US equity funds attracted renewed investor interest in the final full week of January, as markets looked ahead to earnings from mega-cap companies despite lingering concerns over tariff threats from Donald Trump.

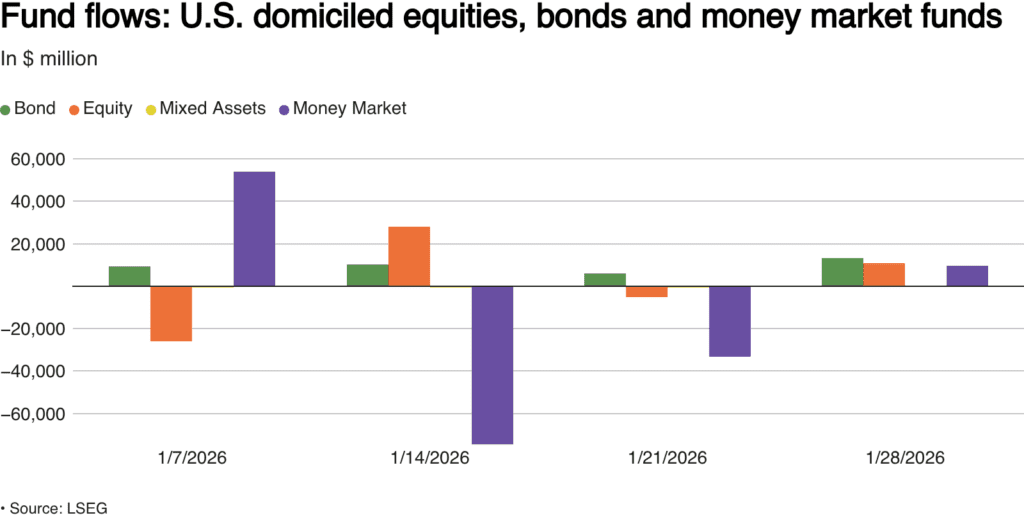

According to data cited by Reuters, US equity funds recorded $10.73 billion in net inflows in the week ending January 28. That marked a sharp turnaround from the $5.25 billion in outflows seen the previous week, signaling a rebound in risk appetite ahead of key earnings releases.

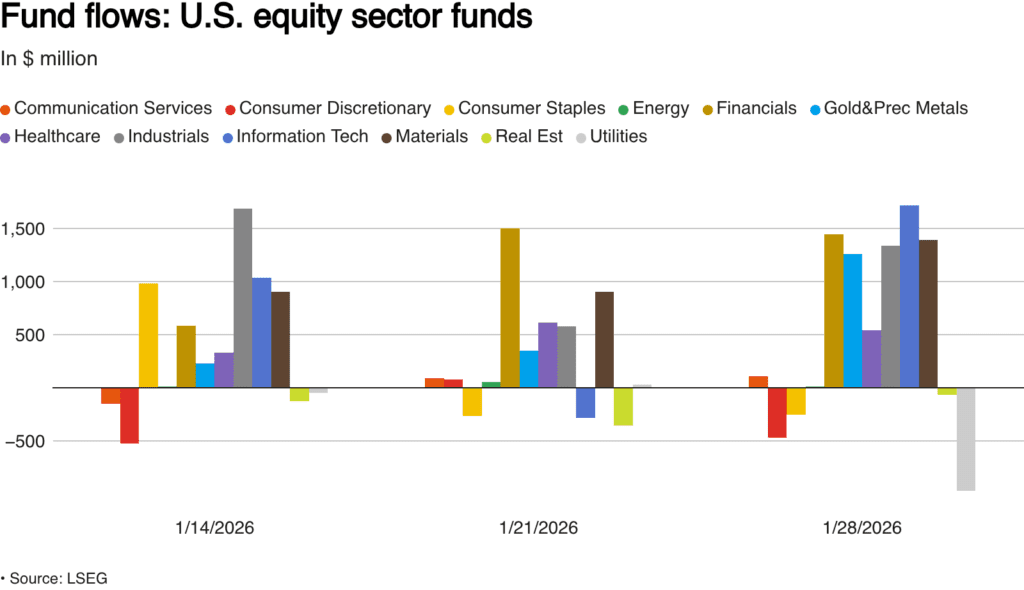

Sector Funds Lead the Charge

Equity sector funds were the biggest beneficiaries of the renewed optimism. They attracted $6.07 billion in weekly net inflows, the largest such total since at least 2022.

Technology funds led the way with $1.72 billion in inflows, followed by financials with $1.44 billion and metals and mining funds with $1.39 billion, reflecting investor confidence in earnings resilience and continued interest in commodities.

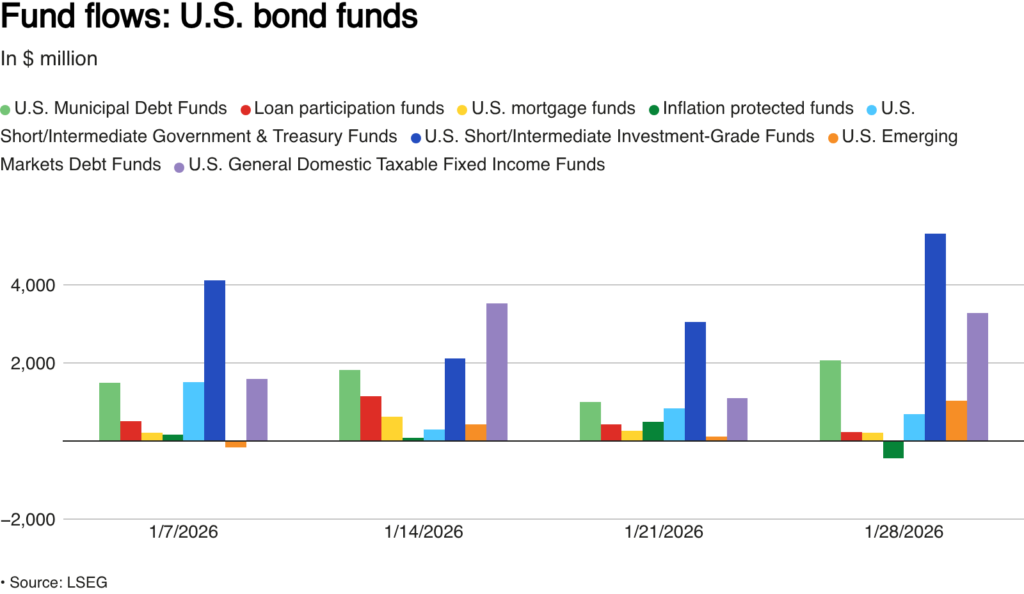

Bond Funds Extend Winning Streak

Demand for fixed income remained strong alongside equity buying. US bond funds extended their streak of inflows to a fourth consecutive week, attracting $13.16 billion in net investments.

Short-to-intermediate investment-grade bond funds were the most popular, pulling in $5.31 billion. General domestic taxable fixed income funds added $3.28 billion, while municipal debt funds attracted $2.06 billion, suggesting investors are still balancing growth exposure with income and safety.

Money Market Funds Rebound

Money market funds also saw a shift in sentiment. After two straight weeks of net selling, they recorded $9.64 billion in net inflows, pointing to renewed cash positioning as markets navigate earnings season and policy uncertainty.

Market Takeaway

The latest fund flow data show investors cautiously leaning back into US equities ahead of mega-cap earnings, while still maintaining significant exposure to bonds and cash-like assets. With tariffs, earnings guidance, and macro policy all in focus, portfolio positioning suggests confidence is improving, but hedges remain firmly in place.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Global equity funds attract inflows for third week in a row