In today’s volatile macro landscape—tariffs, trade wars, and shifting headlines—long-term investors know that true success comes from tuning out the noise and staying focused on fundamentals.

One of the most powerful tools for evaluating SaaS companies is the Rule of 40—a simple but effective benchmark that helps balance growth and profitability in one clear number.

What Is the Rule of 40?

The Rule of 40 is a shorthand metric used to assess the financial health of a software company, especially when growth is a top priority. Here’s the basic formula:

Revenue Growth Rate (%) + Profit Margin (%) ≥ 40%

A result above 40% generally indicates the company is balancing high growth with solid profitability. Below that line? It could mean a business is either burning too much cash or not growing fast enough to justify low profits.

Note: “Profit margin” can vary depending on whether you’re using operating margin, FCF margin, or adjusted EBITDA. Context matters.

Where Did It Come From?

The Rule of 40 was made popular by VC Brad Feld as a quick financial check for SaaS businesses. Over time, it became a favorite among investors.

- McKinsey found only ~33% of software companies hit this metric between 2011–2021.

- Bain says just 16% maintained it for more than five years.

Why It Matters

The Rule of 40 acts as a filter: Is this company growing fast enough, profitably enough, to justify the risk?

It helps you distinguish between reckless spending and smart scaling.

- A young, fast-growing company with low margins may still pass.

- A mature firm with flat growth better have strong profitability.

Tracking the score over time reveals whether a company is maturing efficiently—or stalling out.

What to Watch

While the Rule is easy to compute, the inputs matter:

Revenue:

Focus on high-quality recurring revenue—ARR, MRR, or subscription revenue. Avoid being fooled by one-time contracts or hardware sales.

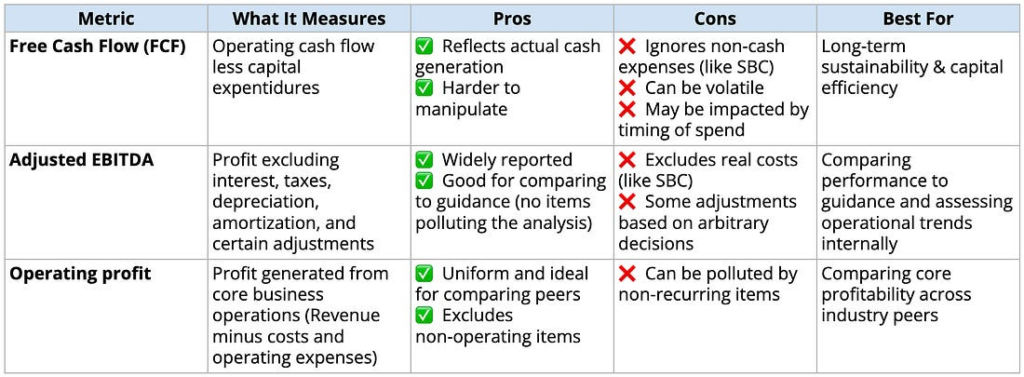

Profitability:

- Free Cash Flow margin is preferred for showing real cash performance.

- Adjusted EBITDA is common but often omits key costs (like SBC).

- GAAP operating margin is the most apples-to-apples across companies but may include noise like one-off expenses.

SBC (stock-based compensation) often exceeds 20% of revenue in SaaS. Be wary of “adjusted” metrics that ignore this.

What About AI?

AI is changing the revenue and cost dynamics of SaaS:

- Can drive revenue via premium features and usage pricing

- Increases costs due to AI talent and infrastructure needs

The Rule of 40 helps investors cut through AI hype and evaluate the fundamentals:

Are margins holding up as AI adoption grows?

Real-World Examples

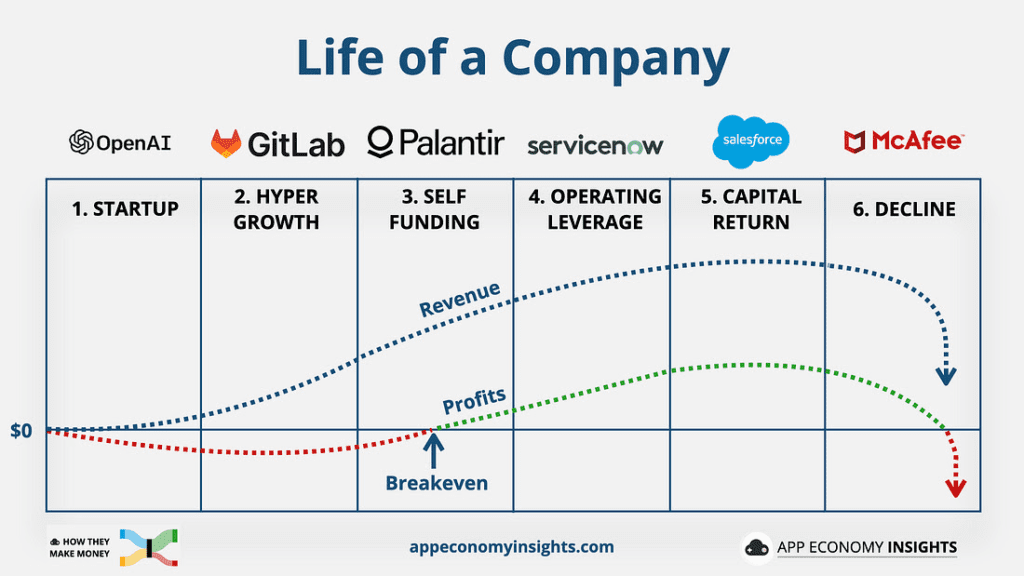

Let’s see how the Rule of 40 plays out across company stages:

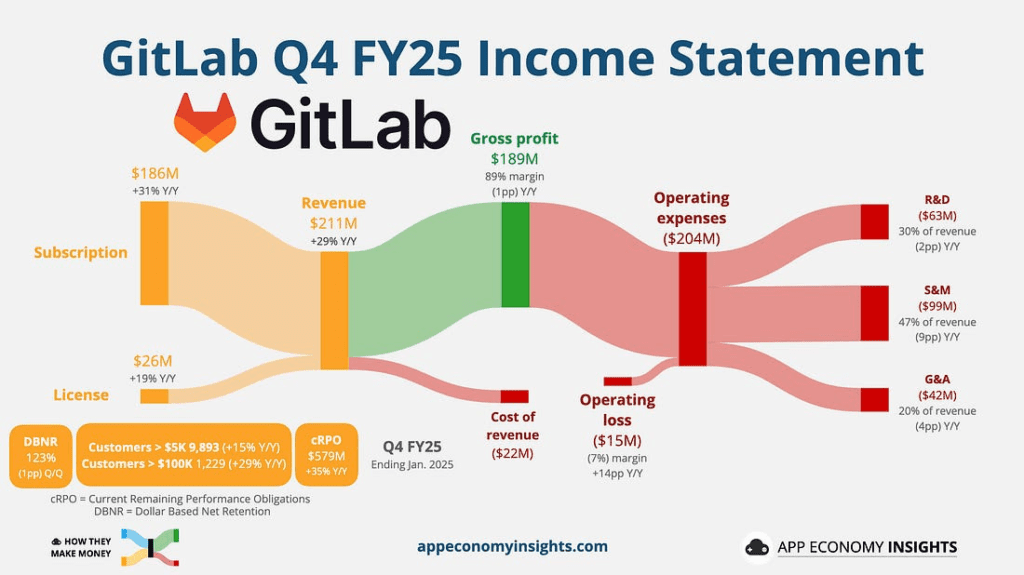

Early Stage: GitLab (GTLB)

Still prioritizing growth

In Q4 FY25 (January quarter):

- Revenue Growth: 29% Y/Y, with Subscription revenue growing of 31% Y/Y and representing 88% of the top line. Another strong KPI here is the current RPO (next-12-month obligations from existing contracts), rising 35% Y/Y, implying a potential growth acceleration.

- Profitability: Free Cash Flow margin of 16% in the past 12 months, and operating loss margin of -7% in Q4 (improving by 14 percentage points Y/Y).

- Rule of 40 Score: 45+ if you focus on FCF, or ~22 if you focus on operating margin.

GitLab is investing aggressively in products (like Duo AI) and go-to-market, especially in the enterprise category. The company is showing exceptional operating leverage, indicating that it’s well on its way to being a high performer on the Rule of 40, even on a GAAP basis.

- Margin expansion as GitLab Dedicated (single tenant SaaS solution) scales.

- Upsell and cross-sell traction with enterprise clients.

- Progress toward the Rule of 40 over time.

For early-stage companies like GitLab, the Rule of 40 is a target, not a requirement.

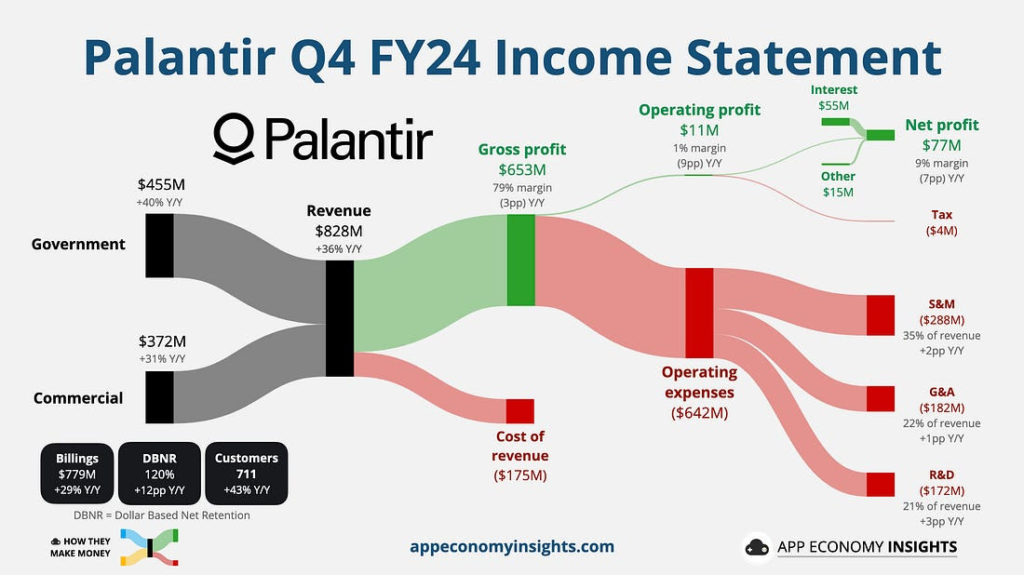

Mid Stage: Palantir (PLTR)

Balancing scale and margins

In Q4 FY24 (December quarter):

- Revenue Growth: 36% Y/Y.

- Profitability: Free Cash Flow margin of 44% in the past 12 months, and operating margin of 1% in Q4 and 11% in FY24.

- Rule of 40 Score: 70 if you focus on FCF, or 47 if you focus on operating margin in the past year.

Palantir is in a sweet spot. It’s monetizing explosive demand for AI while maintaining impressive profitability. The company was added to the S&P 500 in 2024 after being profitable for four consecutive quarters. The US commercial business is booming, and margins are expanding as deals scale.

- European adoption catching up.

- Whether margins hold as growth decelerates.

- Continued momentum in commercial bookings.

Mid-stage companies must sustain strong Rule of 40 scores by showing durable growth while improving margins as they scale.

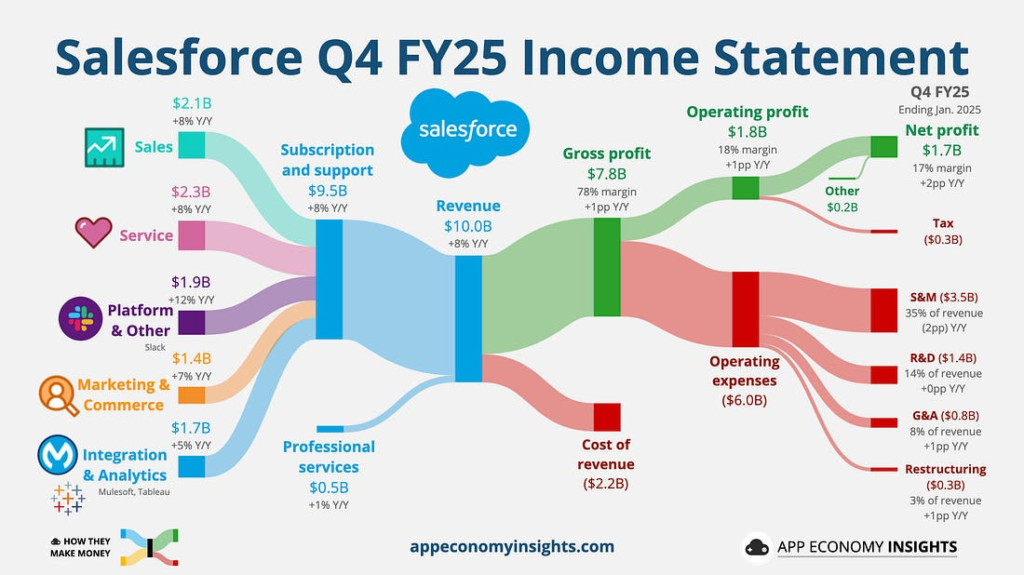

Mature Stage: Salesforce (CRM)

Margin-heavy, growth-light

In Q4 FY25 (January quarter):

- Revenue Growth: 8% Y/Y.

- Profitability: Free Cash Flow margin of 33% in the past 12 months, and operating margin of 18% in Q4 and 19% in FY25.

- Rule of 40 Score: 41 if you focus on FCF, or 27 if you focus on operating margin in the past year.

Salesforce is a classic mature SaaS business. It’s navigating single-digit growth, but strong cash flows and operational efficiency give it an excellent score on the Rule of 40. AI products like Agentforce offer optionality but haven’t yet bent the curve.

- Reacceleration in top-line growth.

- Expansion in RPO (future revenue visibility).

- Margin stability during its current leadership transitions.

Mature companies must lean on efficiency—or reignite growth—to stay in Rule of 40 shape.

The Rule of 40 is a universal framework—but your interpretation should shift based on where the company is in its journey:

- Early-stage: Prioritize growth trajectory and margin potential.

- Mid-stage: Look for efficient scaling and durable growth.

- Mature: Watch for new initiatives and margin discipline.

How Companies Improve Their Rule of 40

To boost the score, companies can:

- Increase Net Revenue Retention (upsells > new customer CAC)

- Improve sales efficiency (lower CAC, faster payback)

- Use product-led growth (organic adoption = margin tailwind)

- Cut infrastructure costs and boost gross margins

- Monetize innovations with tiered pricing or usage models

Summary: Strengths & Limitations

| Strengths | Limitations |

|---|---|

| Easy to calculate and understand | SaaS-specific—less useful outside subscriptions |

| Popular with investors & VCs | Can be manipulated with “adjusted” metrics |

| Blends growth + profit into one KPI | Misses intangibles like product quality or moat |

Final Thought: It’s a Lens, Not a Law

The Rule of 40 doesn’t give all the answers, but it asks the right questions. Use it alongside deep research and context, and you’ll have a sharper eye for what makes great software companies truly great.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source: App Economy Insights

Related:

The Rules of Money: 13 Principles for Financial Success