Markets are poised for a turbulent open on Monday as investors react to Moody’s surprise downgrade of the US sovereign credit rating, citing the country’s ballooning debt and growing fiscal deficits. The move, announced late Friday, strips the U.S. of its last pristine “Aaa” rating — a symbolic blow that could ripple through bond markets and pressure equities, just as optimism over a U.S.-China tariff truce had fueled a market rebound.

What Moody’s Said — And Why It Matters

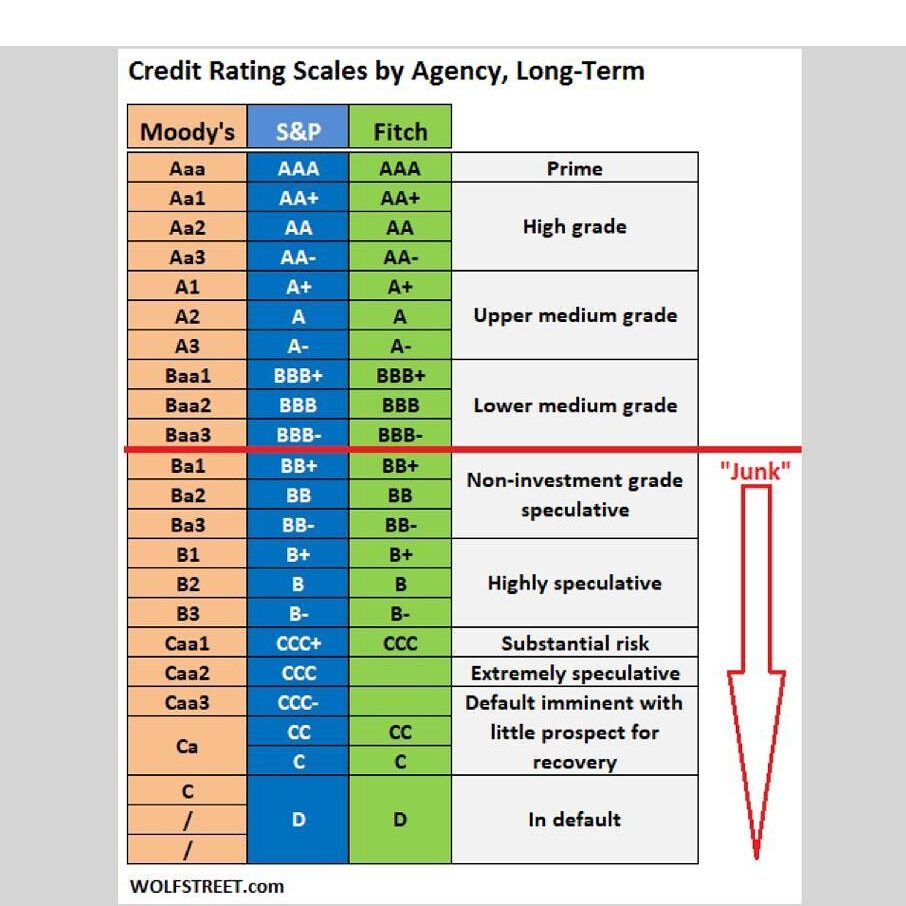

Moody’s downgraded the U.S. credit rating from Aaa to Aa1, citing:

- The rising federal debt burden — now nearing $36 trillion

- High interest costs and lack of credible deficit-reduction plans

- Political gridlock, with successive administrations failing to reverse deficit trends

The agency now projects U.S. debt to reach 134% of GDP by 2035, up from 98% in 2024, largely driven by entitlement spending, interest payments, and low revenue.

“The downgrade should be a wake-up call to Trump and Congressional Republicans,” said Senate Majority Leader Chuck Schumer, while Trump allies called the move ‘outrageous.’

Why Monday Could Be Rough for Stocks

Although the downgrade came after market close, early indicators point to market jitters:

- 10-year Treasury yields briefly jumped to 4.49% in post-market trading Friday — a move that hints at higher borrowing costs and reduced demand for U.S. debt.

- An S&P 500 ETF (SPY) fell 0.6% after hours.

- Bond strategists at Wells Fargo predict a 5–10 bps increase in long-term yields, potentially pushing the 30-year yield above 5%, its highest since 2023.

“This could create a bear steepener in yields, pressure the dollar, and dent the appeal of U.S. stocks,” warned Franklin Templeton’s Max Gokhman.

The downgrade adds to investor unease already heightened by Trump’s global tariff strategy, which has raised fears of inflation and slowed growth.

Political Fallout: Deficits, Tax Cuts & Trade Turbulence

The downgrade coincides with:

- Trump’s stalled push to extend the 2017 tax cuts, a move nonpartisan analysts say could add $3.8 trillion to the deficit over the next decade.

- Ongoing efforts to cut spending via the Department of Government Efficiency, which have underwhelmed.

- Fresh tensions over trade, as tariffs remain paused but not resolved, leaving policy uncertainty hovering over markets.

Despite assurances from Treasury Secretary Scott Bessent, who called the downgrade a “lagging indicator,” concerns persist that higher interest payments and continued fiscal inaction will erode investor confidence.

Global Signals: Dollar Weakness, Safe-Haven Rotation

Early trading in Asia showed mixed performance for the dollar, and options traders remain deeply bearish on the greenback. ECB President Christine Lagarde noted that the euro’s strength against the dollar reflects “uncertainty and loss of confidence in U.S. policies.”

Meanwhile, China continues reducing its exposure to long-term U.S. Treasurys, though experts say it’s more about shortening duration than abandoning the dollar.

“This is a clear warning shot for markets that have largely shrugged off fiscal risk,” said Stanford’s Darrell Duffie.

What to Watch at Monday’s Open

- Treasury yields: A further spike could pressure tech and high-growth names

- U.S. dollar: Weakness could boost commodities and multinationals

- S&P 500 futures: Watch for early dips as traders reprice risk

- Gold and bitcoin: Likely beneficiaries amid fiscal distrust

Despite the downgrade, Barclays analysts said they don’t expect forced selling or panic, citing past downgrades with muted effects. Still, the timing — after a week of fragile optimism — could mean sharper initial reactions before cooler heads prevail.

Moody’s downgrade may not spark a market crash, but it adds another layer of uncertainty to an already uneasy environment. As markets open Monday, investors will be weighing the credibility of U.S. fiscal policy — and wondering just how much risk is already priced in.

Debt, tariffs, and inflation are converging into a volatile mix. Monday will test just how resilient markets really are.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Earnings Calendar, Fed Speech, Housing Data: What to Watch This Week

UK overtakes China as second-largest US Treasury holder

CERN Scientists Turn Lead into Gold — Why This Is Bigger Deal for Bitcoin Than You Think

Nvidia, Cisco, Oracle and OpenAI are backing the UAE Stargate data center project

Trump vs. Tim Cook: Apple’s Global Strategy Sparks Debate Over Economic Patriotism and AI Security

US and EU break impasse to enable tariff talks

China Tightens Control Over AI Data Centers

Trump: US will set new tariff rates, bypassing trade negotiations

Sundar Pichai Interview on AI, Search, and Future of Google

Billionaire Investors Reveal Q1 2025 Portfolio Moves: Buffett, Ackman, Tepper, Burry & More