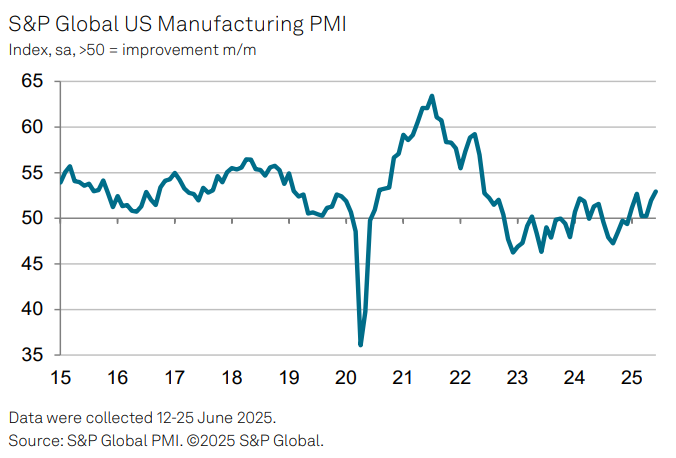

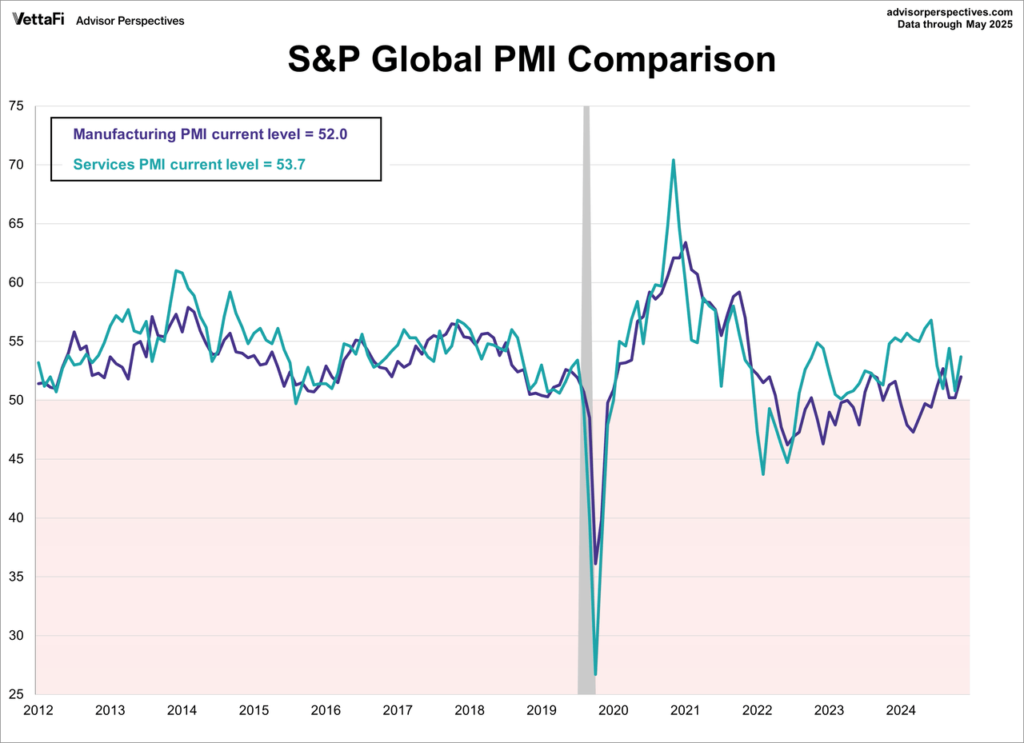

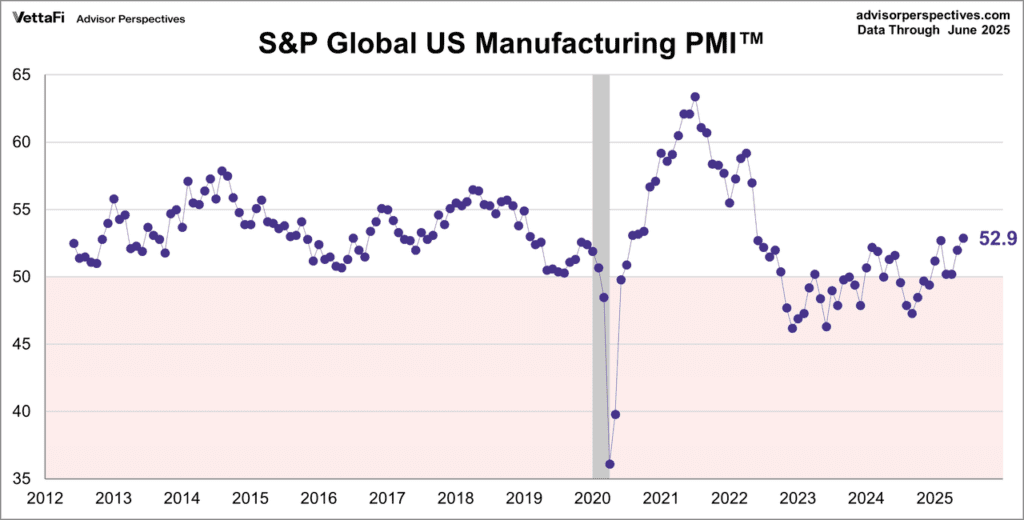

US manufacturing is showing renewed strength as the S&P Global US Manufacturing PMI surged to 52.9 in June — the highest level in three years and well above forecasts of 52.0. The index signals the sixth straight month of expansion, fueled by rising domestic and export orders and a rebound in production activity.

According to S&P Global’s latest report, June marked a return to growth after three months of production decline, with factories ramping up output and hiring at the fastest pace since September 2022. The momentum is attributed in part to inventory building, as manufacturers and retailers seek to hedge against Trump-era tariff increases and potential supply disruptions.

“Reviving demand has encouraged factories to take on additional staff… However, some of this improvement is due to inventory building, which suggests slower growth may follow,” said Chris Williamson, Chief Business Economist at S&P Global.

Highlights from the June Report:

- PMI rose to 52.9, up from 51.3 in May — indicating accelerating expansion

- New orders and export demand saw a solid uptick, supporting stronger factory workloads

- Employment growth hit its highest rate in nearly two years

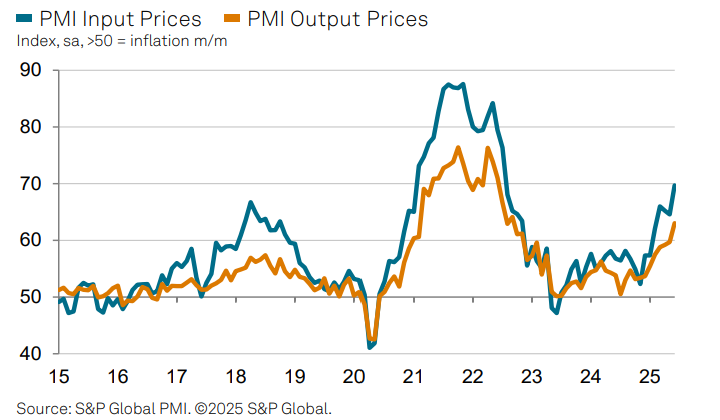

- Input costs surged, driven by tariffs — with producers passing costs to customers

- Business confidence improved, though caution remains amid tariff deadline uncertainty

Inflation Pressures & Inventory Risks

While the report reflects growing optimism, Williamson warned of looming risks:

“Factories reported steep cost increases again in June, linked to tariffs… The big question is whether this results in a short-term spike or a return to stubborn inflation.”

The surge in inventory suggests that some of the current growth may be front-loaded. Firms are reportedly stockpiling goods in anticipation of higher prices and tighter trade conditions as Trump’s July 9 tariff deadline approaches.

What Is the S&P Global Manufacturing PMI?

The Purchasing Managers’ Index (PMI) gauges business conditions in the manufacturing sector via surveys of around 600 firms. A score above 50 signals expansion, while a reading below 50 indicates contraction. The June reading of 52.9 marks the strongest pace since 2022, with broad-based improvements across output, employment, and new orders.

Outlook for H2 2025

Despite the upbeat data, S&P Global analysts caution that some of the growth may prove temporary, driven by inventory and short-term demand. If tariff risks escalate or consumption slows, growth may moderate in the second half of the year.

Still, with improving sentiment and easing fears around trade disruptions, US manufacturing appears to have regained a firmer footing.

Relevant ETFs to Watch:

- First Trust Industrials/Producer Durables AlphaDEX Fund (FXR)

- Industrial Select Sector SPDR Fund (XLI)

- Vanguard Industrials ETF (VIS)

- iShares U.S. Industrials ETF (IYJ)

Full report: S&P Global June Manufacturing PMI

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

What’s in Tax and Spending Bill That Trump Signed Into Law

F1 The Business: Apple chases Netflix’s Formula 1 playbook

Markets Hit New Highs, Fed Cuts Off Table After Strong Jobs Data; Trade Talks & Tariff Risks Still Loom

Markets Hit Highs After Trump–Vietnam Deal, But All Eyes on US Jobs Report Now

FHFA Chief Claims Powell Lied to Congress; Trump Demands Immediate Resignation

Global Stocks Are Crushing US – But Which Ones?

Market Wrap: Stocks Hit Records, Dollar Slides, and Gold Surges as July Begins

Bessent Warns: US Tariffs Could Snap Back to 50% as July 9 Deadline Looms