Global stock markets delivered strong gains in 2025, but beneath the surface, the structure of returns changed dramatically. Trade tensions, artificial intelligence disruption, shifting monetary policy expectations, and a weaker US dollar all played key roles in reshaping where investors found opportunities.

Rather than a simple US-led rally, 2025 became the year of concentration, diversification, and rapid dip-buying.

US stocks rose, but leadership weakened

The S&P 500 gained roughly 14% in 2025, a respectable return that kept US equities among the world’s top performers. However, US markets no longer dominated global rankings.

A key reason was the weakening US dollar, which fell sharply in the first half of the year and never fully recovered. This reduced the appeal of US assets for international investors and pushed capital toward Europe, Asia, and emerging markets.

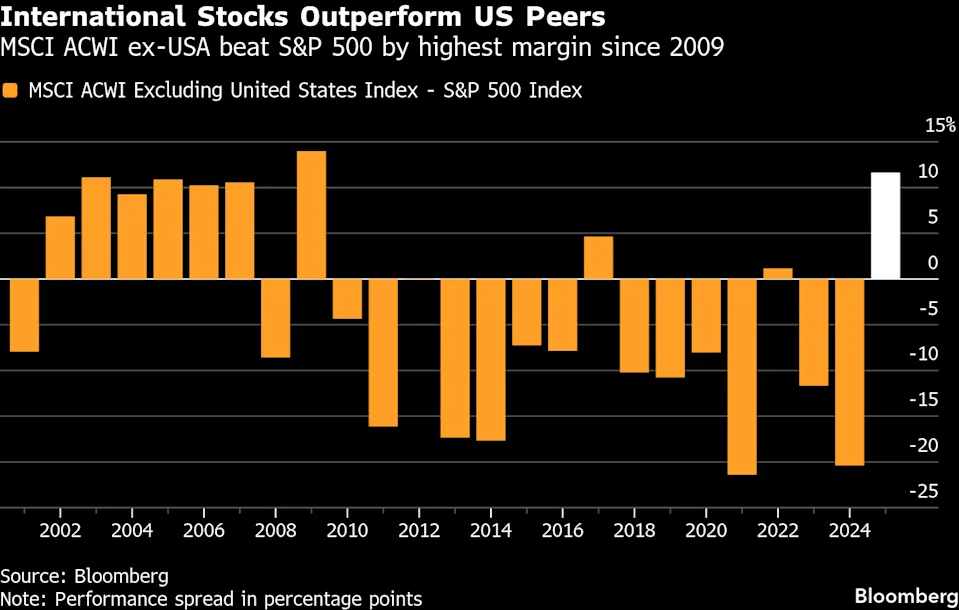

As a result, global stocks excluding the US posted their strongest outperformance versus the S&P 500 since 2009, according to MSCI data. Many strategists increasingly recommended international equities over US stocks as cracks appeared in the idea of US market exceptionalism.

Returns became extremely concentrated

One of the most striking features of 2025 was how narrow US market gains became.

Just five companies Nvidia, Alphabet, Broadcom, Microsoft, and Apple accounted for nearly 45% of the S&P 500’s total return. The technology sector briefly reached 36% of the index’s total weight, surpassing levels seen before the dot-com crash, before easing slightly later in the year.

This concentration raised concerns about valuation risk and bubble-like behavior, even as enthusiasm around AI remained strong. Many investors worried that broader market performance depended too heavily on a small group of megacap stocks.

AI optimism powered US and Asian markets

Artificial intelligence continued to dominate investor narratives. US and Asian equities benefited most from AI spending, chip demand, and data-center expansion.

Despite setbacks such as China’s DeepSeek challenging US AI leadership and concerns about massive capital spending, AI-linked stocks remained the primary engine of global equity gains. Investors consistently used pullbacks to increase exposure rather than reduce risk.

Europe rallied for completely different reasons

Europe’s strong performance had little to do with AI.

Instead, banks, defense companies, energy firms, and infrastructure stocks led the rally, supported by higher interest rates and large government spending commitments. European banks recorded their strongest year since 1997.

This created the largest divergence ever between US and European market leadership. Growth stocks dominated returns in the US, while value stocks led in Europe, an unusual split that pushed traditional factor investing into uncharted territory.

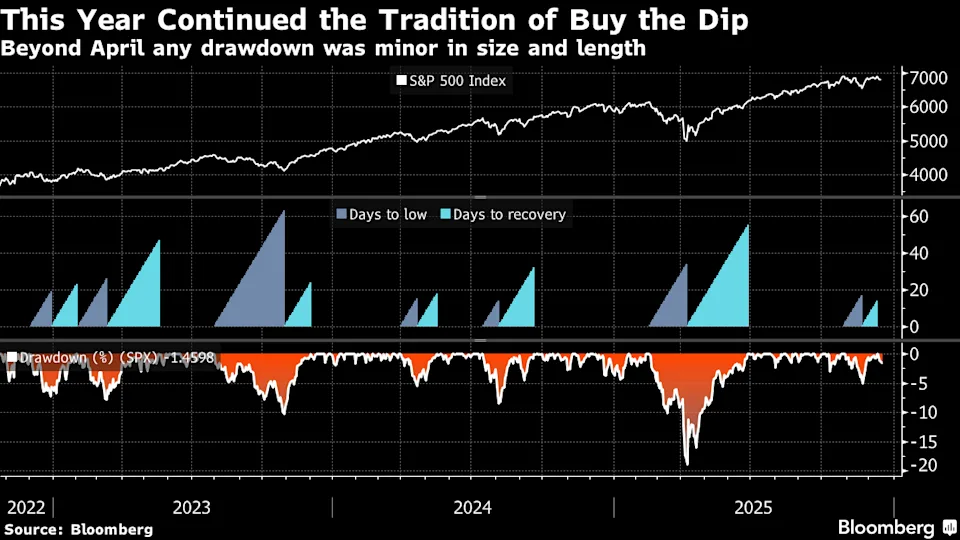

Market selloffs were shallow and short-lived

After severe volatility in April following tariff announcements, markets stabilized quickly. For most of the year, no drawdown exceeded 5% until November, as investors aggressively bought every dip.

Strong earnings, steady economic data, and leftover positioning from earlier selloffs helped support the rally. Confidence only began to fade late in the year as questions emerged around AI spending efficiency.

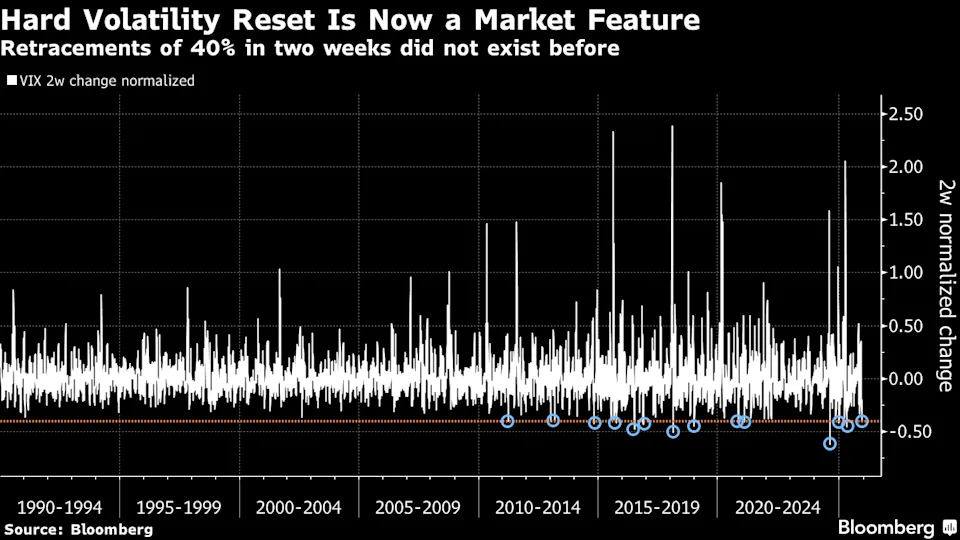

Volatility collapsed faster than ever

Volatility spikes became shorter and less threatening. The VIX index repeatedly fell back within days after major jumps, reinforcing a new investor mindset that panic events would not last.

This behavior marked a clear shift from previous cycles, encouraging investors to stay invested rather than move into defensive positions.

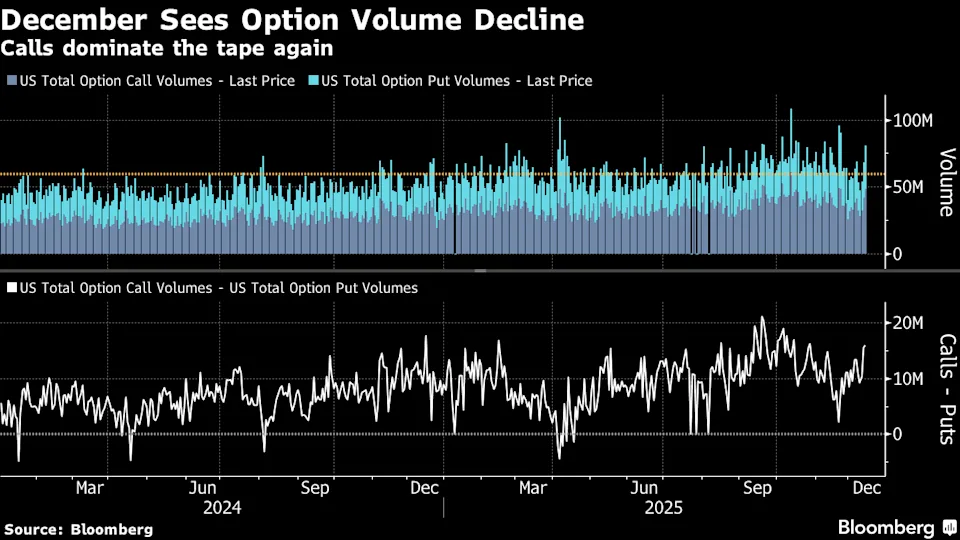

Options trading exploded

Another defining trend of 2025 was the surge in derivatives trading.

US options volumes hit record highs, with more than 100 million contracts traded on multiple days. Call options dominated activity for most of the year, showing strong appetite for upside exposure.

This surge in options activity helped explain why volatility fell so quickly, as short-term trading, income strategies, and volatility selling became central to market mechanics.

What investors learned in 2025

The charts tell a clear story:

- US dominance weakened but did not disappear

- Returns became more concentrated than ever

- Global diversification finally paid off

- Dip-buying became the default strategy

- Options markets played a larger role in price behavior

For investors, 2025 was not just about strong returns, but about a structural shift in how markets function, how leadership rotates, and how risk is priced across regions.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.