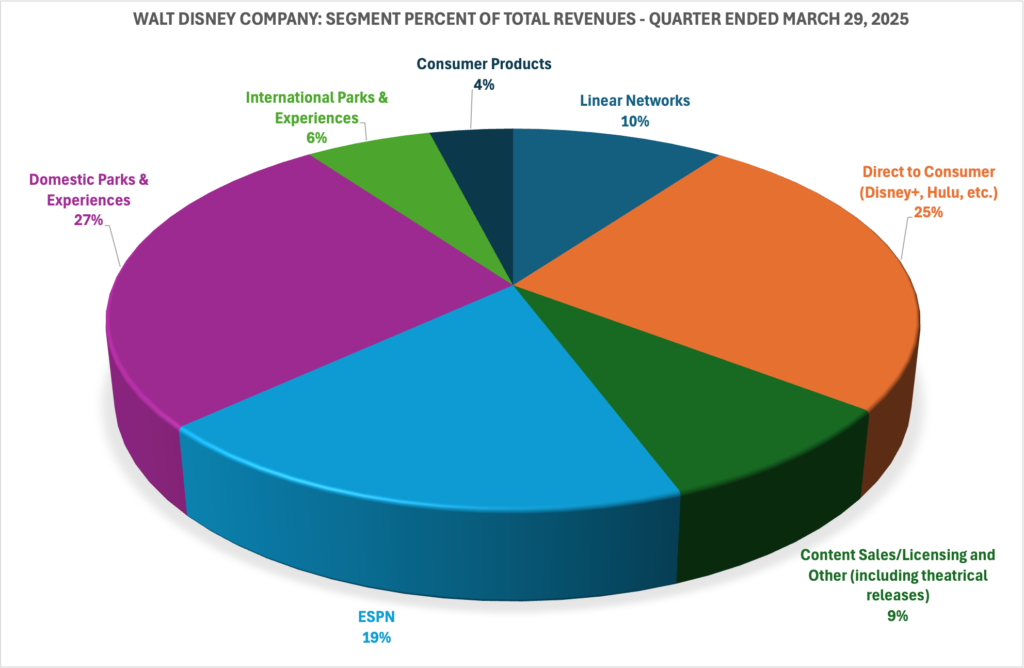

Walt Disney (DIS) is set to report fiscal Q4 2025 results on Thursday, November 13, before the market opens. This quarter is less about fireworks and more about consistency. Investors want confirmation that Disney’s streaming division remains profitable, its newly launched ESPN direct-to-consumer (DTC) app is gaining traction, and parks and resorts are holding steady—even as legacy TV continues to decline.

With the stock treading water this year and guidance relatively tight, this is a “prove it” quarter ahead of a critical FY2026.

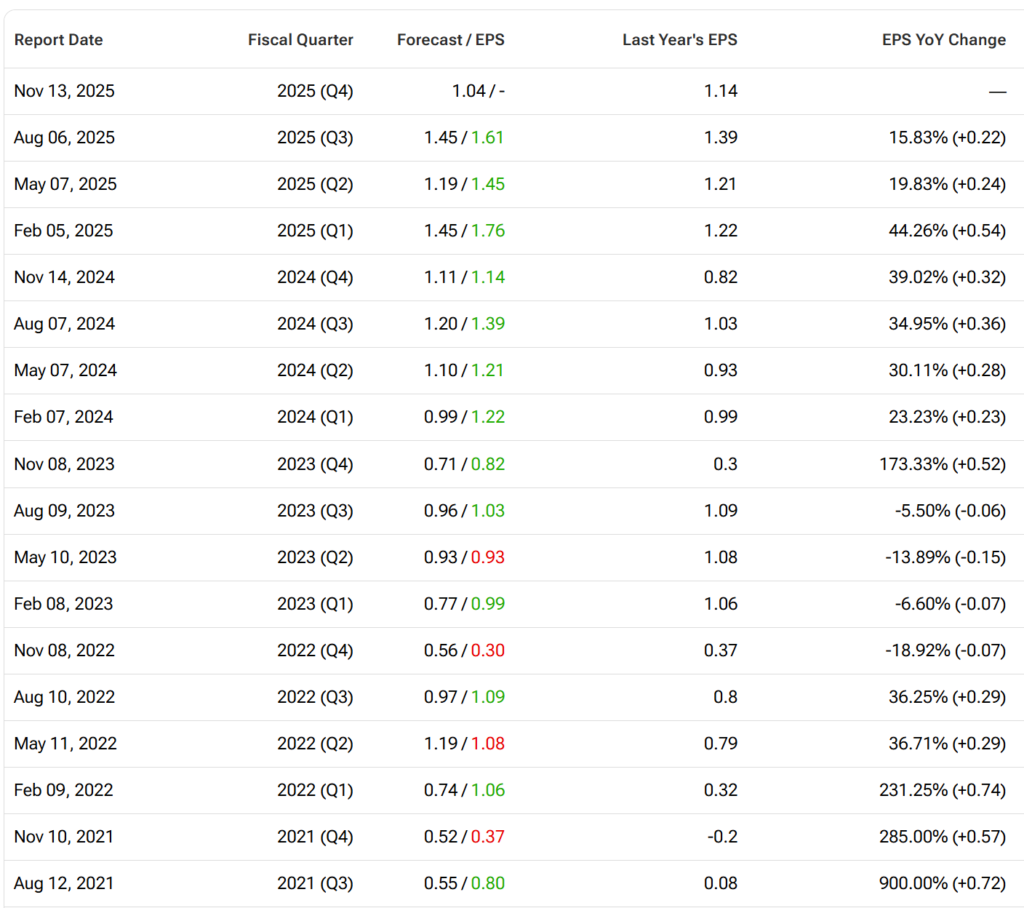

Street Forecast: Muted growth, all about margins

| Metric (Q4 FY2025) | Consensus Estimate | YoY Change |

|---|---|---|

| Revenue | ~$22.8B | +1% |

| Adjusted EPS | ~$1.03 | –10% |

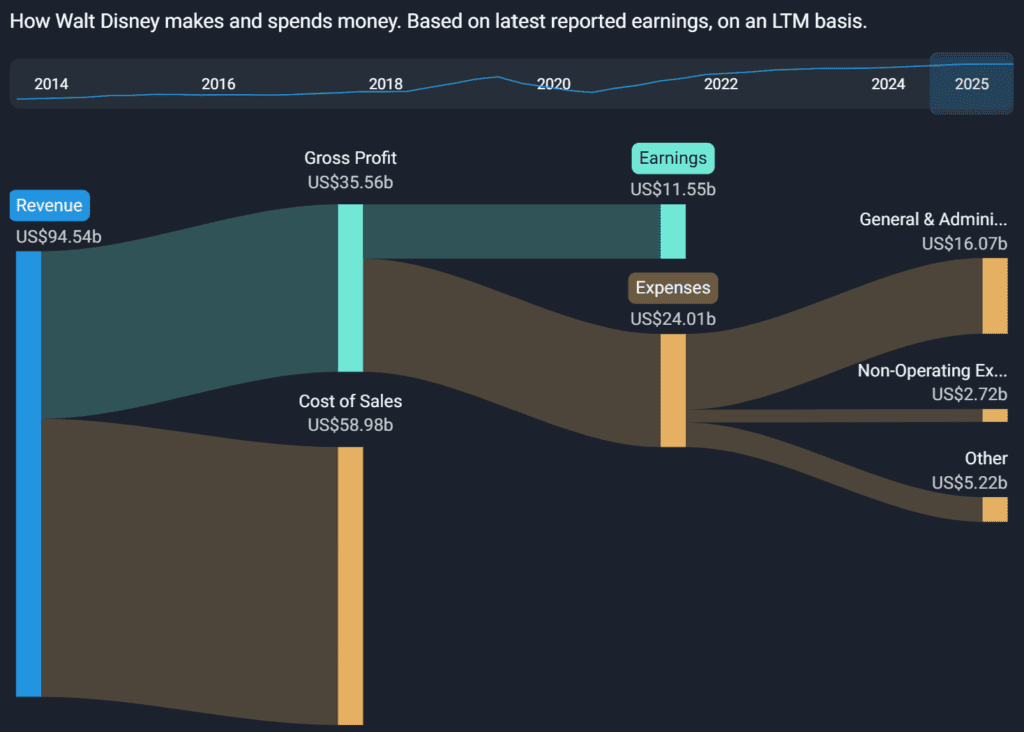

Analysts expect a flat top-line and a modest earnings dip versus last year. The focus is squarely on streaming margins, ESPN rollout traction, and the tone of forward commentary.

Disney+, Hulu, ESPN+: Streaming profitability in focus

Disney’s streaming operations finally turned a profit in Q3, with $346M in DTC operating income. That was a big milestone—and now Wall Street wants to see that profitability stick.

The company is also integrating Hulu into Disney+ to create a single, streamlined app by 2026, which could help improve engagement and reduce churn. ARPU continues to rise across regions due to price hikes and ad-supported tier uptake.

- Disney+ Core subs: ~131M

- Hulu SVOD subs: ~56M

- Combined streaming subs: ~183M

- Domestic Disney+ ARPU: $8.01

- International ARPU: $7.73

Management is placing less emphasis on subscriber counts and more on how much revenue (and margin) each subscriber brings in.

Prediction: Streaming operating income remains positive, ARPU trends continue higher, and Hulu integration commentary will be constructive.

ESPN DTC: A game-changer or just another bundle?

Launched in August 2025, the new ESPN streaming app is Disney’s boldest move in live sports since acquiring full control of ESPN. The premium tier, ESPN Unlimited, costs $29.99/month (or $299.99/year) and includes access to NFL, NBA, MLB, college sports, and more.

Disney is also bundling this with Disney+ and Hulu at a promotional $29.99/month for the first 12 months.

The key now is:

- How many signups are coming via bundles?

- Is ESPN cannibalizing linear TV faster than expected?

- Are advertisers and sponsors leaning in?

Prediction: Management shares upbeat early signals on ESPN bundle traction, but keeps long-term guidance cautious.

Parks & Experiences: Still Disney’s cash engine

Disney’s U.S. parks (Disney World, Disneyland) had a strong Q3 with record revenue and operating income. Per-capita spend was up, bookings held firm, and new attractions helped offset any softness in movie tie-ins.

International parks (like Shanghai and Paris) are seeing mixed trends, though new Frozen and Marvel areas are in the pipeline.

The cruise segment is expanding too—three new ships are set to launch by 2026. Investors will want to hear about:

- Holiday season bookings

- Guest spending trends

- Labor and operations cost pressures

Prediction: Parks revenue is steady, bookings are slightly up YoY, and margin commentary is neutral-to-positive.

Linear Networks: The long sunset continues

Cable and traditional TV remain a drag.

losses and lower ad revenue continue to weigh on linear, even as ESPN’s cable version benefits from live sports.

Disney is actively de-risking this segment, shifting more content to its streaming platforms and reducing overhead. Any positive surprises here would likely come from cost discipline, not revenue.

Prediction: No upside here, but linear won’t be a disaster—investors care more about how fast it’s being replaced.

Financial Outlook & FY2026 Strategy

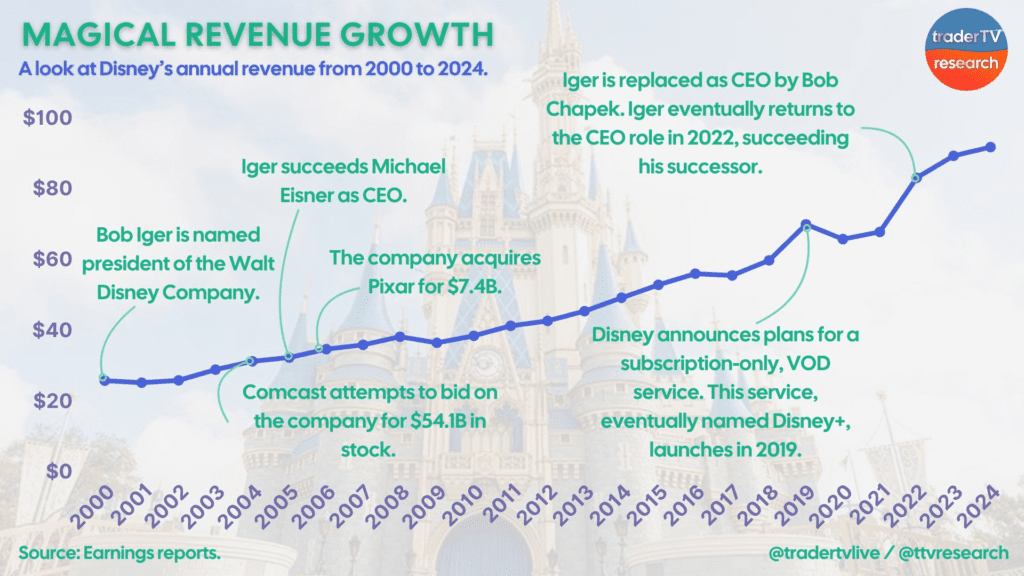

Disney reaffirmed FY2025 adjusted EPS guidance of ~$5.85, which implies 18% YoY growth. That puts Q4 right in line with consensus, assuming no major surprises.

The big FY2026 themes are:

- ESPN DTC ramp and monetization

- Full Hulu–Disney+ integration

- Parks expansion (Frozen, Marvel, new cruise ships)

- Keeping streaming profitable while investing in content

Prediction: FY2026 guidance commentary will highlight margin discipline and growth investments, reinforcing the long-term bull case.

Investor Sentiment: Cautious optimism

- Disney stock is up ~3% YTD

- Forward P/E: ~17–18x

- Analyst price targets: ~$134 (10% upside from current levels)

- Institutional ownership: >70%

Wall Street is supportive of Disney’s turnaround strategy, but sentiment remains fragile. Execution—not narrative—will drive the next move.

Expect an in-line quarter, guidance is the wildcard

Unless Parks disappoint or ESPN DTC stumbles out of the gate, Disney is unlikely to shock the market. This is a transition quarter—and the focus will be on 2026.

Our call: Revenue and EPS land roughly in line with estimates. A confident tone on streaming profitability and ESPN momentum could push the stock higher. But without those signals, the stock likely trades sideways.

Disclosure: All predictions and insights shared in this article are based on a comprehensive review of publicly available analyst reports, media coverage, and market consensus. These views are for informational purposes only and do not constitute investment advice. Please conduct your own research or consult a licensed financial advisor before making any investment decisions.