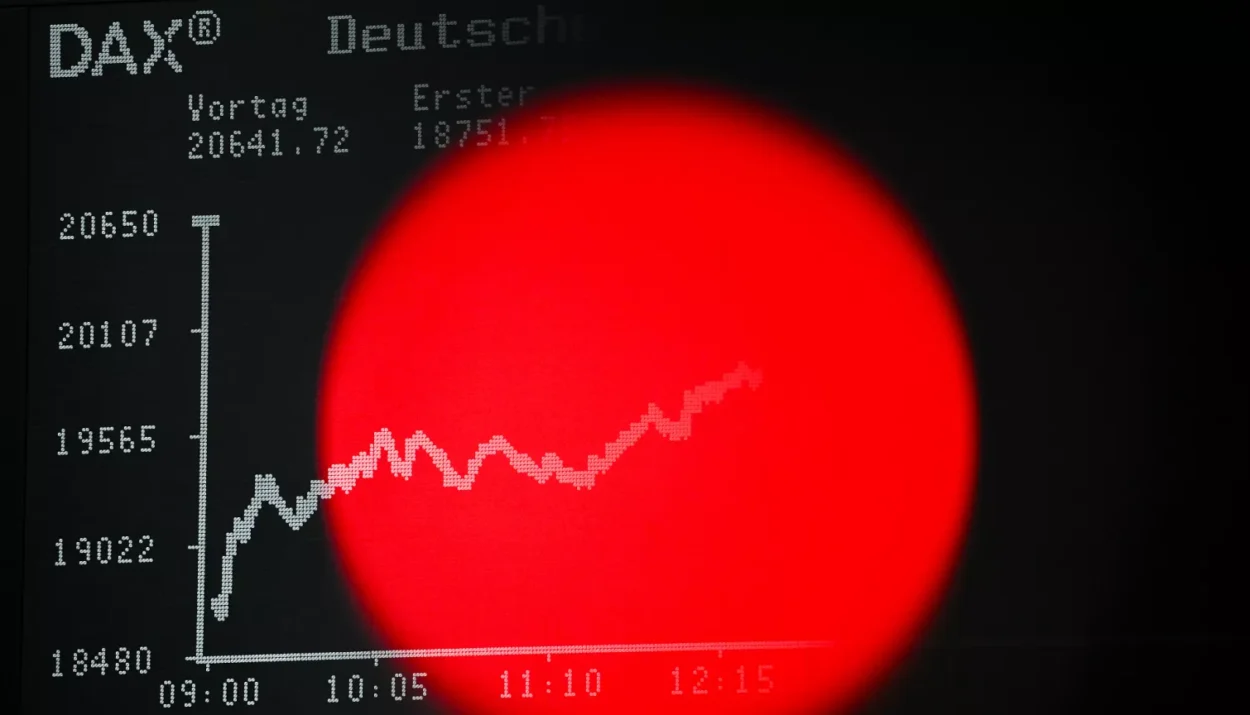

Markets reversed early losses Wednesday as investors looked past weak jobs data and focused on trade optimism and mega-cap tech strength.

- S&P 500 closed at a new record, led by tech and consumer stocks

- Trump announces trade deal with Vietnam, but tariff threats linger

- ADP report shows first private-sector job losses since 2023

- 10-year yields rise to 4.31% amid deficit and labor concerns

The S&P 500 and Nasdaq closed higher Wednesday, rebounding from early losses as a fresh US-Vietnam trade deal and a modest tech rally outweighed concerns over weakening labor market data.

President Trump announced a new bilateral agreement allowing duty-free US exports to Vietnam, a move seen as a partial de-escalation in ongoing trade tensions. However, Trump also warned that Japan and others could face new tariffs as early as July 9, calling them “spoiled” trade partners. Markets took the mixed messaging in stride.

The S&P 500 rose 0.31% to a new record high, while the Nasdaq gained 0.81%, led by a bounce in Tesla (+4%) and strength in consumer-facing names like Nike. The Dow Jones Industrial Average dipped slightly, down 26 points.

Meanwhile, economic data provided a more sobering backdrop. The ADP private payroll report showed the economy shed 33,000 jobs in June, the first decline in over 18 months. Analysts noted growing corporate hesitancy to hire or replace departing workers. The official nonfarm payrolls report is due Thursday and could significantly move markets if it confirms a broader labor slowdown.

Despite the disappointing jobs data, bond yields climbed. The 10-year Treasury yield rose to 4.31%, with investors citing growing concerns over fiscal policy, including the passage of Trump’s tax-and-spending package in the Senate. In the UK, government bond yields also jumped after Labour leaders rolled back key welfare reforms, adding to global rate volatility.

On the commodity front, crude oil prices rose to $66.62 after a surprise build in US inventories. Analysts said the rebound reflected a combination of improved import flows and broader risk-on sentiment.

The US Dollar Index ticked higher, bouncing from multi-year lows, as currency traders weighed interest rate differentials and geopolitical risk.

Key Movers:

- Tesla ($TSLA) +4%: June China sales fell y/y, but results beat worst fears

- Nike ($NKE) +2.7%: Boosted by Vietnam trade optimism and supply chain clarity

- Microsoft ($MSFT) flat: Reports of scaling back internal AI chip ambitions

- Energy Sector (XLE) +0.8%: Supported by crude inventory data and rising oil prices

Eyes now turn to Thursday’s nonfarm payrolls report, which could confirm whether the labor market is entering a broader slowdown. Investors will also watch for updates on Trump’s tariff timeline, as the July 9 deadline looms for possible hikes on Japan, Europe, and other trading partners.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Global Stocks Are Crushing US – But Which Ones?

Market Wrap: Stocks Hit Records, Dollar Slides, and Gold Surges as July Begins

Bessent Warns: US Tariffs Could Snap Back to 50% as July 9 Deadline Looms

Trump’s trade deals are stalling out at worst possible time

What Traders Have Gotten Wrong in 2025

What to Watch in Markets This Week: Jobs Report, Tesla Delivery, Trump’s Budget Deadline