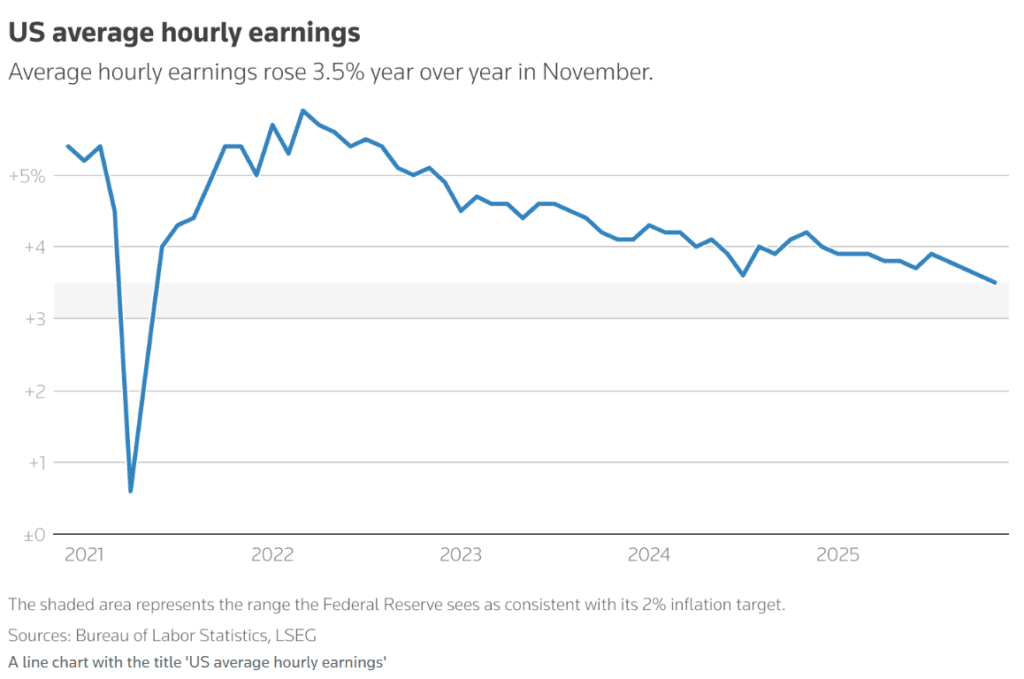

The November US jobs report showed further signs of cooling in the labor market, but economists say it is unlikely to change the Federal Reserve’s policy path in the near term.

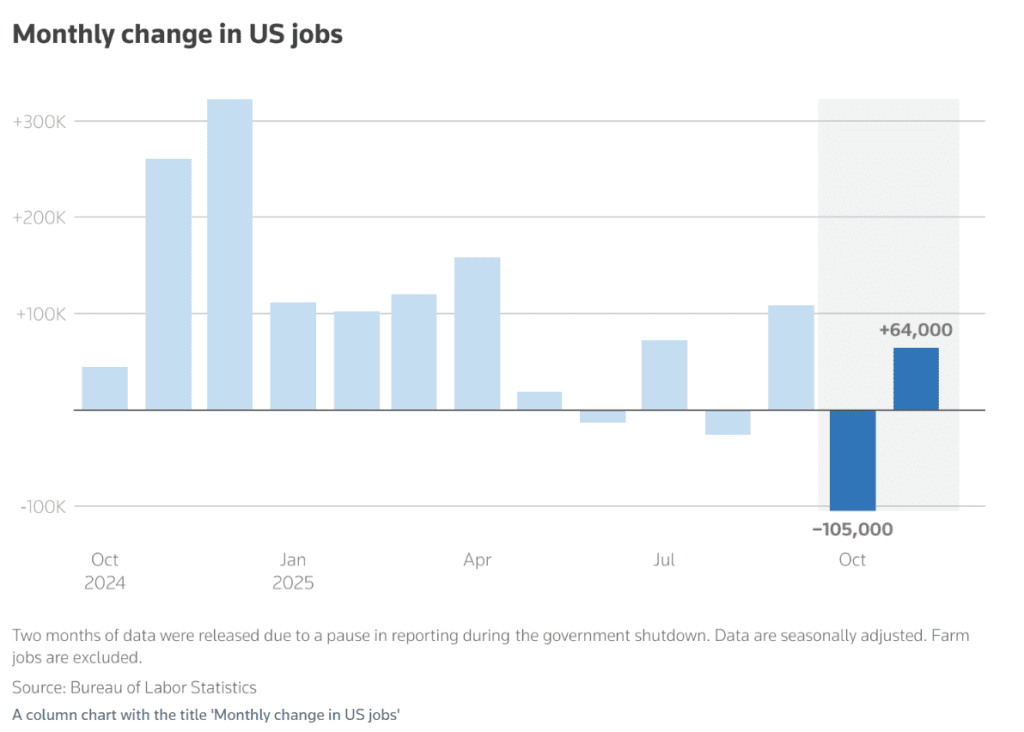

The economy added 64,000 jobs in November, rebounding from a revised loss of 105,000 jobs in October, while the unemployment rate rose to 4.6%, the highest level since September 2021. Despite the uptick in unemployment, analysts say the data was not weak enough to trigger another rate cut soon.

Krishna Guha of Evercore ISI said the figures do not meet the threshold for near-term easing, adding that the Fed would need to see “appreciably worse” data to justify another cut. Capital Economics economist Stephen Brown echoed that view, saying the report is unlikely to push the Fed toward rate cuts at its next few meetings.

Economists also urged caution in interpreting the data, noting distortions linked to the recent government shutdown. The Labor Department said the report carries higher uncertainty due to lower survey response rates and changes in data methodology.

A key factor behind the higher unemployment rate appears to be federal job losses. Government employment fell sharply in October as deferred resignations took effect, with additional declines in November. Federal employment is now down more than 270,000 jobs from its January peak.

National Economic Council Director Kevin Hassett said rising labour force participation suggests many former federal workers are actively looking for new jobs, pushing up the unemployment rate without signalling a broader economic downturn.

Fed Chair Jerome Powell has also warned that recent labour data may be distorted and should be viewed cautiously. He noted that underlying job growth may be weaker than headline numbers suggest, potentially closer to flat or slightly negative.

Some economists said the report keeps the door open for future rate cuts if weakness persists. Joe Brusuelas of RSM said late cycle data often gets revised lower, which could support easing if upcoming employment reports disappoint. Morgan Stanley’s Ellen Zentner added that while labor market softness is real, there is no sign the broader economy is breaking down.

For now, the November jobs report reinforces the Fed’s wait and see stance rather than prompting an immediate policy shift.

Related: S&P 500 slips for a third day as jobs report sparks economic fears

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.