After a turbulent 2025, the FED enters 2026 facing a familiar but uncomfortable dilemma. Inflation is still above target. The labor market is cooling. Economic growth remains solid. And inside the Fed, policy unity is cracking.

The big question markets are asking is simple but critical: does the Fed cut again, or does it stop and wait?

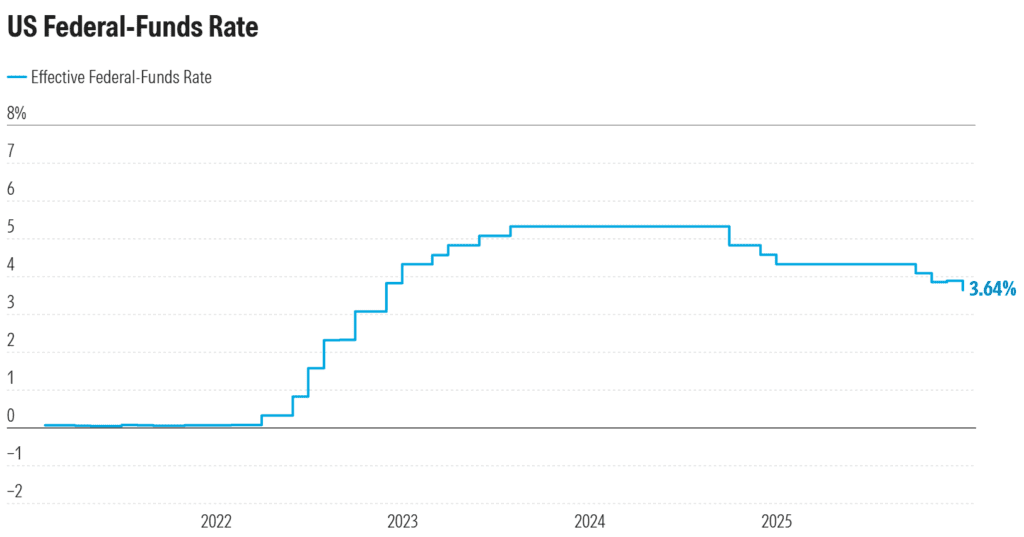

From rate cuts to hesitation

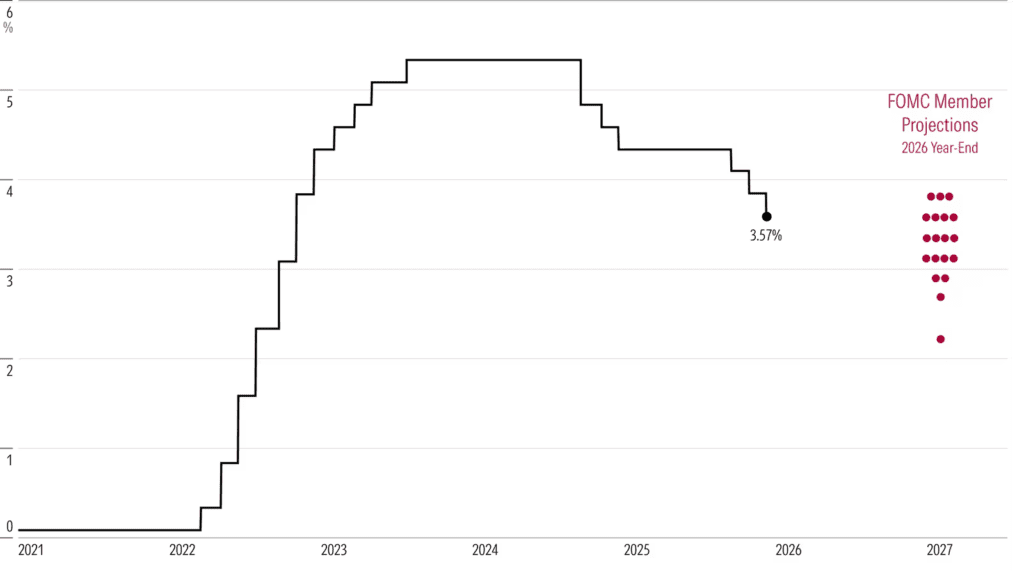

The Fed cut interest rates three times in 2025, bringing the federal funds rate down to 3.50%–3.75%, from 4.25%–4.50% at the start of the year. Those moves were driven mainly by signs that the labor market was losing momentum, even as inflation stayed stubbornly high due in part to tariffs introduced earlier in the year.

But those decisions came with a twist. None of the cuts were unanimous. Dissenting votes increased at each meeting, revealing a central bank split between officials worried about rising unemployment and others concerned that inflation is not falling fast enough.

Download CSV

That split is not going away.

How many rate cuts in 2026?

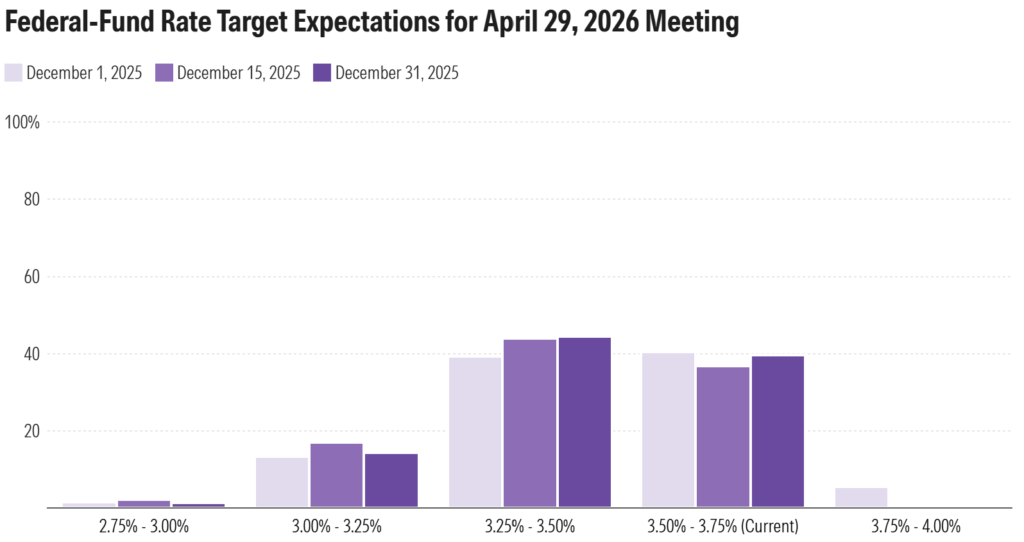

Most analysts expect the Fed to hold rates steady early in 2026, possibly for several months. Market pricing suggests one or two cuts later in the year, totaling around 50 basis points.

Bond markets currently assign:

- Low odds of a January cut

- Rising probability by spring

- A second cut possibly arriving in late 2026

Still, nothing is guaranteed. If inflation proves stickier than expected, the pause could last longer. If unemployment rises faster, pressure to cut will intensify.

As one strategist put it, these would not be aggressive easing moves, but “mid-cycle adjustments” designed to guide rates slowly toward a neutral level near 3%.

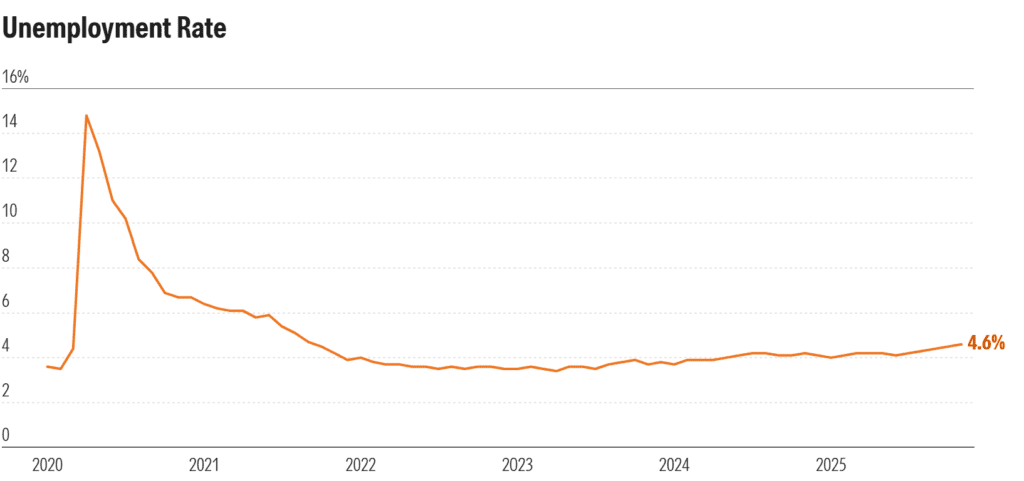

Jobs matter more than inflation, for now

While inflation remains above the Fed’s target, many economists believe jobs data will carry more weight in 2026. The unemployment rate has already edged higher, from 4.4% to 4.6% in recent months.

If that trend continues, the path to more rate cuts opens, even over the objections of hawkish policymakers. But if hiring stabilizes or improves, the Fed may decide it has done enough.

That uncertainty is exactly what keeps markets on edge.

Download CSV

A new Fed chair changes the equation

Another major wildcard arrives in May 2026, when Jerome Powell is set to step down as chair.

The White House has not named a successor yet, but names like Kevin Hassett and Kevin Warsh are widely discussed. Both are seen as more supportive of rate cuts, aligning more closely with Donald Trump, who has repeatedly criticized tight monetary policy.

That raises an uncomfortable question. Will politics influence the Fed in 2026?

Most analysts say institutional safeguards remain strong. The Fed’s committee-based structure makes it hard for any single chair to force through dramatic policy shifts. Still, leadership change adds another layer of uncertainty at a time when unity is already strained.

Expect more dissents, not less

One thing markets should prepare for is more divided votes. Analysts expect disagreements within the Federal Open Market Committee to remain visible, especially in the first half of the year.

Some see this as healthy debate. Others worry that prolonged public division could erode the Fed’s credibility, especially if political pressure becomes part of the story.

The risk is not chaos, but confusion. And markets dislike confusion.

The bond market is watching closely

If the Fed appears to bend too far toward politics, investors say the response will be swift. Bond yields would rise, the dollar could weaken, and financial conditions could tighten on their own.

In that sense, the market itself acts as a guardrail.

As one economist put it bluntly: the market votes in real time.

For 2026, the most likely Fed path is caution, patience, and internal debate. Rate cuts are possible, but not urgent. A long pause looks increasingly realistic. Leadership change will add noise, but not necessarily a policy revolution.

What is certain is this. The Fed’s hardest decisions are still ahead.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: How Fed Handled 2025, and What 2026 Could Bring

Divisions at the Fed That Shaped 2025 Are Set to Carry Into 2026