US equities surged to new record highs midday Thursday after the June jobs report came in stronger than expected, easing recession fears and effectively taking a July rate cut off the table. However, beneath the surface, private-sector job creation showed signs of fatigue, and trade risks remain elevated.

Market Snapshot (Midday US ET)

- S&P 500: +0.80% to 6,271 — new record

- Nasdaq: +1.02% to 20,561 — new record

- Dow Jones: +0.94% to 44,825

- Russell 2000: +0.65% — turns positive for 2025

- 10Y Treasury Yield: up to 4.36%

- Gold: down 0.3%

- Oil (WTI): steady at $66.70

- USD Index: firming as odds of Fed easing fade

Jobs Data Shakes Up Fed Expectations

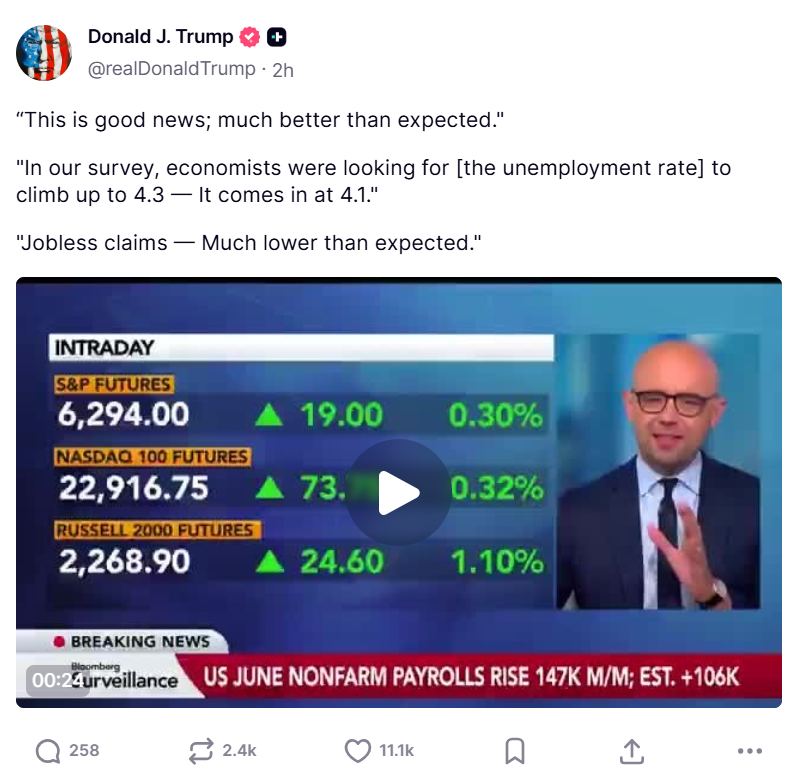

The June nonfarm payrolls report showed the US economy added 147,000 jobs, well above forecasts for 106,000. The unemployment rate fell to 4.1%, defying expectations of an increase to 4.3%. Wage growth, however, moderated — with average hourly earnings rising 0.2% MoM and 3.7% YoY, slightly below estimates.

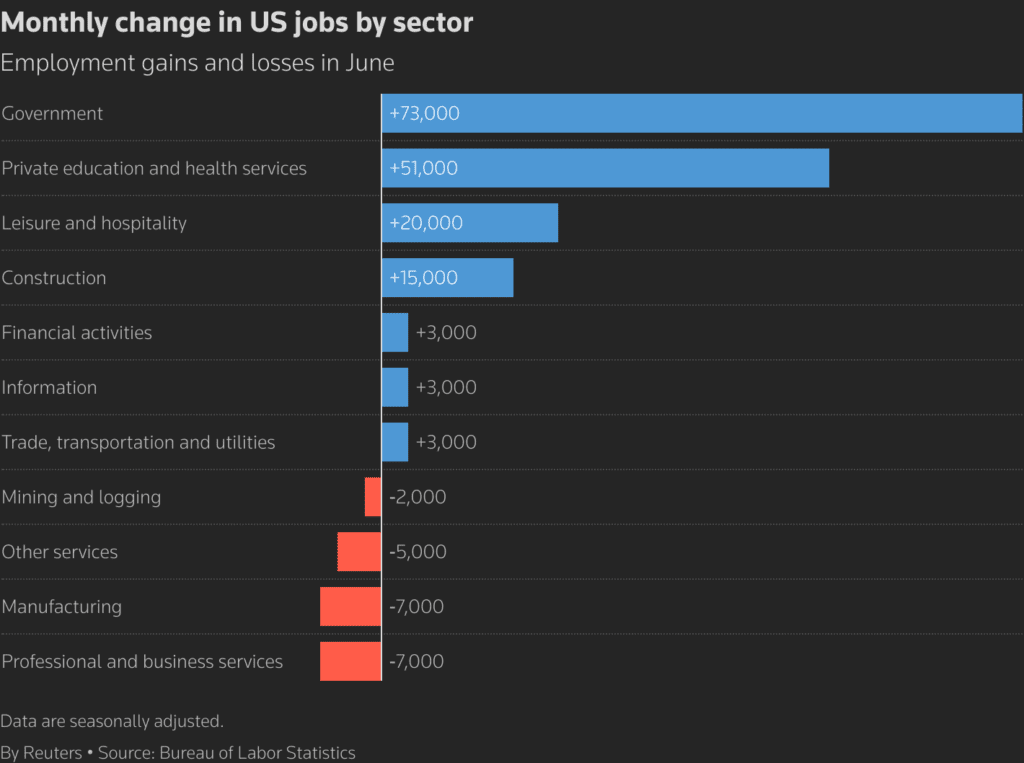

While the headline jobs figure beat expectations, nearly half of all new jobs came from the government sector, with private job growth slowing to just 74,000 — the weakest since October 2024. Sectors like manufacturing and business services posted losses, and the average workweek shortened again to 34.2 hours.

Economists warn this mixed picture may complicate monetary policy.

“The labor market isn’t crumbling, but it’s clearly not booming either,” said RSM’s Joe Brusuelas. “This feeds right into Powell’s wait-and-see messaging.”

Traders have now priced out a July rate cut, with CME FedWatch showing only a 5% probability. September remains in play, but odds fell from 74% last week to just under 69% today.

Trade Watch: EU Ready for Deal, Bessent Warns

Global trade remains a central driver of market sentiment. Earlier today:

- EU Commission President Ursula von der Leyen said Brussels is “ready for a deal” with Washington on tariffs, following Trump’s Vietnam agreement.

- Treasury Secretary Scott Bessent, speaking from Washington, warned countries not to drag out talks, adding: “Tariffs can cantilever back up to April 2 levels overnight if partners stall. We’re watching the EU closely.”

- Bessent confirmed ongoing meetings with EU trade negotiators, but said progress is “not guaranteed.”

Meanwhile, US Trade Balance data for June showed a deficit of -$71.5B, wider than the expected -$71B, highlighting ongoing challenges despite export wins in Vietnam.

Market Reactions & Fed–White House Tensions

President Trump reacted to the jobs data with characteristic flair:

“This is GOOD NEWS — much better than expected!” he posted on Truth Social.

Still, he renewed his criticism of the Fed, demanding Powell’s resignation and claiming he “cheated Congress.”

Fed Chair Jerome Powell, who has not ruled out future cuts, emphasized that the tariff-induced inflation risk remains the central reason for holding off.

“We went on hold when we saw the size of the tariffs. Every inflation forecast shot up,” Powell said Tuesday.

What’s Next

Markets will close early today (1 PM ET) for Independence Day, with Friday fully closed.

Next major catalyst:

- July 9, when Trump’s tariff pause deadline expires.

- Any further signs of private sector softness or new trade escalation could weigh on sentiment going into Q3.

For now, optimism dominates — but the cracks under the surface haven’t disappeared.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Markets Hit Highs After Trump–Vietnam Deal, But All Eyes on US Jobs Report Now

FHFA Chief Claims Powell Lied to Congress; Trump Demands Immediate Resignation

Global Stocks Are Crushing US – But Which Ones?

Market Wrap: Stocks Hit Records, Dollar Slides, and Gold Surges as July Begins

Bessent Warns: US Tariffs Could Snap Back to 50% as July 9 Deadline Looms