging a portion of your company’s ownership for capital, which can help fuel growth.

- Angel Investors: Angel investors are wealthy individuals who provide capital to startups in exchange for equity. They often invest in the early stages of a business and may also offer mentorship and industry connections. To attract angel investors, you’ll need a compelling business idea, a strong team, and a clear path to profitability. Networking and pitching events are common ways to connect with angel investors.

- Venture Capital: Venture capital (VC) firms invest in startups with high growth potential. Unlike angel investors, VCs typically provide larger amounts of capital and may require significant ownership stakes. In exchange, they offer expertise, resources, and strategic guidance. Venture capital is often sought by businesses in the tech sector or those aiming for rapid expansion. However, securing VC funding is highly competitive and usually requires a proven business model and substantial market potential.

- Private Equity: Private equity (PE) firms invest in businesses that are already established but need capital to grow, restructure, or enter new markets. PE firms typically seek significant control over the companies they invest in and aim to increase their value before selling their stake at a profit. This type of funding is more common for businesses that are further along in their development and have a track record of success.

Alternative Financing Without Traditional Loans

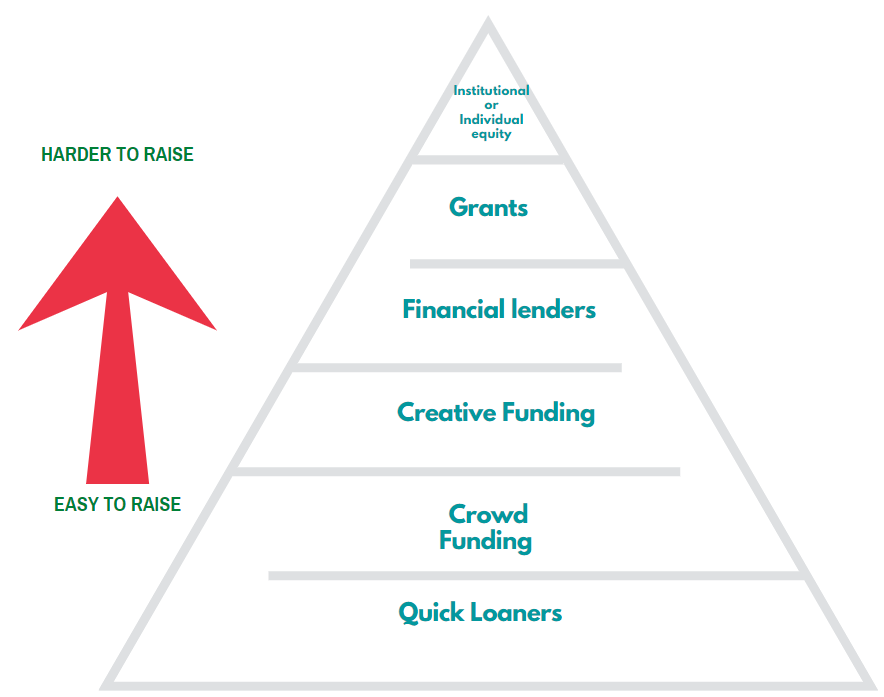

If traditional financing methods or equity investments don’t suit your needs, there are several alternative options to consider for how to fund your business.

- Crowdfunding: Crowdfunding platforms like Kickstarter, Indiegogo, and GoFundMe allow you to raise small amounts of money from a large number of people. Crowdfunding can be an excellent way to validate your business idea while simultaneously generating funds. Campaign success often depends on a strong marketing strategy and an engaging pitch that resonates with potential backers. There are different types of crowdfunding, including reward-based, equity-based, and donation-based, each with its own set of rules and expectations.

- Grants: Grants are funds provided by governments, foundations, or corporations that do not require repayment. While grants are highly competitive, they are an excellent source of funding for specific types of businesses, such as those in the nonprofit sector, research and development, or green technologies. Researching and applying for grants can be time-consuming, but the financial benefit can be significant if you qualify.

- Peer-to-Peer Lending: Peer-to-peer (P2P) lending platforms, like LendingClub and Prosper, connect borrowers directly with individual lenders. This method often results in lower interest rates than traditional bank loans and can be quicker to secure. P2P lending is particularly useful for small businesses that need capital quickly but may not qualify for traditional loans.

- Invoice Financing: If your business issues invoices with extended payment terms, invoice financing (or factoring) can help you manage cash flow. This option involves selling your unpaid invoices to a lender in exchange for immediate cash. The lender then collects the invoice payments from your customers. While invoice financing provides quick access to funds, it can be more expensive than traditional loans due to fees and interest.

Bootstrapping and Self-Funding Options

Bootstrapping refers to funding your business using personal resources or revenues generated from the business itself. This method allows you to maintain full control of your company without taking on debt or giving up equity.

- Reinvesting Profits: As your business generates revenue, reinvesting profits back into the company can help fund growth. This approach requires patience, as it may take time to accumulate enough capital to finance significant expansions. However, it allows you to grow your business organically without external financing.

- Business Incubators and Accelerators: Incubators and accelerators provide resources, mentorship, and sometimes funding in exchange for equity or a small fee. These programs are designed to help startups grow quickly by providing access to networks, office space, and expert advice. They are highly competitive, but successful applicants can gain valuable support that can significantly enhance their chances of success.

- Partnerships: Forming a strategic partnership can provide funding through shared resources or investment from the partner. This method can be particularly effective if you partner with a business that complements your own, as it allows for collaboration that benefits both parties. However, partnerships require careful planning and clear agreements to ensure mutual benefit and avoid conflicts.

Understanding how to fund your business involves exploring various financing options, from traditional loans to innovative alternatives like crowdfunding and peer-to-peer lending. The right choice depends on your business model, growth stage, and financial needs. By carefully evaluating these options, you can secure the funding necessary to start, grow, and sustain your business.

Sources: