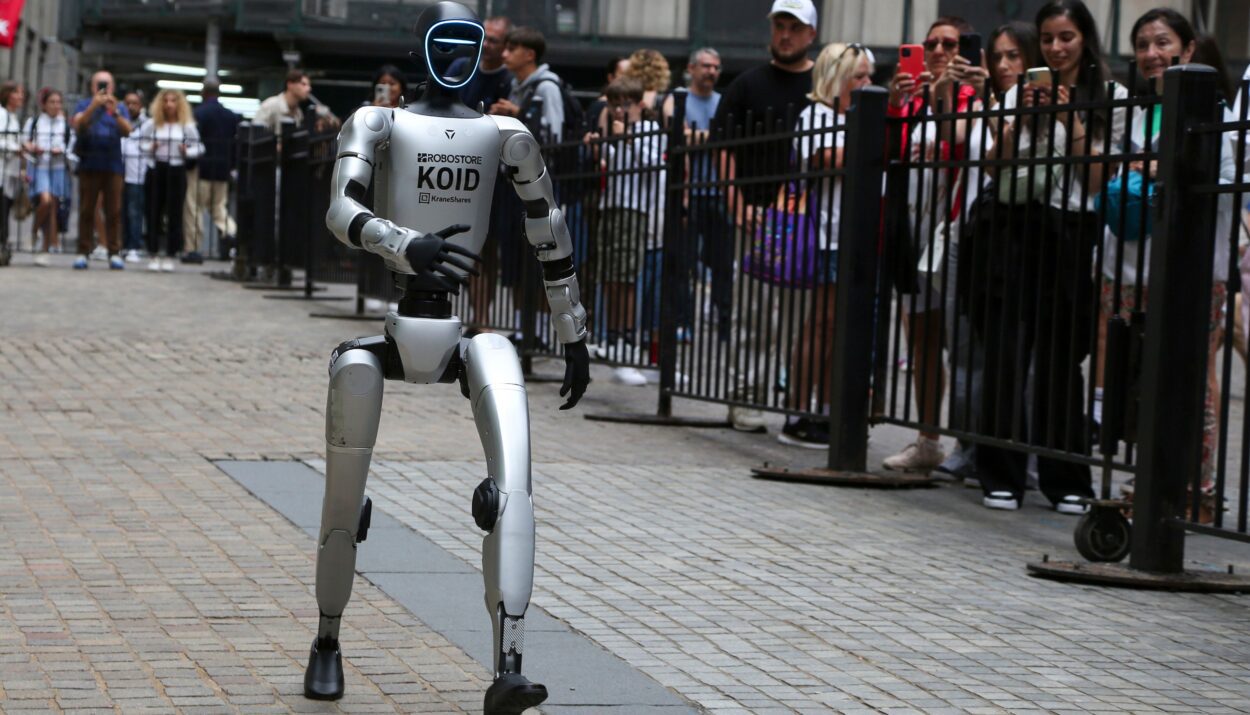

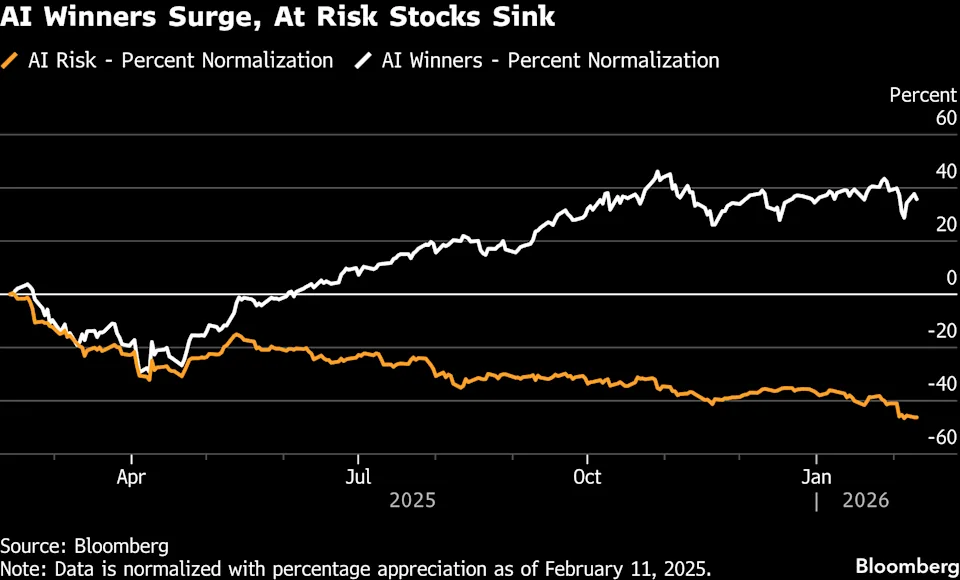

Wall Street is quickly pulling money out of companies seen as vulnerable to artificial intelligence, as investors grow more nervous about how fast new AI tools could reshape entire industries.

The latest wave of selling began after startup Altruist launched an AI-powered tax and advisory tool called Hazel. Investors reacted sharply, sending shares of Charles Schwab, Raymond James, and LPL Financial down by 7% or more at one point. Some European financial firms were dragged lower as well.

It’s part of a broader shift in sentiment. For much of the past two years, investors focused on AI winners. Now, attention is turning to who could be disrupted.

“Every company with any sort of potential disruption risk is getting sold indiscriminately,” said John Belton of Gabelli Funds.

The pressure started in software stocks but has now spread into financial services, insurance, and asset management. Earlier, new AI tools from Anthropic triggered heavy losses across software names. Insurance brokers also slid after Insurify introduced a ChatGPT-powered system to compare auto insurance rates.

Altruist CEO Jason Wenk said he was surprised by the scale of the reaction, but believes it reflects how seriously markets are taking AI’s potential. He argued that jobs traditionally handled by entire teams in wealth management could now be done by AI for around $100 per month.

Executives at established firms pushed back. Charles Schwab CEO Rick Wurster said the company is already embracing AI to boost efficiency and expand client services, arguing large firms with scale, data, and infrastructure could ultimately be natural beneficiaries.

Some analysts caution that markets may be reacting too quickly. Tech disruption often takes longer than expected to fully materialize. But after years of AI-driven gains and stretched valuations, investors appear far less patient.

For now, the tone has clearly shifted. Instead of chasing the next AI leader, traders are focused on avoiding the next potential loser.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: 4 charts show why massive AI spending has started to weigh on Big Tech