US stocks ticked higher on Wednesday despite another barrage of tariff threats from President Trump and mixed signals from the Federal Reserve, as markets focused instead on Nvidia’s historic $4 trillion market cap and ongoing hope that major trade deals can still be reached before the looming August 1 deadline.

- The Dow Jones Industrial Average gained 0.37%

- The S&P 500 climbed 0.42%

- The Nasdaq Composite rose 0.73%, fueled by tech strength

Nvidia (NVDA) surged 1.71% intraday, briefly reaching $4 trillion in market cap — a first in corporate history — as it unveiled plans for a new AI chip aimed at China and confirmed CEO Jensen Huang will visit the country later this year. Nvidia’s rise buoyed broader sentiment and helped offset investor nerves around tariffs and Fed indecision.

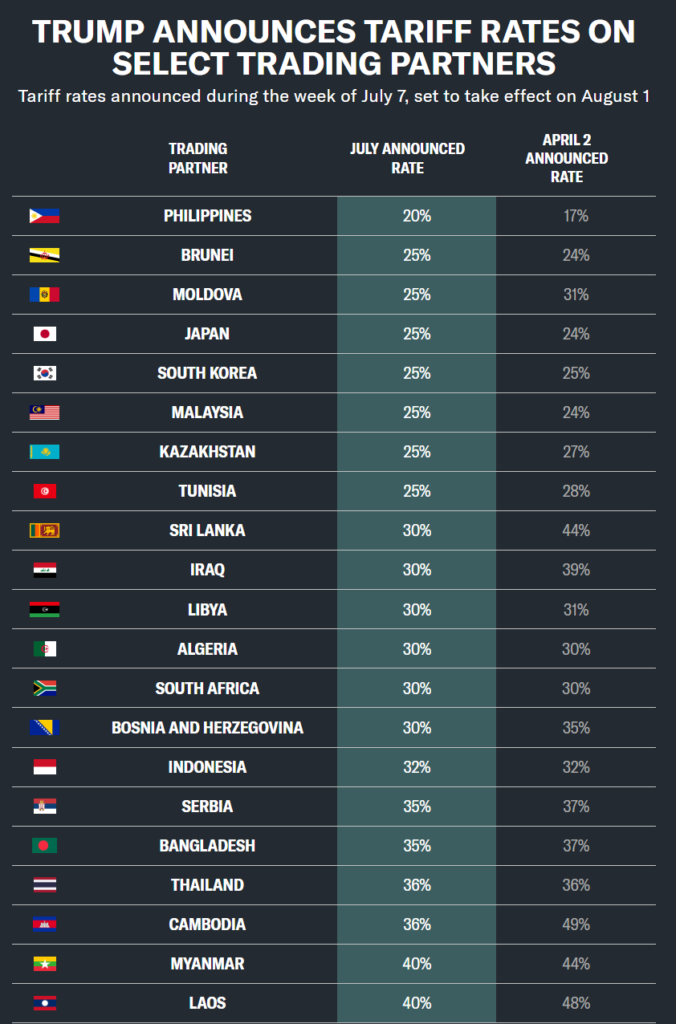

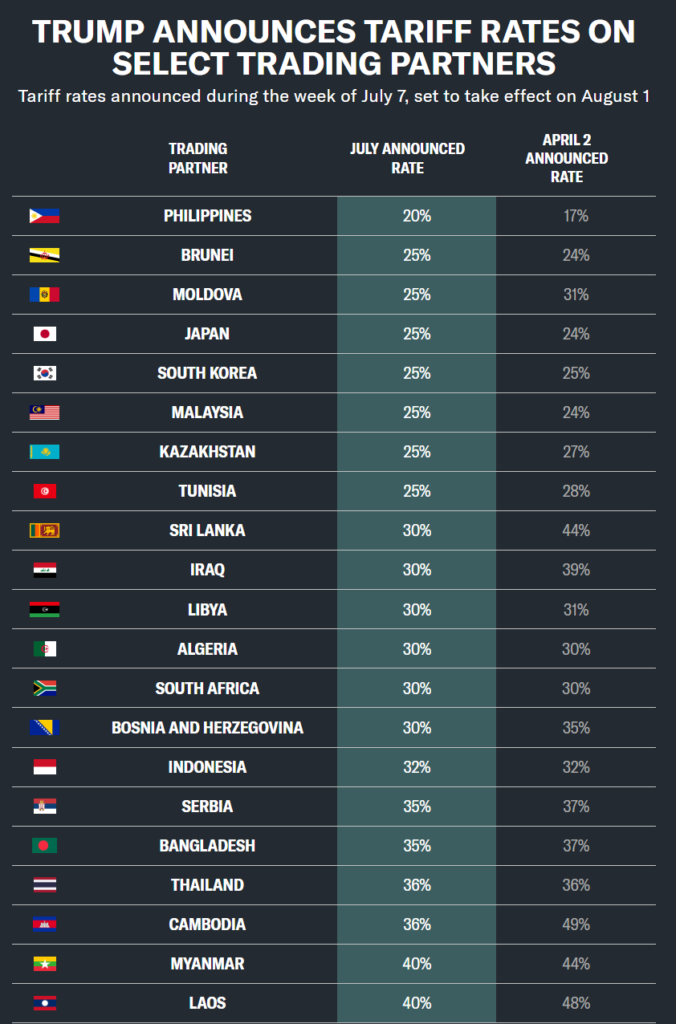

Trump Unleashes More Trade Letters, Hits 21 Countries

President Trump issued seven more tariff warning letters on Wednesday, bringing the week’s total to 21 nations. The new batch includes:

- 30% tariffs for Algeria, Iraq, Libya, and Sri Lanka

- 25% tariffs for Brunei and Moldova

- 20% for the Philippines, revised up from the 17% announced in April

Trump said the rates were determined using a “common sense formula” based on trade deficits and historical treatment. The tariffs are scheduled to take effect August 1 — the new hard deadline following a delay requested by Treasury Secretary Scott Bessent, who reportedly asked for time to secure more deals.

Trump emphasized that “no extensions will be granted” past August 1, though analysts and diplomats remain skeptical.

“Markets watched it all with as much interest as watching reruns on TV,”

quipped Edward Yardeni in a note, capturing the calm response from investors.

Former trade negotiator Wendy Cutler suggested partners are no longer panicking, instead entering a “wait-and-see” phase, calling Trump’s blitz “too much, too fast, too scattered.”

EU and India Remain in Focus as Deal Hopes Flicker

- The European Commission said it aims to finalize a tariff deal “in the coming days,” but acknowledged talks are “very complicated.”

- President Trump said the EU may receive its own tariff letter “in two days.”

- Commerce Secretary Howard Lutnick claimed the bloc made “significant, real offers” to help US farmers.

India, meanwhile, shows no signs of rushing. Officials are holding firm on protecting agriculture, dairy, and auto sectors, with no US relief expected for Indian steel exports.

Fed Minutes: Caution Rules, But Split Widens on Cuts

Newly released minutes from the June 17–18 Fed meeting showed that only “a couple” of officials supported a rate cut as early as July, with most leaning toward two cuts this year, potentially beginning in September.

Officials acknowledged tariff-driven inflation could be “temporary or modest” and emphasized a data-driven approach.

- The Fed Funds Rate remains at 4.25%–4.5%, unchanged since December

- Recent data showed 0.1% CPI rise in May, and June job gains of 147,000, above expectations

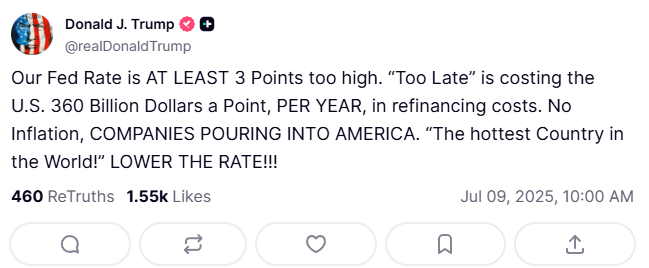

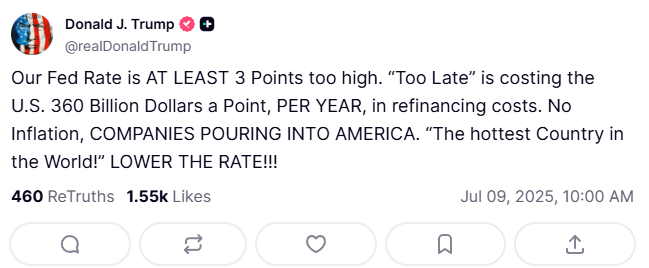

President Trump renewed pressure on the Fed this week, demanding a 3-point cut and calling current rates “too late” and “costing America $360 billion a point, per year.” He also called for Chair Jerome Powell’s resignation, but Powell has repeatedly rejected political influence over monetary policy.

Copper Retreats Slightly After Record Spike

Copper prices cooled on Wednesday, dipping 2.5%, after spiking to record highs on Tuesday following Trump’s announcement of a 50% tariff on copper imports. He also teased a 200% tariff on pharmaceuticals, set for a later rollout.

Market observers note that while these threats are headline-grabbing, actual implementation remains uncertain, especially as Trump’s team juggles dozens of negotiations simultaneously.

Analysts: Markets Are Shrugging Off the Drama

From Wall Street desks to media commentary, the prevailing sentiment is cautious detachment.

“It’s almost like Trump is losing credibility in terms of negotiating tactics,”

said AJ Bell analyst Dan Coatsworth. “His bark is worse than his bite.”

The term “TACO” (Trump Always Chickens Out) is circulating among traders, highlighting growing skepticism that all these letters and threats will lead to actual tariffs.

Looking Ahead

- August 1 is the next hard deadline for Trump’s tariff plan — unless, of course, it moves again.

- Investors await upcoming CPI and PPI data, Powell’s next appearance, and further trade letter releases — possibly including the EU and Brazil.

- Nvidia’s rise and tech momentum remain key market drivers, possibly overshadowing tariff anxiety unless a real economic hit materializes.

For now, markets are doing exactly what Trump’s team feared:

They’re watching — but not reacting.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump Slaps 50% Tariff on Copper, Threatens 200% Duties on Pharmaceuticals

Dow, S&P 500, Nasdaq Drop as Trump Slaps 25–40% Tariffs on Trade Partners

Global Stocks Are Crushing US – But Which Ones?

Markets This Week: Tariff Chaos, Fed Clarity, Prime Day, and Earnings Heat Up

Elon Musk Launches ‘America Party’ After Breaking With Trump