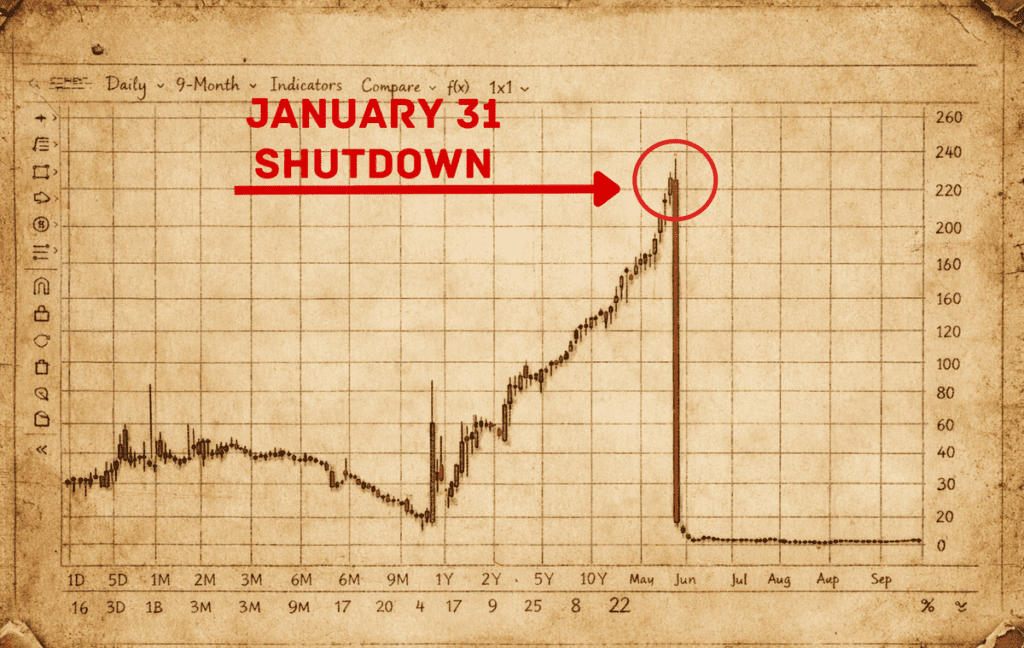

Fears of a looming US government shutdown sent shockwaves through global markets late Sunday, triggering a sharp selloff in cryptocurrencies and raising volatility across risk assets.

Prediction markets are now pricing more than an 80% chance of a US government shutdown by January 31, driven by a political stalemate over funding for the Department of Homeland Security. Senate Democrats are threatening to block the budget package unless accountability reforms are added, while Republicans lack the votes needed to pass the bill alone.

The uncertainty hit crypto first.

Total cryptocurrency market value fell by about $100 billion in just six hours, sliding from $2.97 trillion to $2.87 trillion. Bitcoin dropped 3.4%, while Ether sank 5.3%, as more than $360 million in leveraged positions were liquidated, mostly long bets.

Analysts say shutdown risks often hit crypto earlier than stocks or bonds because digital assets trade around the clock and react quickly to shifts in liquidity and political stress.

A shutdown would likely delay key economic data, disrupt federal operations, and weaken investor confidence. Treasury markets and equities are expected to react next if negotiations fail.

With only days left before the funding deadline, investors are bracing for more volatility as politics and markets collide.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Government shutdown is over, but things are not back to normal

Government shutdowns and the markets – 3 things to know

US Government shutdown watch: what it means for markets — and your wallet