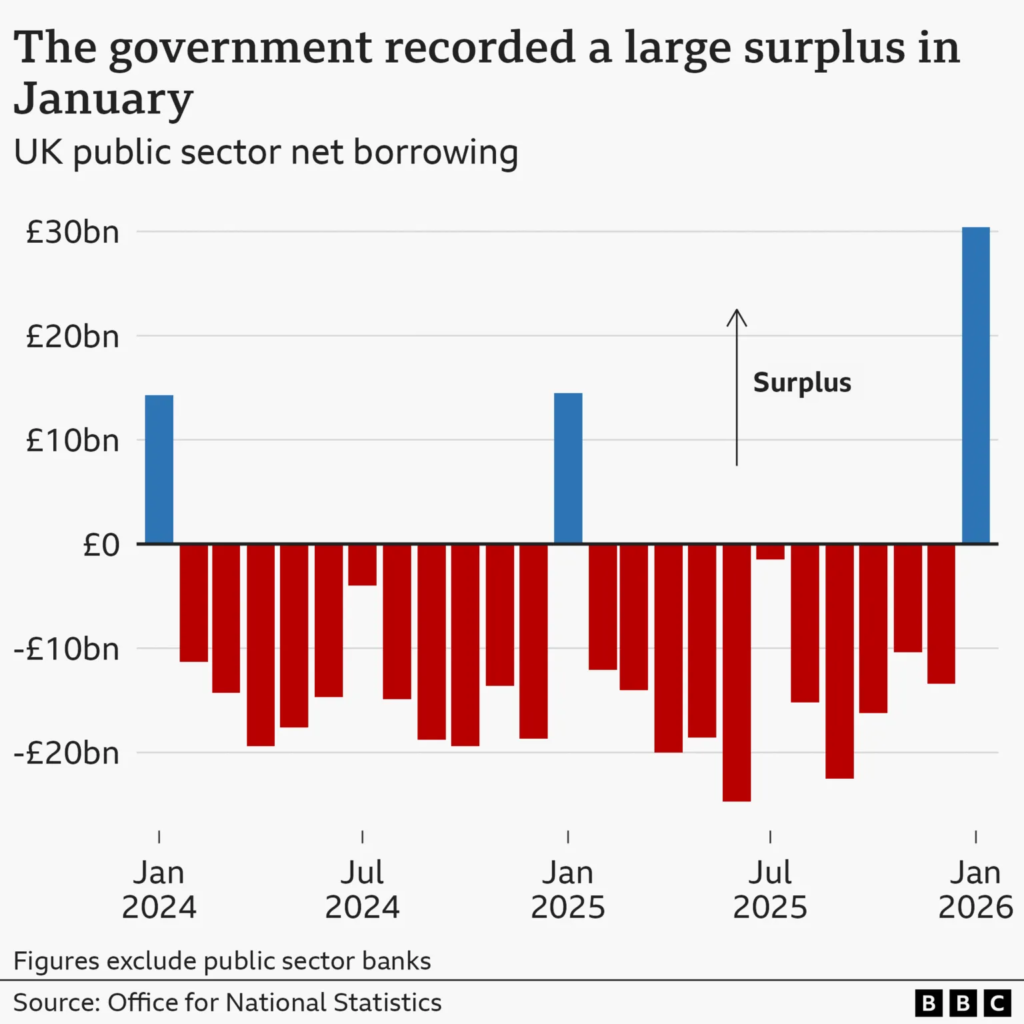

The UK government recorded a record £30.4 billion budget surplus in January, driven by a surge in tax receipts that far exceeded expectations and delivered a rare fiscal boost ahead of the spring policy season.

According to the Office for National Statistics, the surplus was the largest for any month since records began in 1993 and nearly double January 2025’s £15.4 billion figure. Economists had expected roughly £24 billion, while projections from the Office for Budget Responsibility had pointed to lower levels.

Tax Revenues Lead the Surprise

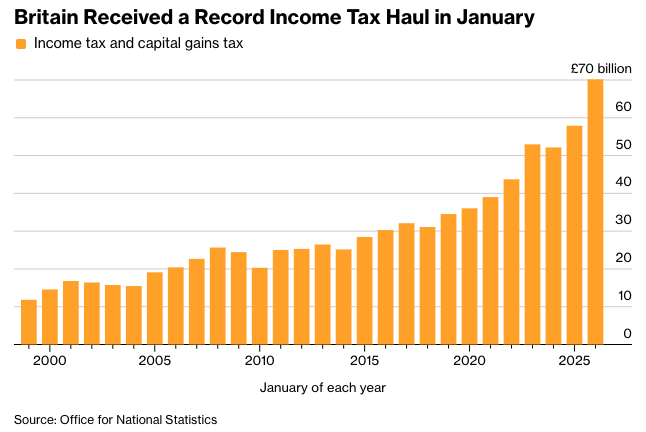

Government income surged to £133.3 billion, up 13.8% year over year, fueled by several key factors:

- Capital gains tax generated about £17 billion, roughly £7 billion more than a year earlier, as investors sold assets ahead of anticipated tax changes.

- National Insurance contributions rose by £2.9 billion.

- Income tax receipts increased by £3.6 billion, partly due to frozen tax thresholds pulling more workers into higher brackets.

Lower interest payments on public debt also helped improve the monthly balance.

Borrowing Still Elevated

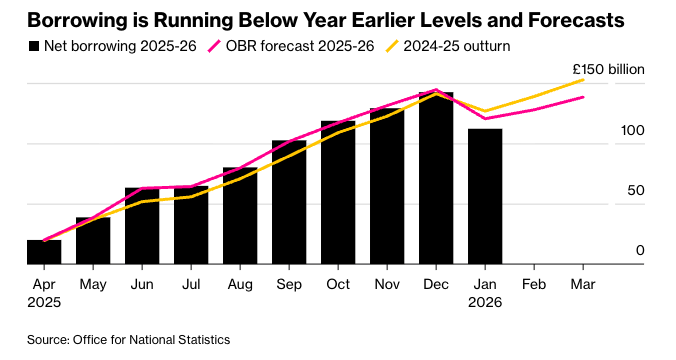

Despite the strong January performance, the broader fiscal picture remains mixed. Borrowing for the financial year so far stands at £112.1 billion, below the OBR forecast of £120.4 billion but still the fifth-highest level on record for this point in the year.

Officials at HM Treasury said borrowing is expected to be the lowest since before the pandemic, though economists caution that the public finances remain “finely balanced” due to slow wage growth and modest economic expansion.

Political and Economic Implications

Chancellor Rachel Reeves is likely to highlight the figures as evidence of improving fiscal discipline ahead of her Spring Statement. Still, analysts warn that January is typically a strong revenue month because of self-assessment tax payments, meaning the surplus may not signal a lasting trend.

With UK growth estimated at around 1.3% in 2025 and expected to hover near 1% this year, economists say the economy may not provide enough momentum to ease political pressure over taxes, spending, and borrowing rules.

The record surplus offers short-term relief for the government, but underlying fiscal challenges and slow growth suggest the improvement may prove temporary.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Trump announces new 10% ‘global’ tariffs after US Supreme Court decision