The S&P 500 might be hitting record highs, but beneath the surface, the story is very different. In 2025, investors are quietly shifting their money away from the US and toward international markets that are leaving Wall Street in the dust.

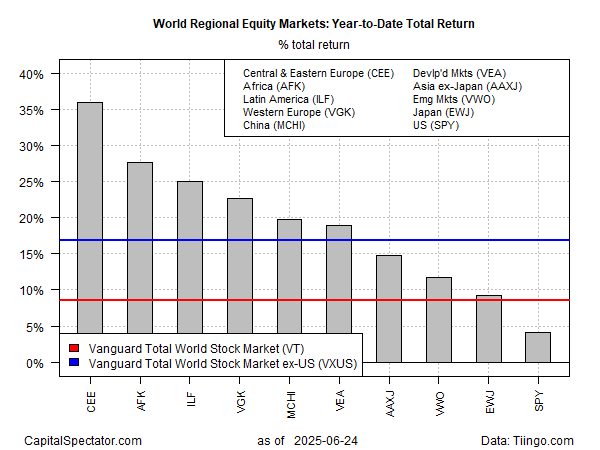

South Korea, Germany, Mexico, and China are all posting double-digit gains this year, while the S&P 500 is up just around 5%. That’s not nothing—but compared to a 37% rally in Korean equities or 28% in Germany, it’s hardly worth celebrating.

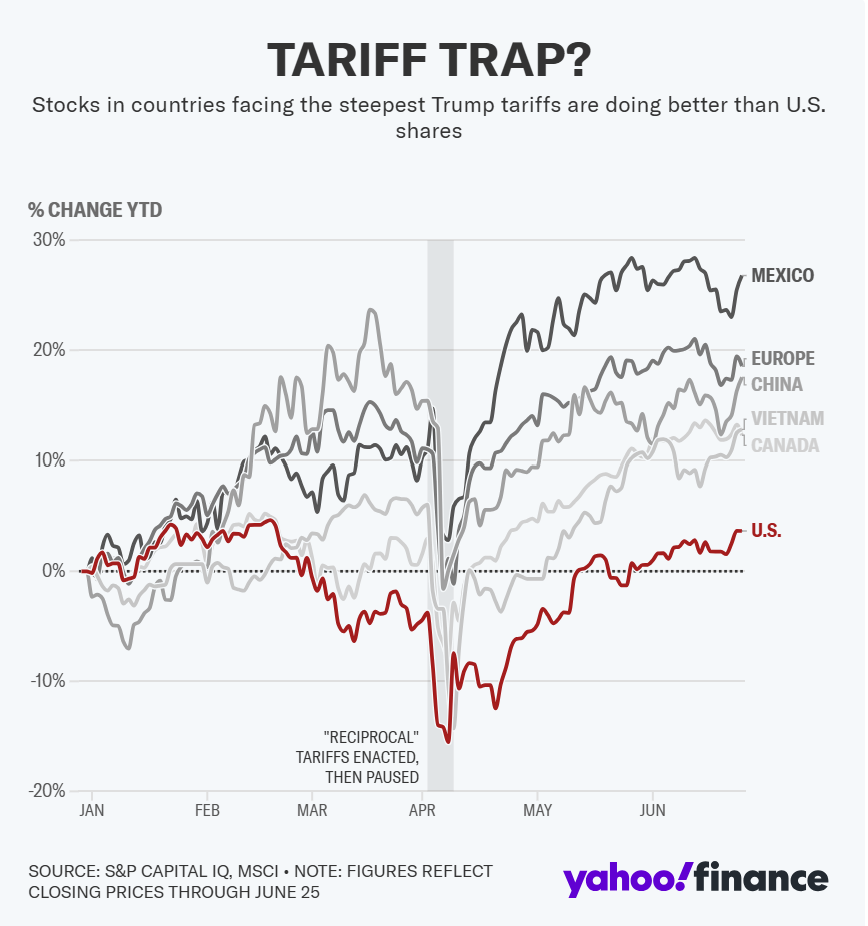

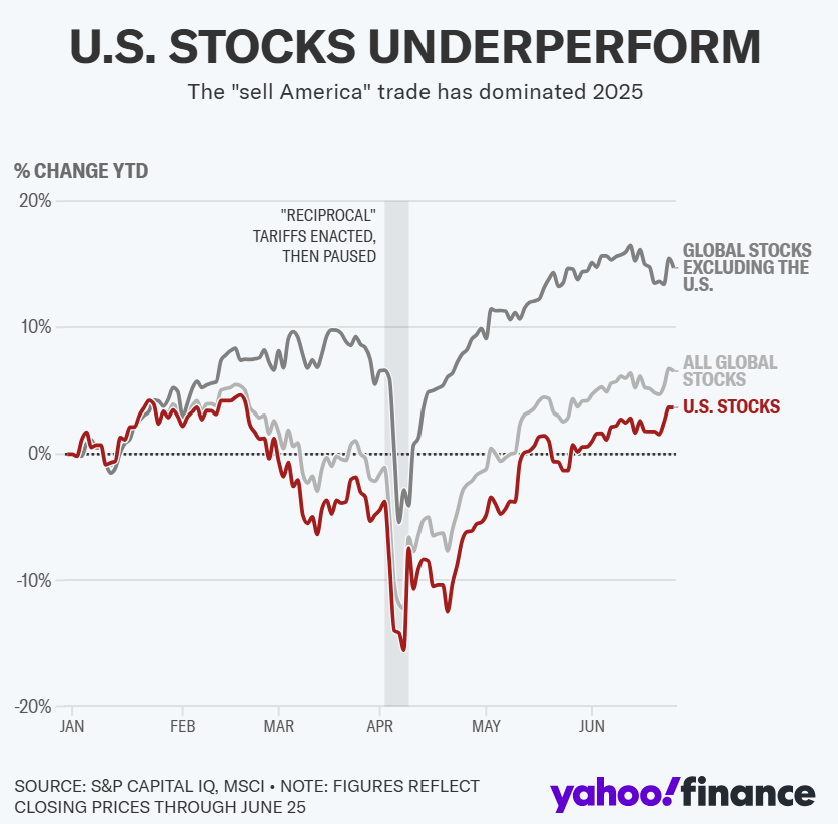

What’s driving this shift? Tariffs, inflation, and political instability in the US are making global investors nervous. President Trump’s sweeping “reciprocal tariffs” plan, announced in April, initially sparked a 16% sell-off in US markets. Although the most aggressive tariffs were postponed, others remain in place, raising average import taxes to around 15%, with especially steep costs on Chinese goods, cars, and industrial metals.

At the same time, America’s national debt has surged past $36 trillion. Rising interest rates, a downgraded credit rating, and the risk of further fiscal chaos are putting pressure on US equities. The dollar has fallen nearly 10% this year, and inflation remains sticky.

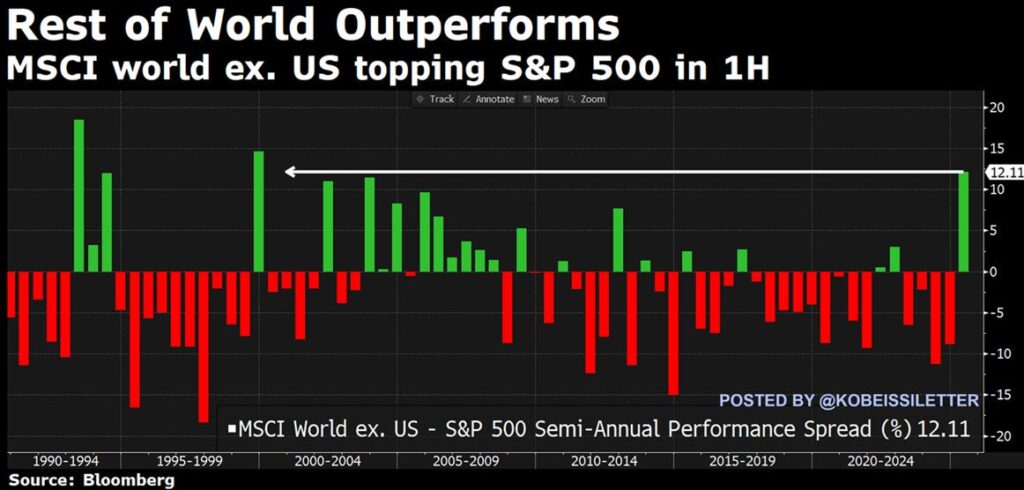

The result? A “sell America” trade is gaining momentum. Investors are reallocating into foreign markets that not only offer better value—but also seem less politically chaotic. Ironically, many of the countries targeted by Trump’s tariffs are now outperforming US stocks by wide margins.

The 2025 market isn’t just about diversification—it’s about choosing the right geography. And right now, that geography looks increasingly non-American.

Foreign Stocks Surge — Which Ones Are Powering the Rally?

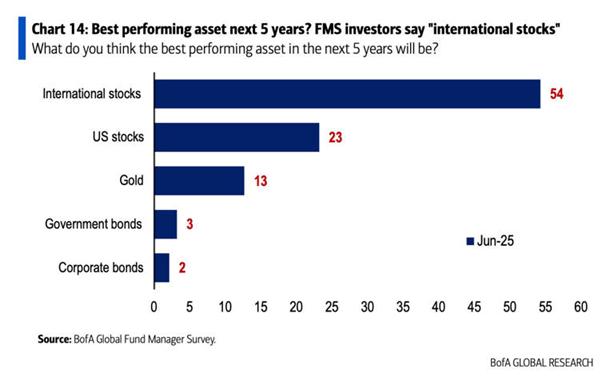

Global equities have handed US markets a decisive loss in 2025: international stocks are up ~15–17% YTD, while the S&P 500 lags at ~+4%. Survey data confirms this: 54% of fund managers expect international equities to outperform for the next five years. But that’s still a broad brush—let’s zoom in on the specific regional winners and top-performing stocks behind this momentum.

1. Central & Eastern Europe (CEE): +36% YTD

Poland-centric energy giant $PKN (PKN Orlen) has delivered standout gains, thanks to booming fuel margins and expansion across Europe — it’s the biggest component in the CETOP blue-chip index. Meanwhile, e‑commerce star $ALE (Allegro.eu) continues to capitalize on surging online retail traffic across the region . These companies exemplify CEE’s mix of commodity strength and digital acceleration.

2. Africa: +28% YTD

African markets have benefited from both commodity tailwinds and currency tailwinds. Notable movers include $NPN (Naspers) in South Africa—supported by Tencent-linked tech exposure—and $GBF (Gold Fields Ltd), whose miners have jumped with rising golden demand. Egypt’s market reforms have also buoyed regional ETF performance, but ticker-level data is limited.

3. Latin America: ~+25% YTD

Latin America is booming, with high-profile stocks fueling the rally. $MELI (MercadoLibre) has exploded ~50% YTD as e‑commerce and fintech gains in Brazil, Mexico, and Argentina drive momentum — trading near buy zones. In Brazil, oil and materials giant $PBR (Petrobras) remains the region’s most profitable entity , and Mexican telecom heavyweight $AMX (América Móvil) is riding an improving macro backdrop.

4. Germany (DAX): +28% YTD

Germany is defying expectations with multiple standouts. Industrial conglomerate $SIE (Siemens) and agritech leader $BAYRY (Bayer) are benefiting from renewed fiscal spending and global trade optimism . Steel-to-submarine maker $TKA (Thyssenkrupp) thrilled investors with a Q1 surge of +141%, riding defense and energy sector tailwinds.

5. South Korea (KOSPI): +~30–37% YTD

South Korea has emerged as Asia’s standout thanks to digital-asset enthusiasm and chip-led AI growth. Crypto infrastructure names like $KAKAO (Kakao Pay) and $LGNS (LG CNS) have rallied on stablecoin expectations. Semiconductors are also booming: $SKX (SK Hynix) just overtook Samsung in DRAM market share, delivering a 158% profit gain in Q1 on AI-driven demand. And robotics play $DSAN (Doosan Robotics) also continues gaining traction

6. Japan (EWJ): +~8% YTD

Japan hasn’t soared as much, but its defensive and AI-linked names are quietly strong. $TM (Toyota) has benefited from improved global auto sales, while $SNE (Sony) sees momentum in entertainment and AI-infused electronics. Meanwhile, defense-linked $MHI (Mitsubishi Heavy) and $KAI (Korea Aerospace) are performing well amid broader global defense demand .

Why US Stocks Are Losing Ground ( Key Facts)

Despite some rebound, the S&P 500’s ~+4% YTD pales in comparison . Key reasons:

- Trump-era tariffs (~15% on average) are eroding corporate margins amid import inflation .

- Mounting US debt (~$36T+) and credit downgrades have weakened investor confidence and the dollar.

- While US tech dominates, many global investors see other regions as undervalued or less policy-risky .

What This Means for Investors

This isn’t a simple “buy ex-US” play—your strategic approach matters:

- Tap into CEE via $PKN and $ALE, riding energy and digital trends.

- Play Latin America through $MELI, $PBR, and $AMX, diversifying across e‑commerce, oil, and telecom.

- Explore South Korea with $SKX, $KAKAO, $LGNS, and $DSAN for AI and digital asset exposure.

- Add German industrials like $SIE, $BAYRY, $TKA to benefit from fiscal stimulus and defense.

The global rally is being led not by generic “international stocks,” but by specific high-conviction plays: AI-driven semiconductors in South Korea, internet-fintech in Latin America, and industry-defense in Germany and CEE. For 2025, smart geolocation and selectivity—not just geographic diversification—are what’s generating real alpha.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Market Wrap: Stocks Hit Records, Dollar Slides, and Gold Surges as July Begins

Bessent Warns: US Tariffs Could Snap Back to 50% as July 9 Deadline Looms

Trump’s trade deals are stalling out at worst possible time

What Traders Have Gotten Wrong in 2025

What to Watch in Markets This Week: Jobs Report, Tesla Delivery, Trump’s Budget Deadline