- Meme coins dominated the crypto narrative in Q2, driving DEX volume increase to $371 billion.

- Solana and Base meme coins, along with celebrity endorsements, pushed this trend.

- However, the rapid growth raises concerns about whether this can last and if the market is getting too crowded. It’s also uncertain if these tokens can keep up the hype in Q3.

- Decentralized exchanges continue to gain traction as centralized exchanges face regulatory hurdles.

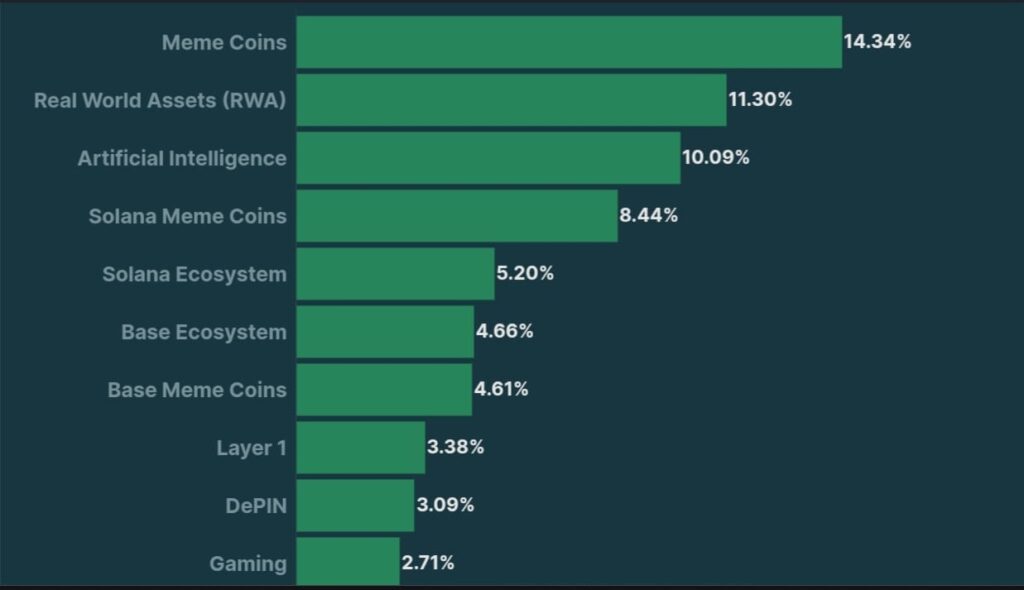

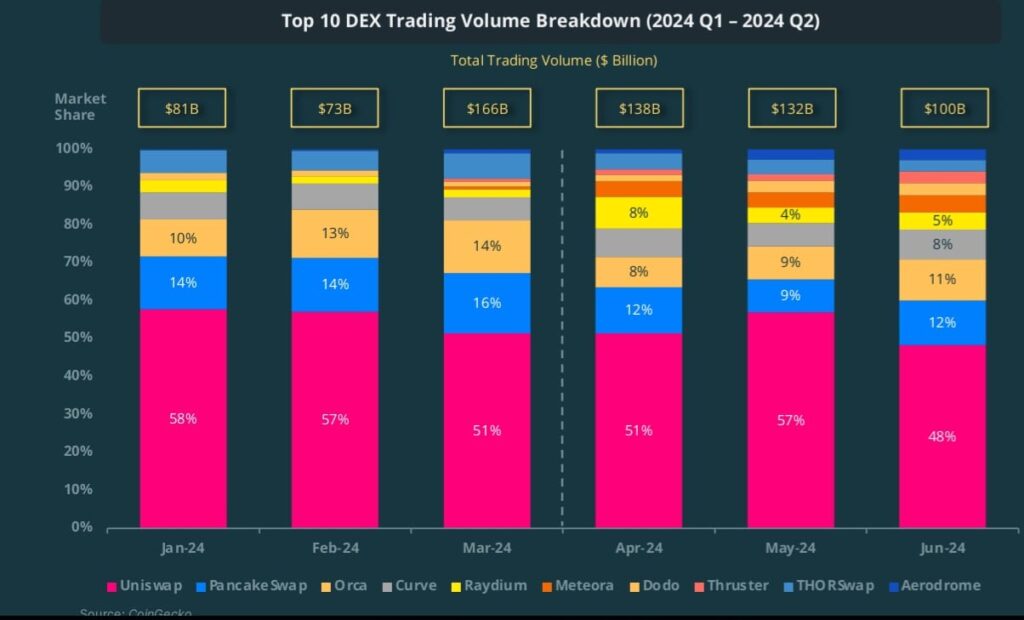

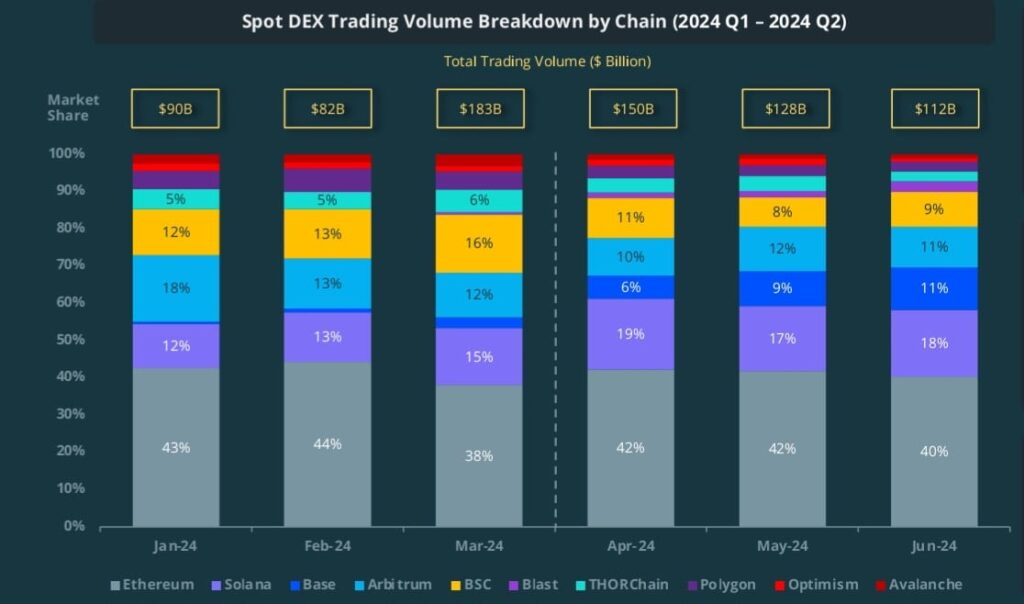

Meme coins have dominated the cryptocurrency scene, driving 36% of the market share in Q2 alongside real-world assets (RWA) and AI, according to CoinGecko. These coins made up four of the 15 most popular crypto narratives, pushing DEX trading volume up 16% to $371 billion. Solana DEXs, central to the meme coin culture, saw the most significant rise.

Market Shifts and Analyst Predictions

While meme coins surged, CEX volumes fell 12% to $3.4 trillion due to regulatory scrutiny and poor performance of VC-backed tokens. Analysts suggest the meme coin boom may not last, with investor focus likely shifting to projects with stronger fundamentals. Meme coin web traffic dropped from 23% in Q2 to 15% in July.

“Investors may shift towards projects with stronger fundamentals, especially in an economically uncertain market environment,” said Ryan Lee, chief analyst at Bitget Research. “As the crypto market matures, people increasingly prefer projects with clear use cases, utility, and strong development teams.”

Risks and Future Trends

Meme coins often lose value quickly after the initial hype, exemplified by the crash of BALD, a Base meme coin, to zero one day after its launch. Despite their popularity, most lack staying power compared to dominant tokens like DOGE, Pepe, Floki, and Shiba Inu, which have all reached over $1 billion in market capitalization. Analysts foresee potential declines in meme coin trading volumes unless new trends or celebrity endorsements, like Lionel Messi’s promotion of Water, revive interest.

Decentralization vs. Centralization

The contrast between DEX and CEX activity highlights a core debate in crypto. DEX trading, boosted by meme coins, underscores the appeal of decentralization. Ethereum and Solana DEXs saw significant volume increases, while CEXs faced declines. Despite this, CEXs remain crucial for their user-friendly interfaces and support for fiat trading, which DEXs often lack.

“Centralized exchanges provide more financial services,” said Lee. “They offer various asset management and strategy trading services, with multiple financial products available for holding BTC, ETH, or other altcoins. Copy trading and strategy trading on CEXs are also more mature and secure.”

Emerging Trends and Future Outlook

Meme coins could see a resurgence through celebrity endorsements or integration with popular culture. For example, on July 8, the Solana meme coin Water rose as much as 350% after football star Lionel Messi’s Instagram post promoting the token. However, Water’s price has since slumped more than 95% since its high on June 26, indicating that even celebrity backing might not ensure lasting value without real utility.

Meme tokens could also benefit from the recent Bitcoin halving event, which historically boosts interest in non-Bitcoin assets. As Bitcoin prices surged 85% to an all-time high of $73,000 before the halving event in April 2024, meme coins could capture speculative interest from investors seeking the next big trend.

The rise of meme coins and decentralized exchanges reflects a shift in the crypto market. While meme coins have captured significant attention, their long-term success remains uncertain. As regulatory scrutiny intensifies and the market matures, the focus may shift towards projects with robust fundamentals and clear use cases. However, the potential for meme coins to surge again through new trends or celebrity endorsements cannot be entirely ruled out.