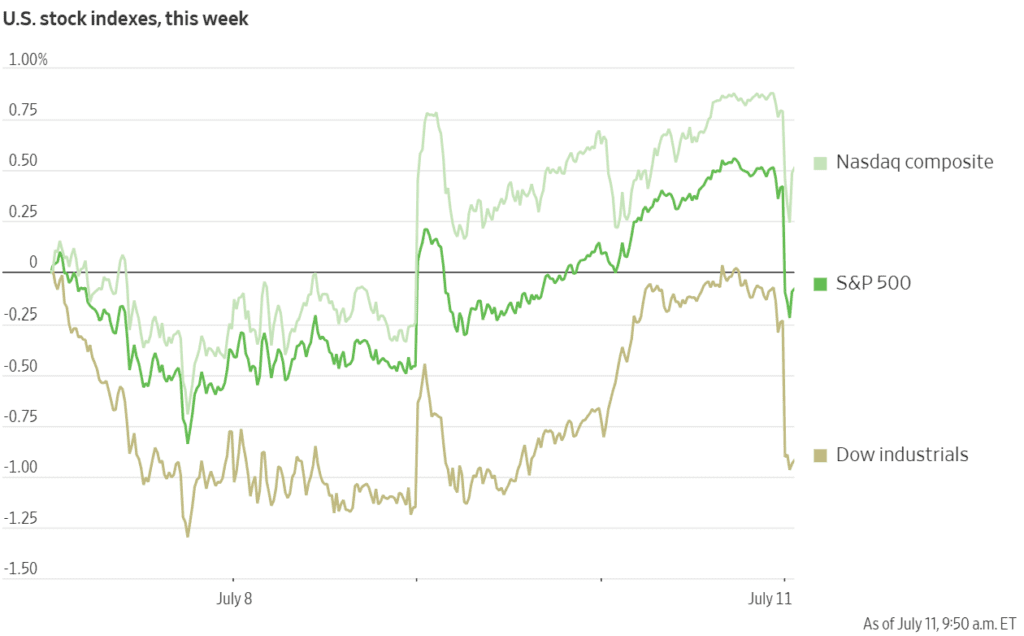

Wall Street’s winning streak hit a speed bump Friday after President Donald Trump stunned investors with a 35% tariff on Canadian imports and hinted at broader 15–20% blanket levies on countries that haven’t yet received formal tariff letters. The surprise salvo rattled global risk appetite, lifted the US dollar, and sent the Dow Jones Industrial Average down more than 300 points in early trading.

| Index | Latest | Change |

|---|---|---|

| Dow Jones | 44,240 | −0.8% |

| S&P 500 | 6,256 | −0.7% |

| Nasdaq Composite | 20,575 | −0.5% |

Tariff Twist: Canada First, EU Next?

- Letter to Ottawa: Trump’s overnight letter slaps a 35% duty on all Canadian goods starting Aug. 1. A White House official later said products that meet US-Mexico-Canada Agreement (USMCA) rules are temporarily exempt.

- Fentanyl rationale: Trump tied the higher duty to Canada’s “failure” to curb fentanyl flows, warning rates “will go higher” if Ottawa retaliates.

- EU in the cross-hairs: Trump told NBC he is “probably two days off” from sending Europe its tariff letter. Brussels says talks are ongoing but “no outcome yet.”

“Markets were priced for a goldilocks tariff path. A 35 % Canada duty plus blanket 20 % threats tells us that the assumption was wrong,” said Drew Pettit, US equity strategist at Citi. “Investors now need macro data to hold and the Fed to cut—both are still uncertain.

Markets React

| Asset | Move | Driver |

|---|---|---|

| USD/CAD | ↑ 0.3% | Tariff shock sinks the loonie |

| 10-Year UST | ↑ 4.39% yield | Inflation fears on higher import costs |

| Bitcoin | New record $118,000 | Haven bid, crypto-policy optimism |

| TSX Composite | −0.6% | Canada-centric risk-off |

Megacaps lose altitude: Nvidia slipped after celebrating a $4 trillion cap, while JPMorgan, Citi and Wells Fargo retreated ahead of next week’s bank-earnings kickoff.

Sector heat map: Opening-bell data showed broad red across the $SPY, $QQQ, $DJI, and $IWM ETFs.

Global Ripples

- Europe: STOXX 600 down 0.7% as traders brace for a potential EU tariff letter.

- Asia: Most regional bourses fell, though Shanghai eked out gains after US–China talks revived communication channels.

- Canada sentiment: A Nanos/Bloomberg poll shows 47 % of Canadians want pensions to cut US exposure amid the trade clash.

What’s Next

- Fed focus: Investors eye the FOMC minutes at 2 p.m. ET for clues on rate-cut timing amid tariff-driven inflation angst.

- Earnings season: Big banks start reporting next week; margins, credit costs, and tariff commentary will set the tone.

- Tariff timeline: August 1 looms as the hard deadline. Markets will track whether Ottawa and Brussels reach deals—or brace for retaliation.

Trump’s Canada tariff has pierced the market’s calm, knocking major indexes off record highs and reviving fears of a rolling trade war. With earnings season and a hot data calendar ahead, the next move—both from the White House and the Fed—will determine whether Friday’s sell-off is just a wobble or the start of a broader reset.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Tesla Paid for Elon’s Politics — Will the “America Party” Help or Hurt?

Shaken, Not Stirred: Markets brush off Trump’s latest tariff barrage

Wall Street Remains Resilient Amid New Tariff Threats

Trump Slaps 50% Tariff on Copper, Threatens 200% Duties on Pharmaceuticals

Dow, S&P 500, Nasdaq Drop as Trump Slaps 25–40% Tariffs on Trade Partners

Global Stocks Are Crushing US – But Which Ones?

Markets This Week: Tariff Chaos, Fed Clarity, Prime Day, and Earnings Heat Up

Elon Musk Launches ‘America Party’ After Breaking With Trump