Despite testing the $65,000 support on June 14, Bitcoin (BTC) has maintained its position above $66,000 since May 17, showing resilience in the face of regulatory and economic pressures. BTC struggled to break above $72,000 resistance over the past month, but favorable market conditions and strong derivatives metrics suggest limited downside risk.

Regulatory Developments

U.S. lawmakers passed a Congressional Review Act on May 16 to explore an SEC rule on crypto asset reporting, marking a significant step in crypto legislation. Though President Biden vetoed the resolution, the growing influence of crypto advocates in U.S. politics is evident. The banking sector’s interest in offering crypto custody services further indicates a shift towards more favourable regulatory sentiment.

Federal Reserve Policies

The Federal Reserve faces pressure to lower interest rates amid persistent inflation and a softening labour market. Inflation remains above the Fed’s 2% target, with the Consumer Price Index at 3.4% and unemployment slightly up. The 2-year Treasury yield dropped to a 70-day low, while the S&P 500 hit a record high, reflecting investor moves towards equities and scarce assets to hedge against inflation.

Bitcoin Derivatives

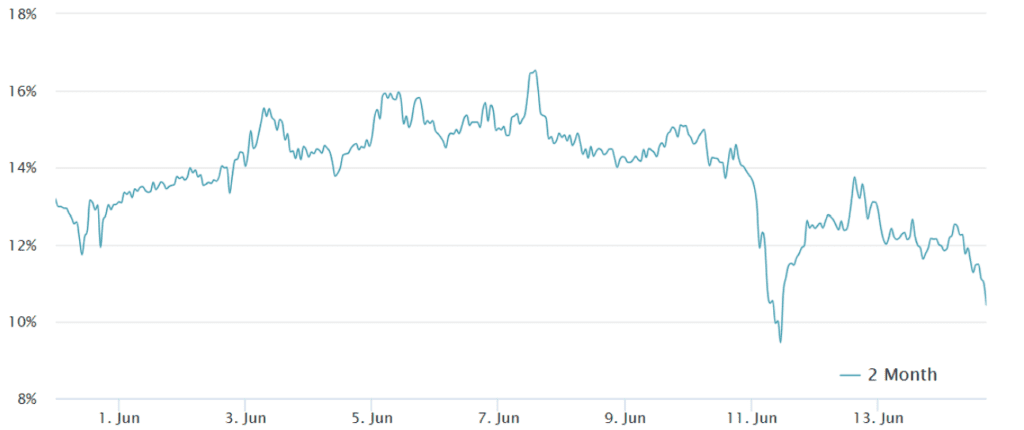

Despite an 8.5% price drop between June 6 and June 14, Bitcoin’s derivatives market remained stable. The 2-month futures premium stayed above 10%, indicating a bullish market. This stability, combined with current regulatory and economic trends, suggests strong support at the $65,000 level.

Overall, Bitcoin’s resilience amid regulatory and economic shifts points to a solid support base and potential for future gains.