US stocks closed higher Friday, marking a fourth straight day of gains as investors grew confident the Federal Reserve will cut interest rates at next week’s policy meeting. The rally pushed the S&P 500 to within touching distance of a new record high, while the Nasdaq Composite posted its ninth gain in ten sessions.

The S&P 500 rose 0.19% to 6,871.82, the Nasdaq Composite gained 0.31%, and the Dow Jones Industrial Average climbed 0.22% to 47,954.99, extending a two-week winning streak.

Fed Cut Expectations Strengthen

Investor sentiment was lifted after a delayed reading of the Personal Consumption Expenditures (PCE) price index — the Fed’s preferred inflation gauge — showed prices rising 2.8% year-over-year, matching forecasts and marking a modest cooling in “core” inflation.

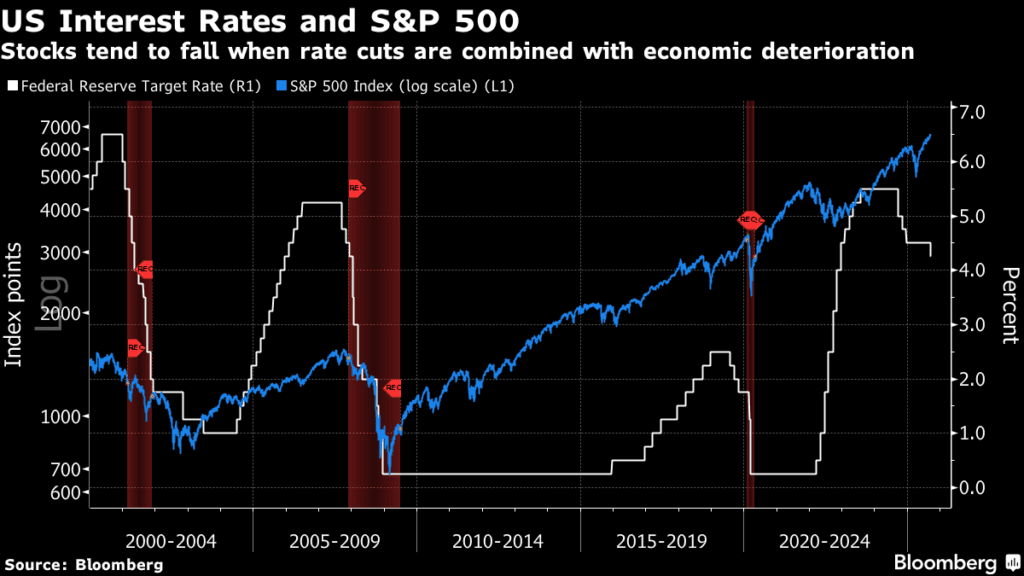

The data bolstered expectations that the Fed will deliver a 25-basis-point rate cut at its December 10 meeting. According to the CME FedWatch tool, traders are now pricing in an 87% chance of a rate reduction, up sharply from 62% a month ago.

“Inflation is easing and growth remains steady, that’s exactly the mix the Fed wants heading into next week,” said one strategist, noting that cooling price data has helped ease recession fears while fueling optimism for a soft landing.

Labor Market Mixed, Confidence Rises

The broader economic picture remains nuanced. Challenger, Gray & Christmas reported that US companies cut 71,000 jobs in November — the highest monthly figure since 2022 — yet weekly jobless claims fell to their lowest level since September 2022, pointing to gradual cooling rather than a sharp slowdown.

Meanwhile, consumer confidence rose for the first time in five months, reflecting improving sentiment as inflation expectations moderated.

Netflix Buys Warner Bros. Discovery Studios

In corporate news, Netflix (NFLX) confirmed a $72 billion deal to acquire Warner Bros. Discovery’s (WBD) studios and streaming unit after a heated bidding war. Netflix shares dipped slightly following the announcement, while WBD stock jumped over 6%, reflecting optimism that the deal could unlock new streaming synergies.

Elsewhere, Hewlett Packard Enterprise (HPE) shares edged higher despite issuing a weaker-than-expected sales outlook, as investors remained upbeat on its long-term AI infrastructure strategy.

Bitcoin Slips Below $90,000

Outside equities, bitcoin (BTC-USD) fell sharply, dropping below $90,000 for the first time in weeks. The cryptocurrency, down about 3% year-to-date, has diverged from stock market trends for the first time since 2014, even as the S&P 500 has gained more than 17% in 2025.

Traders say bitcoin remains vulnerable amid shifting liquidity and risk appetite, despite holding above key long-term support near $85,000.

Outlook: Fed Meeting to Set the Tone

With inflation cooling and markets near record highs, all eyes now turn to next week’s Federal Reserve meeting. Chair Jerome Powell is expected to announce the Fed’s final rate move of 2025, alongside updated economic projections and a press conference that could shape expectations for 2026.

Investors are betting on a “Santa Claus rally” to carry stocks through December, but the tone of Powell’s remarks and the Fed’s outlook on inflation could determine whether this year ends with a final surge or a dose of market reality.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.