If you have been watching global markets this year and wondering why Latin American markets keep showing up at the top of performance tables, you are not imagining it.

At the start of 2026, Latin American stocks and currencies are among the best-performing assets in the world. They are clearly outperforming the US and Europe, after spending years on the sidelines of global portfolios.

So what changed?

Commodities are back in control

Latin America lives and breathes commodities, and that is finally working in its favor again.

Prices for copper, gold, silver, and other industrial metals have risen sharply. That matters because many South American economies are built around exporting exactly these resources. When metals rise, export revenues increase, government finances improve, and investor confidence follows.

Chile and Peru are the clearest examples. Both are major producers of copper and precious metals, and both are now enjoying the upside of the global metals rally. For markets, this is not an abstract story. It shows up directly in stock prices and currencies.

Money flows in quickly when commodities move. That is exactly what is happening now.

The numbers tell a powerful story

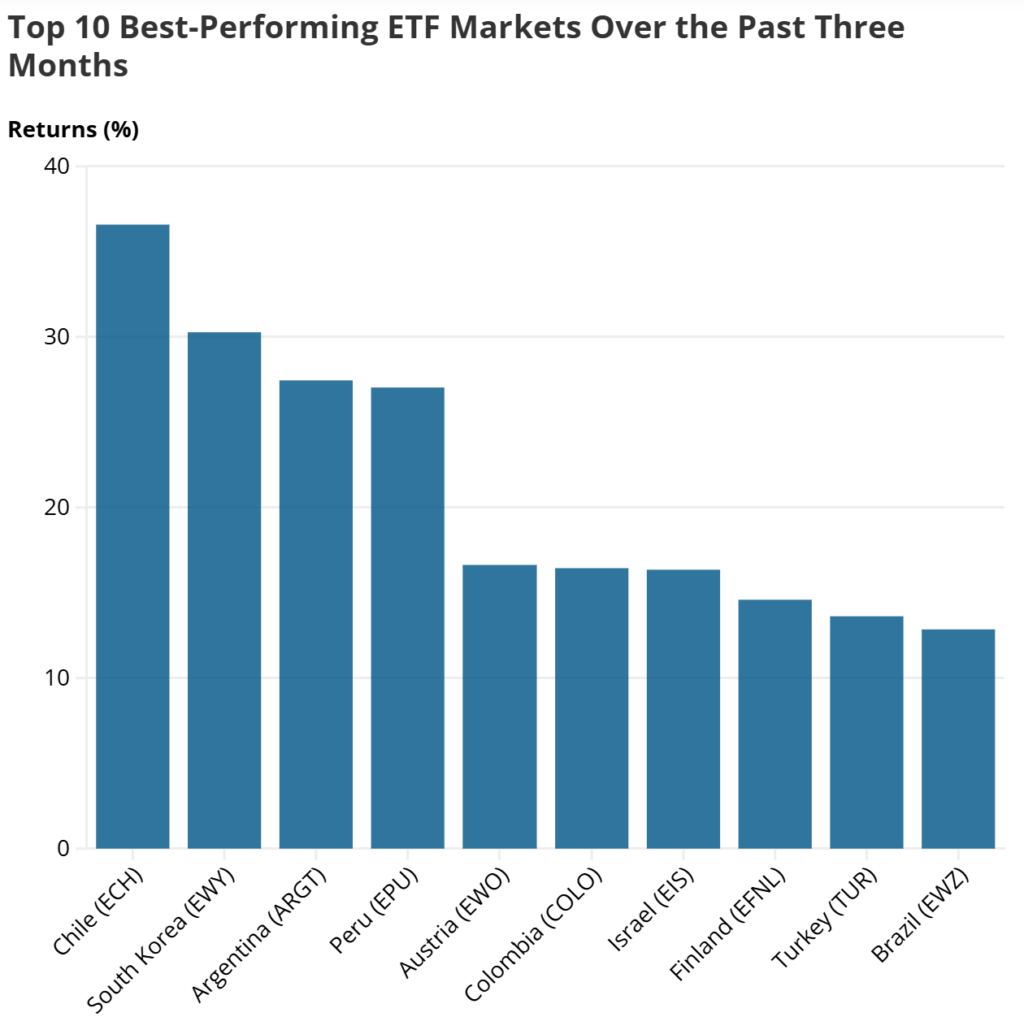

The performance gap between Latin America and developed markets has become hard to ignore.

Chile leads globally, with stocks up 36.6% since mid-October. The Chilean peso has strengthened by more than 8% in just two months, reflecting better trade conditions and renewed capital inflows.

Argentina has surged 27.45%, as investors react to market-oriented reforms under President Javier Milei.

Peru is up around 27%, with the sol trading at its strongest level against the dollar in more than five years.

Colombia has gained roughly 16%.

Brazil has climbed about 12.9%.

By comparison, the S&P 500 is up only about 4.8% over the same period, while Germany’s DAX has risen around 5%.

That contrast alone explains why global investors are suddenly paying attention.

Argentina’s shift is changing perceptions

Argentina deserves special mention, because sentiment there has flipped faster than many expected.

For years, the country was viewed as one of the most unpredictable and risky markets in the world. Since Milei took office, that perception has started to change. His government has pushed fiscal tightening, deregulation, and market liberalization, and markets are responding to the direction of travel.

International investors are cautiously returning after years away. Even the International Monetary Fund has described the reform agenda as ambitious, noting that it could deliver meaningful medium-term gains if sustained.

This does not mean Argentina’s problems are solved. They are not. But for markets, direction matters more than perfection, and the direction now looks different from the past.

A weaker US dollar is doing quiet work

One of the most important drivers of this rally is also one of the least visible.

In 2026, the US dollar has been weakening. Historically, that is one of the most supportive backdrops for emerging markets.

When the dollar weakens, US assets become less dominant, global capital looks for higher returns elsewhere, and emerging markets with improving fundamentals tend to benefit first.

Large institutions such as Bank of America and AllianceBernstein have highlighted this pattern. Latin America, with its commodity exposure and reform momentum, is a natural beneficiary.

Europe just became a bigger partner

Another major catalyst is trade.

The long-awaited EU–Mercosur trade agreement is set to be formally signed this month, marking a major shift in relations between Europe and South America.

For Argentina, Brazil, Paraguay, and Uruguay, this is their first major trade agreement with an external partner. It opens preferential access to nearly 450 million EU consumers and goes far beyond agriculture.

Lower tariffs on industrial inputs, improved supply-chain integration, and stronger incentives for foreign investment could reshape manufacturing and export dynamics across the region. Studies suggest EU–Latin America trade could expand significantly over time, with knock-on effects for growth and investment.

Investors see this not as a short-term headline, but as a long-term structural positive.

Is this just a short-term rally?

That is the big question.

Some of the gains are clearly cyclical. Commodity prices can fall. Political reforms can stall. Global risk appetite can change quickly. But this rally is not built on just one factor.

It is being driven by strong commodities, improving policy credibility, trade integration, and global macro support all at the same time. That combination is rare, and markets are reacting accordingly.

Latin America is no longer just a high-risk corner of the market.

In early 2026, it is one of the strongest-performing regions globally, backed by real catalysts rather than hype alone. The road ahead will not be smooth, but for now, investors are voting with their money.

And right now, they are voting for Latin America.

Related: How Big Tech Created the 2025 AI Boom on Debt

Stocks Split as Jobs Data and Trump’s Venezuela Oil Deal Take Spotlight