Global markets pushed higher on Wednesday as US equities tracked Europe’s rally, while oil and gold surged amid geopolitical tensions and fresh signals from the Federal Reserve.

Stocks on New York Stock Exchange closed in positive territory after paring earlier gains. The Dow Jones Industrial Average rose 0.26%, the S&P 500 climbed 0.56%, and the Nasdaq Composite advanced 0.78%, reflecting cautious optimism despite lingering macro uncertainty.

Europe Outperforms Again

European equities led the move, with the STOXX 600 closing at a record high, powered by gains in banking and defense stocks. Investors also reacted to reports that Christine Lagarde could step down early as head of the European Central Bank, a development that weakened the euro and lifted the dollar.

Global equities followed suit. The MSCI World Index rose 0.60%, while Japan’s Nikkei 225 gained just over 1%.

Oil and Gold Rally on Tensions

Commodities moved sharply higher as geopolitics intensified. Crude surged after Russia-Ukraine talks ended abruptly and supply concerns grew following disruptions tied to tensions near the Strait of Hormuz.

- US crude settled up 4.59% at $65.19

- Brent closed up 4.35% at $70.35

- Spot gold jumped 2.22% to about $4,985

Ukraine’s president, Volodymyr Zelenskiy, accused Russia of delaying peace progress, reinforcing risk-off demand for safe-haven assets.

Fed Minutes Keep Rate Debate Alive

Minutes from the Fed’s latest meeting showed policymakers were nearly unanimous in holding rates steady, though they remain divided about the next move. Strong US economic data pushed Treasury yields higher, signaling markets expect borrowing costs to stay elevated for now.

Bond markets reflected that shift:

- 10-year yield rose to 4.087%

- 2-year yield climbed to 3.468%

- 30-year yield edged up to 4.71%

Currency and Crypto Moves

The dollar strengthened after upbeat housing and durable goods data, while the euro slipped on leadership uncertainty at the ECB. Meanwhile, cryptocurrencies weakened, with Bitcoin down about 2% and Ethereum off more than 3%.

Market takeaway: investors are balancing three forces at once: strong data supporting higher rates, geopolitical tensions boosting commodities, and global equity momentum led by Europe. The result is a market that is rising, but cautiously.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

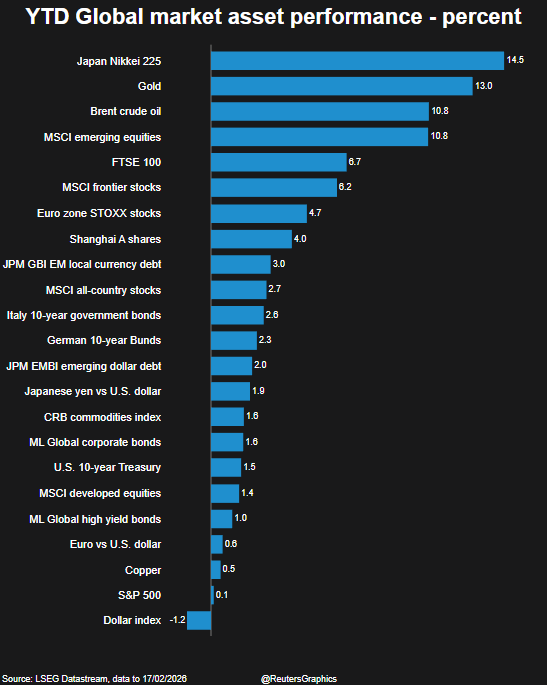

Related: US Stocks are losing the global race. Should Investors Be Worried?