The IPO market in 2025 is roaring back to life — and one thing is clear: size matters. A wave of billion-dollar debutants is dominating the public markets, with investors pouring into the largest, trend-driven names across crypto, AI, and medtech.

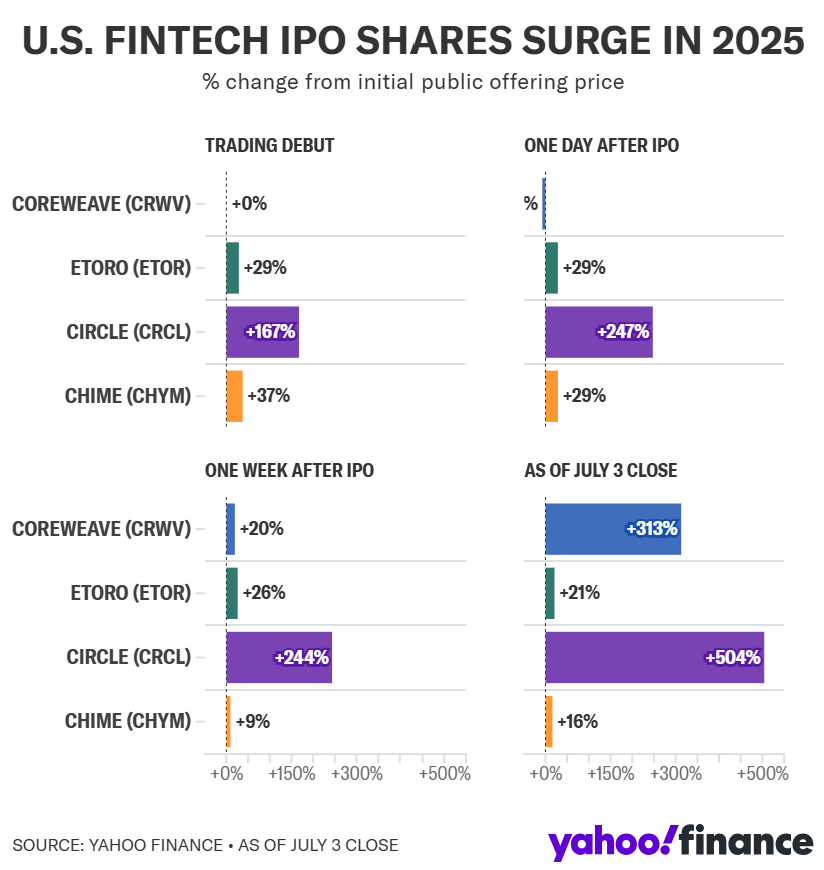

- Circle (CRCL) and CoreWeave (CRWV), riding high on crypto and AI hype, have skyrocketed over 500% and 310% respectively since their debuts earlier this year. Both now boast market caps above $45 billion.

- IPO activity is up sharply. According to Renaissance Capital, 100 US companies with a market cap of $50M+ have priced IPOs in 2025 — a 42.9% increase from last year.

- At least six companies worth over $1B have doubled post-IPO, with three rising over 500% since pricing.

- Even outside AI and crypto, returns are booming: Medtech firm Anbio Biotechnology (NNNN) is up 630%, and ESG-tech developer Diginex (DGNX) surged 930%, despite its Hong Kong base.

- The Renaissance IPO ETF rallied 20% in Q2, fully erasing its 14% Q1 losses — a signal that IPO momentum is back.

Renaissance’s Avery Marquez told Yahoo Finance that the strong performance of mega-IPOs like Circle and eToro (ETOR) — all raising over $600M — is driving large private firms to accelerate their public debut plans. One of them is Figma, which just filed for IPO on July 1 under ticker “FIG,” aiming to ride the AI tailwind with a $12.5B valuation.

While June and early July saw a brief IPO cooldown due to Trump’s looming July 9 tariff deadline, analysts expect a strong fall recovery.

“It’s not just two or three companies that have done amazing — it’s really a broader group that has been well received,” Marquez said. “Companies are watching these deals come to market and do well, and then continue to do well.”

With IPO appetite heating up again, all eyes are on who’s next — and whether the “bigger is better” trend continues to rule the public markets.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

F1 The Business: Apple chases Netflix’s Formula 1 playbook

Markets Hit New Highs, Fed Cuts Off Table After Strong Jobs Data; Trade Talks & Tariff Risks Still Loom

Markets Hit Highs After Trump–Vietnam Deal, But All Eyes on US Jobs Report Now

FHFA Chief Claims Powell Lied to Congress; Trump Demands Immediate Resignation

Global Stocks Are Crushing US – But Which Ones?

Market Wrap: Stocks Hit Records, Dollar Slides, and Gold Surges as July Begins

Bessent Warns: US Tariffs Could Snap Back to 50% as July 9 Deadline Looms