Tesla delivered 384,122 vehicles in Q2 2025 — in line with analyst expectations — but overall demand remains soft amid intensifying global competition.

- Total deliveries: 384,122 (Est. 389,407), down 13% vs Q2 2024

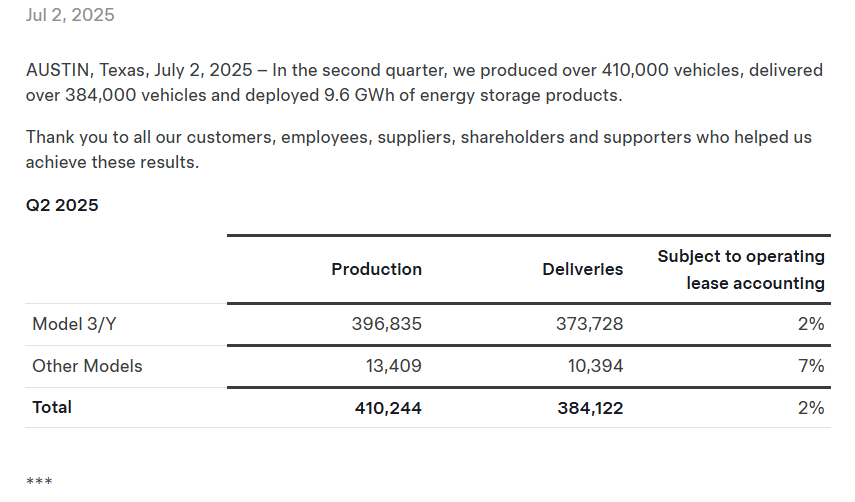

- Production: 410,244 vehicles, adding ~26,000 units to inventory

- Energy storage deployments: 9.6 GWh (vs 10.4 GWh in Q1)

Tesla ($TSLA) released its Q2 2025 delivery and production results Wednesday, confirming 384,122 global deliveries, almost exactly in line with Wall Street’s lowered consensus forecast of 385,000. However, the number still represents a 13% decline compared to Q2 2024, when Tesla delivered 444,000 vehicles globally.

Production surged to 410,244 units, up from 362,000 in Q1, signaling that Tesla is ramping manufacturing — but also adding roughly 26,000 cars to inventory, reflecting continued demand pressures.

Most of the volume came from the company’s mainstream offerings:

- Model 3/Y production: 396,835 | Deliveries: 373,728

- Other models (Cybertruck, S/X): 13,409 produced | 10,394 delivered

Tesla also deployed 9.6 GWh of energy storage in Q2, slightly down from 10.4 GWh in Q1 but flat year-over-year.

Tesla China Reverses 8-Month Slump — But Q2 Deliveries Still Fall

Tesla’s Shanghai factory delivered 71,599 vehicles in June, up slightly from last year — but its quarterly sales continued to slide as local competition intensifies.

- June deliveries from China rose 0.83% y/y — the first increase since September 2024.

- Q2 China-made vehicle sales fell 6.82% y/y, marking a third straight quarterly decline.

- Xiaomi’s YU7 SUV already undercutting Model Y with over 240,000 orders.

Tesla ($TSLA) saw its first year-on-year rise in China-made EV sales in nine months, with 71,599 vehicles delivered in June, up 0.83% from last year and 16.1% higher than May. However, the relief may be short-lived — quarterly data shows a continued slide.

According to the China Passenger Car Association, Tesla China sold 191,720 vehicles in Q2, down 6.82% y/y. That marks the third straight quarterly decline for Tesla’s Shanghai operations, which supply both domestic buyers and export markets like Europe and Australia.

The modest June recovery comes amid rising pressure from local rivals, particularly Xiaomi ($1810.HK / $XIACY). Xiaomi’s new YU7 SUV, launched just last week, secured over 240,000 locked-in orders in 18 hours. Priced nearly 4% below the Model Y, it directly targets Tesla’s bestselling segment. Xiaomi’s SU7 sedan has already outsold the Model 3 in China since December.

Tesla has yet to cut prices in response. Instead, it raised the price of the long-range Model 3 by 3.6% in China this week, while extending its range to 753 km.

So far in 2025, Tesla’s China-made deliveries have fallen 14.57% y/y in H1. Globally, Tesla is expected to report its total Q2 deliveries later today — and early signs suggest another decline is coming.

Tesla will report its Q2 financials on July 23, followed by a live management Q&A session at 5:30 PM ET.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Global Stocks Are Crushing US – But Which Ones?

Market Wrap: Stocks Hit Records, Dollar Slides, and Gold Surges as July Begins

Bessent Warns: US Tariffs Could Snap Back to 50% as July 9 Deadline Looms

Trump’s trade deals are stalling out at worst possible time

What Traders Have Gotten Wrong in 2025

What to Watch in Markets This Week: Jobs Report, Tesla Delivery, Trump’s Budget Deadline