Regencell Bioscience (NASDAQ: $RGC), a Hong Kong-based herbal medicine company with no revenue and over $100 million in accumulated losses, is in full meltdown mode. After a surreal run-up of over 82,000% in 2025, the stock is now spiraling down — plunging 34% today, after a 25% drop late last week. From a peak of over $83, RGC is now trading around $26.

Just 1 day ago, l published a deep dive into this wild rally — “Mystery $33 Billion Medical Fortune Collapses in Days” — highlighting how Regencell’s price surge was driven more by structural distortion, social media hype, and short squeeze mechanics than any fundamentals. This week’s crash? It’s the reckoning.

The Setup: A Volatility Time Bomb

Regencell’s meteoric rise started with numbers that defy logic. CEO Yat-Gai Au controls 86.24% of shares—about 426 million—leaving just 6.1% of shares (30.5 million) as public float. That kind of scarcity makes the stock hyper-reactive. Even small trading volumes can trigger massive swings.

Then came the 38-for-1 stock split in June. While technically dilutive, it lowered the price and pulled in retail traders eager for a “cheap” entry. With float so limited, it also became nearly impossible for short sellers to borrow shares—raising fails-to-deliver risks and flagging potential regulatory interest.

By June, short interest had surged from 0.04% to 3.5% of float—a 5,150% spike. That may sound modest compared to GME, but factor in the 188% borrow fee, and it’s a financial minefield for anyone betting against the stock.

Retail vs. Reality

On Reddit and Twitter, $RGC became a symbol. Narratives painted Yat-Gai Au as a lone hero standing up to Wall Street short sellers. Like GameStop before it, Regencell morphed into a meme war. But this time, the twist was that the CEO controlled the majority of shares, and with that, the emotional trajectory of the stock.

He had tools: splits, buybacks, and filings designed to generate buzz. For a while, it worked. But now, the stock is down over 60% from its peak, and sentiment is shifting.

So Why the 34% Crash Now?

Let’s get blunt. At its peak, Regencell had an $8 billion valuation—despite having no revenue, negative EBITDA, and an experimental herbal pipeline that’s years from commercialization (if ever). Its Price/Book ratio hit 1,254, a level that even the frothiest meme stocks would envy.

- Profit-taking: After weeks of explosive gains, momentum players are cashing out. Regencell is down more than 68% from its high already.

- Meme fatigue: Reddit chatter has cooled. Regencell’s rally depended on constant community reinforcement — once that faded, there was little left.

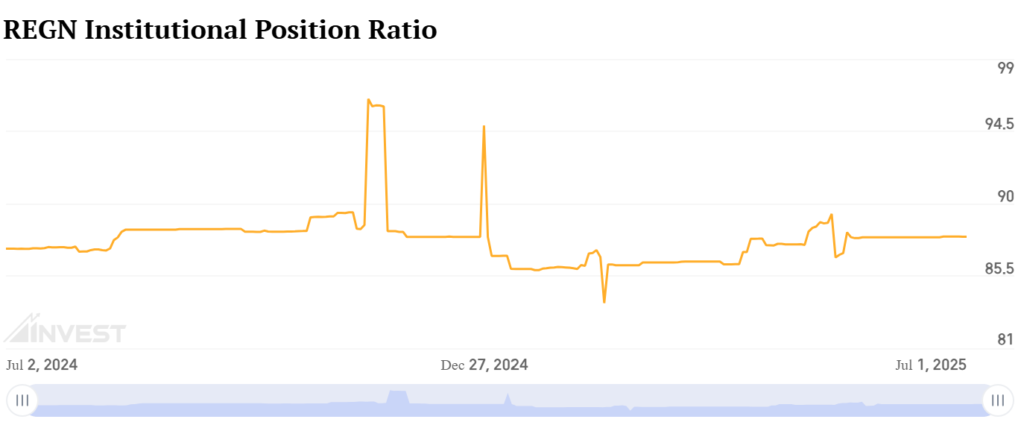

- No institutional support: Just 0.07% institutional ownership, vs ~70% for most public firms.

- CEO liquidity pressure: His paper fortune fell from $33B to ~$10B—he may need to sell.

- Regulatory jitters: Multiple sources, including GuruFocus, flagged that trading in RGC had been suspended or flagged in June due to volatility. That, combined with fails-to-deliver issues and high short borrow fees, raises red flags for SEC and FINRA scrutiny.

- Valuation collapse: Even after the drop, Regencell is still worth ~$7.2 billion, with no revenue. That makes it one of the most overvalued tickers on the NASDAQ, according to recent Investing.com fair value alerts.

“Our models flagged a 60% downside in April when RGC was $36. It’s now under $15. Fair value is still significantly lower.” — Investing.com

This is retail-driven price action, which means when momentum dies, there’s no one left to hold the bag.

CEO Under Pressure

Yat-Gai Au, who once held a paper fortune of $33 billion, has now seen that shrink to around $10 billion. While he’s yet to sell major holdings, analysts warn that any liquidation could further sink the stock, especially with so few shares on the open market.

At the same time, the CEO remains active. He’s issued split announcements, upgraded herbal treatment hopes, and filed positive-sounding updates to feed retail excitement. But these are short-term tactics — the fundamentals remain absent.

What’s Next for RGC?

This isn’t a company with a misunderstood pipeline — it’s a meme-driven speculative vehicle caught between euphoria and reckoning. The fair value is far below its current price, and history suggests parabolic retail-driven rallies without substance end in full retrace.

If you’re trading this stock, here’s the playbook:

- Short (with caution): Just 1.25 days to cover, but high volatility could trigger painful squeezes.

- Options for volatility: Iron condors or straddles could capture wide moves in either direction.

- Avoid long positions unless you’re playing with money you’re prepared to lose.

It Was Never About Fundamentals

Regencell’s rise and fall is a masterclass in meme market mechanics, social media hysteria, and float manipulation. But without real revenue, product approval, or institutional belief, it was never going to last.

The only question now: how much further does it fall — and how many retail traders get burned on the way down?

Related: The $OST Scam: How Nasdaq-Listed Penny Stock Wiped Out Thousands of Lives

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.