US President Donald Trump said he plans to announce his nominee for the next chair of the Fed next week, while renewing pressure on the central bank to cut interest rates aggressively.

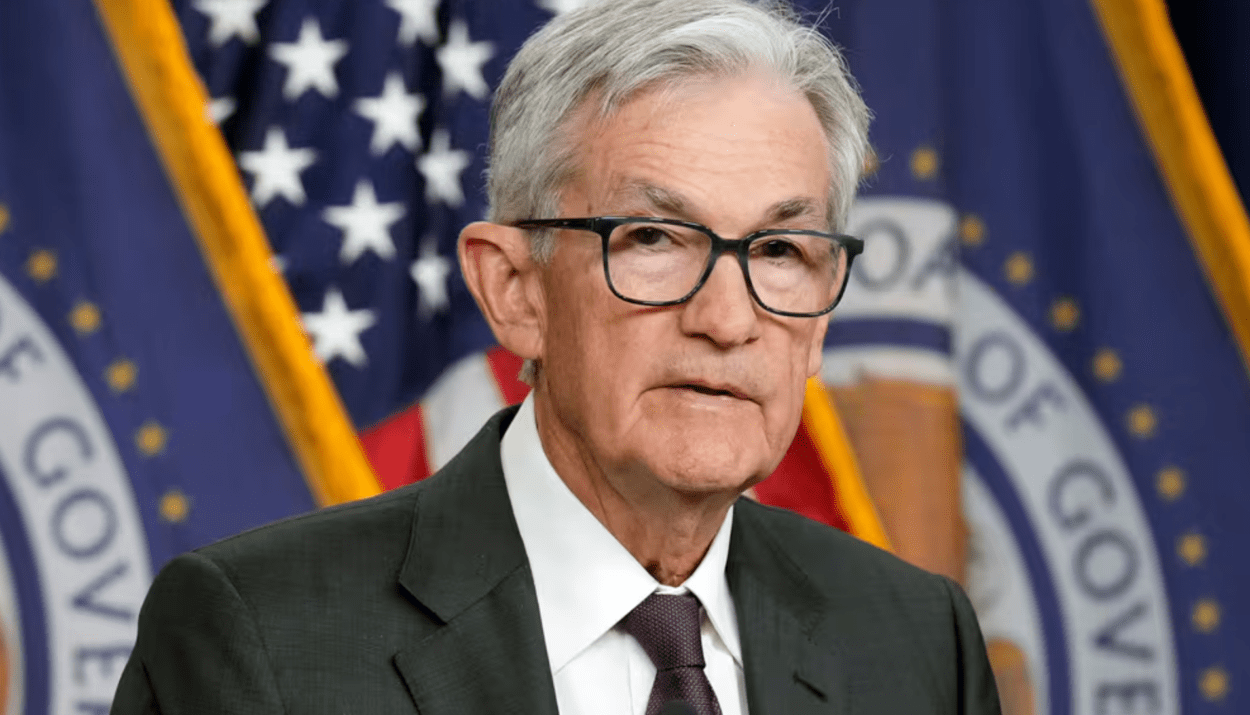

Speaking on Wednesday, Trump said borrowing costs should be 2 to 3 percentage points lower than current levels, reinforcing his long-running criticism of the Fed’s monetary policy stance. His comments come as markets closely watch who could replace current Fed Chair Jerome Powell, whose term ends in May.

The remarks followed the Fed’s latest policy decision to keep its benchmark rate steady at around 3.6%, after cutting rates three times last year. Powell said the economic outlook has improved, with growth holding up and the labor market showing signs of stabilization, giving policymakers little urgency to resume cuts while inflation remains above the Fed’s 2% target.

Trump’s renewed push for lower rates adds to political pressure on the central bank, which has emphasized its independence amid scrutiny from the White House. Investors are now weighing whether a new Fed chair could signal a shift toward a more accommodative policy stance later this year.

Trump is signalling a major Fed leadership decision next week while intensifying calls for much lower interest rates, raising questions about the future direction and independence of US monetary policy.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.