Trade euphoria lifted markets to new highs, but signs of a labor slowdown are flashing louder than ever. As Trump touts a new Vietnam trade deal, Wall Street eyes today’s key jobs report that could tip the Fed toward rate cuts.

Market Snapshot:

- S&P 500 closed at a record high of 6,277.42 (+0.47%)

- Nasdaq hit a new peak at 20,393.13 (+0.94%)

- Dow Jones flat (-0.02%)

- MSCI Asia Pacific +0.2%; Vietnam Index highest since April 2022

- EURO STOXX 50 futures +0.2%, Nasdaq futures +0.1%

- Gold -0.2% (snapped 4-day gain)

- Oil rose to $66.62 on surprise inventory build

- 10Y Treasury yield ticked up to 4.31% on fiscal concerns

- Vietnamese dong hit a record low: 26,218 per USD

- Bitcoin is over 185000.

Markets Hit Records After Vietnam Trade Deal

day Wednesday, President Trump posted a surprise update announcing that the US had finalized a trade agreement with Vietnam. Under the deal:

- US exports will receive full market access in Vietnam (0% tariffs).

- Vietnamese goods entering the US will be subject to a 20% tariff.

- Goods transshipped through Vietnam (mainly from China) face a 40% tariff, aimed at stopping circumvention of previous restrictions.

The agreement, while punishing on the import side, is seen as a win for US companies struggling with global supply chain instability. For Vietnam — where exports to the US make up 30% of GDP — avoiding Trump’s harsher “Liberation Day” tariffs offers economic relief.

Retail and apparel stocks jumped on the news:

- $NKE +4.06%

- $GES +3.69%

- $UAA +1.83%

- $VFC +1.96%

- $LULU +0.48%

Trump jokingly added he looks forward to seeing “giant American SUVs on the streets of Hanoi,” even as Vietnam’s tight road infrastructure makes that unlikely. Nevertheless, the deal gives retailers breathing room ahead of what was shaping up to be a disastrous July 9 tariff deadline.

The Bigger Trade Picture: Clock Is Ticking

The Vietnam deal is only the third such agreement secured ahead of Trump’s July 9 deadline, when sweeping tariffs are set to return if no progress is made with key partners.

- Japan: Trump blasted Japan for being “spoiled” and threatened 35% tariffs if no deal is reached.

- India: Talks have stalled over how to define “Made in India,” with the US demanding 60% value-add vs. India’s 35%.

- EU: Facing 50% auto tariffs, negotiators are under pressure to make progress before the long weekend.

- China: Indirectly targeted via Vietnam transshipments, raising concerns in Beijing over supply chain isolation.

Trump’s administration says more deals are in the pipeline, but only 3 of 18 targeted countries have confirmed agreements so far. The next week is critical.

Tariffs Still Looming: The Corporate Cost

A new analysis from JPMorgan Chase Institute warns that current tariffs already cost US companies $82.3 billion, and if Trump’s full “Liberation Day” regime returns, the burden could double.

- Midsize US firms could face a 3% payroll hit

- Cost per employee could rise by $2,080

- Ripple effects could hurt small businesses and regional supply chains

Labor Market Warning Signs

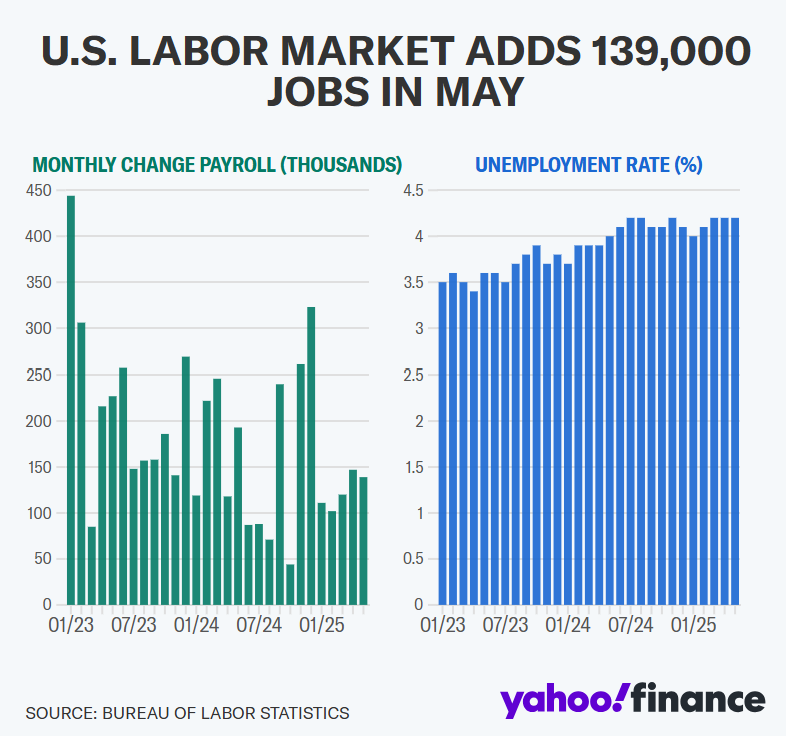

Today’s Nonfarm Payrolls report (8:30 AM ET) will be the biggest driver of markets before the holiday weekend. The release follows a surprisingly negative ADP private payrolls report, which showed a 33,000 job loss in June—the first since 2023.

Expectations for today’s BLS data:

- +110,000 jobs (vs. +139K in May)

- Unemployment rate: 4.3% (vs. 4.2%)

- Wage growth: +3.8% YoY

If the data disappoints again, it could swing market sentiment firmly toward a July rate cut. Right now, futures are pricing only a 25% chance of a cut — but a weak print would increase pressure on the Fed, especially with the labor market flashing early warning signs.

Also on the calendar:

- Initial Jobless Claims

- S&P Global PMIs

- Factory Orders

- ISM Non-Manufacturing PMI

- FOMC Member Bostic’s speech at 11 AM ET

Outlook: Relief Now, Risk Later

Markets are celebrating today, but beneath the surface, risk is building. Trade tensions remain unresolved with most major partners. Today’s payroll data will set the tone for rate expectations heading into Q3. And while stocks remain near highs, earnings and tariffs may soon test investor optimism.

Stay tuned — and watch July 9 like a hawk.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

FHFA Chief Claims Powell Lied to Congress; Trump Demands Immediate Resignation

Global Stocks Are Crushing US – But Which Ones?

Market Wrap: Stocks Hit Records, Dollar Slides, and Gold Surges as July Begins

Bessent Warns: US Tariffs Could Snap Back to 50% as July 9 Deadline Looms