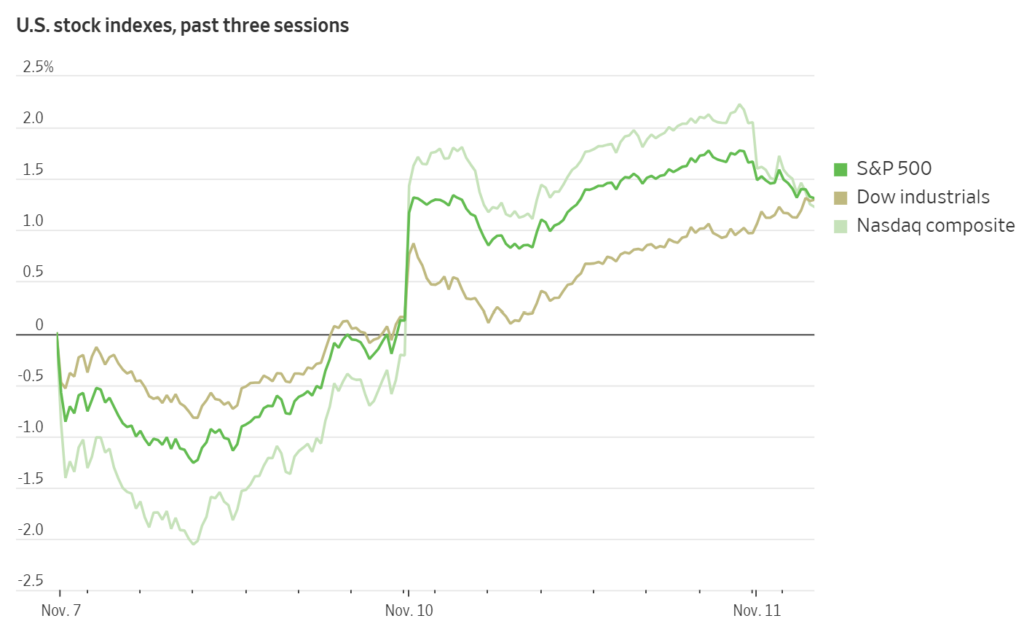

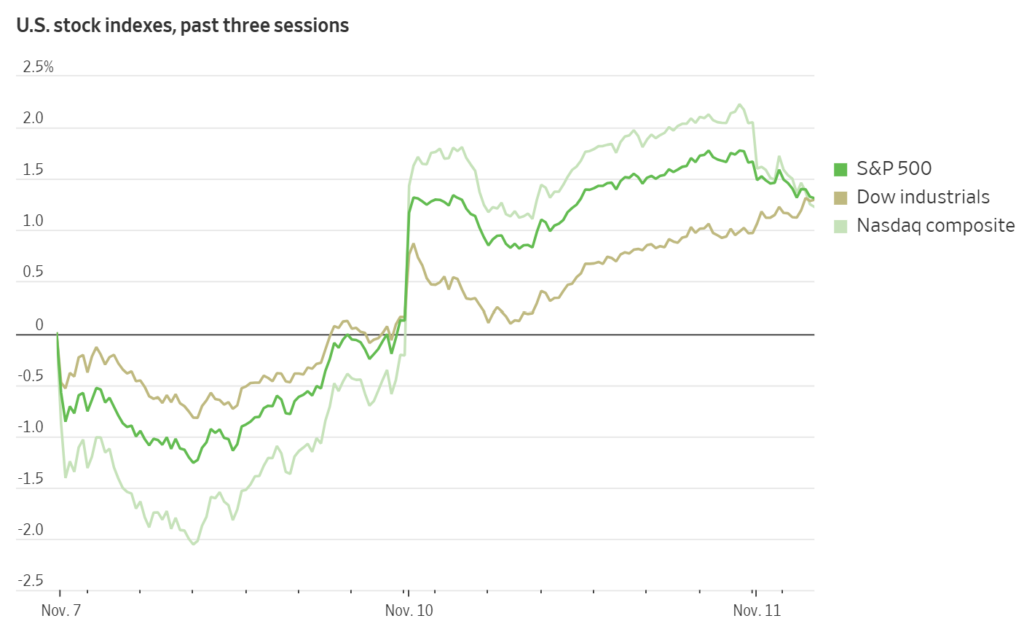

The S&P 500 fell 0.19% and the Nasdaq Composite lost 0.45%, snapping Monday’s rebound that followed Senate approval of a deal to reopen the federal government after 41 days, the longest shutdown in US history. The Dow Jones edged up 0.16%, helped by gains in McDonald’s (MCD) and Goldman Sachs (GS).

US bond markets were closed for Veterans Day, but equity traders focused on two themes: lingering AI valuation stress and the likely release of delayed economic data once the shutdown officially ends.

AI Angst Returns

Nvidia (NVDA) shares dropped 2.3% after Japan’s SoftBank Group sold its remaining $5.8 billion stake in the chipmaker, triggering profit-taking across the AI sector.

CoreWeave (CRWV), backed by Nvidia, plunged nearly 11% after trimming its 2025 revenue forecast to $5.05–$5.15 billion from $5.35 billion, citing delays from one of its data center developers. Analysts flagged its growing reliance on debt and heavy exposure to Microsoft (MSFT) as a key customer.

Bank of America cut its price target on CoreWeave to $140 from $168, while DA Davidson warned that the company’s “circular financing model” — borrowing against Nvidia chips to buy more Nvidia chips — poses long-term risk.

The selloff hit the broader AI complex:

- Tesla (TSLA) fell over 2%

- Meta (META) and Broadcom (AVGO) dropped more than 1%

- Nvidia remains up 40% YTD despite this week’s slide.

Economic Data & Shutdown Outlook

Private payroll data from ADP showed US employers shedding roughly 11,250 jobs per week in October, reinforcing signs of a slowing labor market. Goldman Sachs estimates the shutdown could cause a 50,000-job decline in October’s official payroll count once data resumes.

Markets expect the shutdown to end this week after the Senate passed a bipartisan deal late Monday. The bill now heads to the House of Representatives and then President Trump’s desk. Betting markets fully price in government reopening by Thursday.

Once federal agencies resume operations, traders anticipate a “data catch-up rally” as delayed reports like CPI, retail sales, and nonfarm payrolls are published.

Stock Highlights

- Paramount Skydance (PSKY) surged 8.7% after announcing more cost cuts and a $1.5B investment into streaming and studios.

- Rocket Lab (RKLB) rose 4.7% on record quarterly revenue.

- Occidental Petroleum (OXY) gained 3.6% after beating profit estimates.

Markets are caught between relief over Washington’s progress and renewed anxiety about AI valuations. With SoftBank’s Nvidia exit and CoreWeave’s guidance cut, investors are reassessing how sustainable the AI rally really is — even as the long-awaited government reopening promises a short-term boost in sentiment.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:What to Watch This Week: Shutdown Deal Lifts Markets