This is truly incredible:

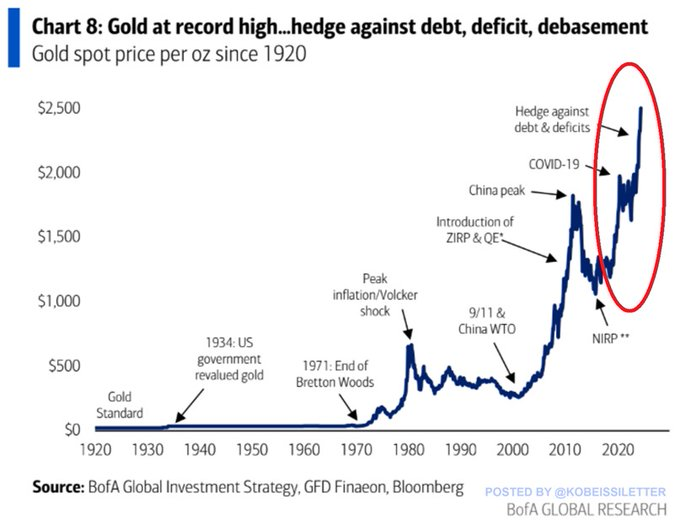

Gold prices are now officially up +50% over the last 14 months and made ANOTHER all time high. In fact, gold’s market cap just hit $20 TRILLION for the first time in history.

Why are people still piling into gold? Here is TKL explanation.

Just to explain how strong gold has been, take a look at this chart: Since late-July, gold prices are up ~24% while the US Dollar is up ~2% and the 10-year note yield is up ~8%. While gold and rates/USD typically have an inverse correlation, they are rising TOGETHER.

Why?

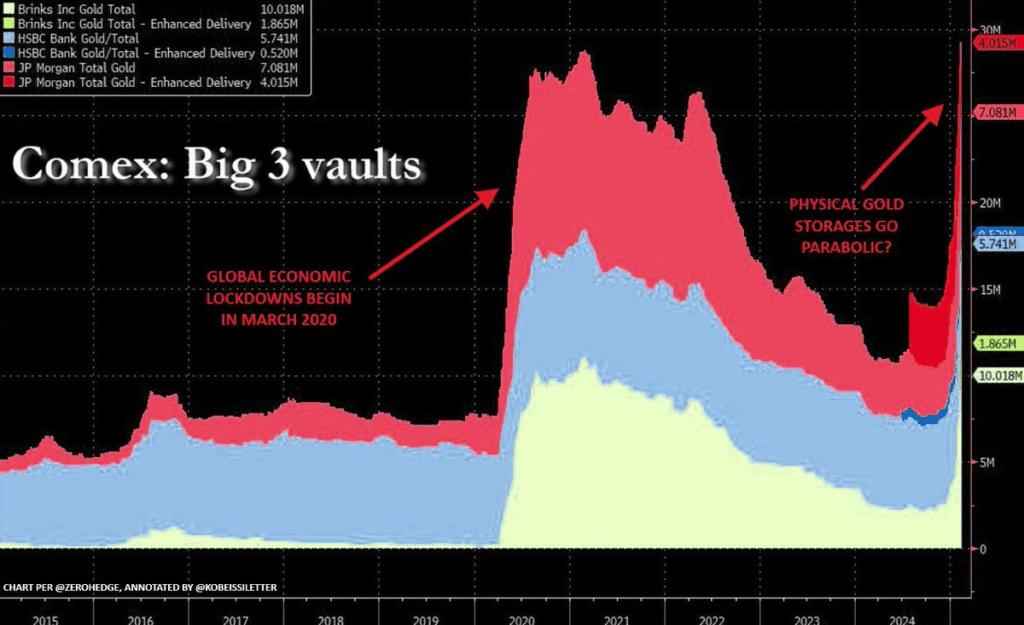

Furthermore, physical gold buying is SKYROCKETING. Gold inventories in the 3 largest COMEX gold vaults just surged by 15 MILLION ounces in 2 months. That’s a +115% increase, putting physical gold holdings ABOVE 2020 pandemic levels.

There has been a CLEAR shift in sentiment.

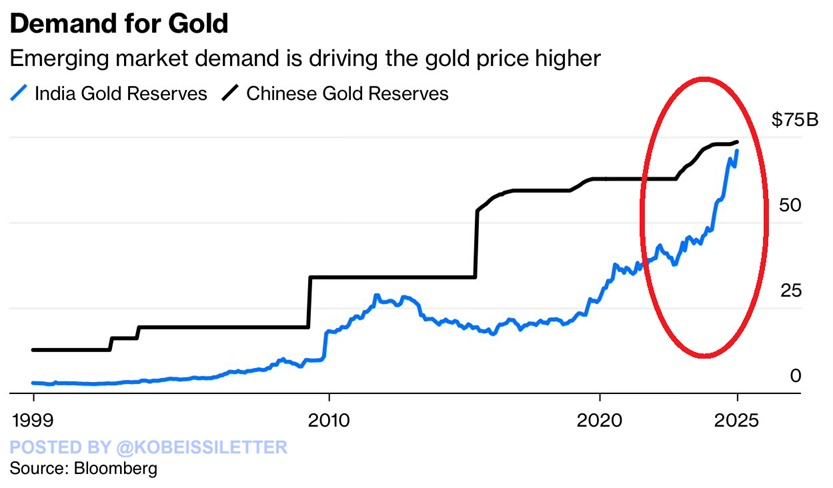

Meanwhile, gold demand in Asia has never been stronger. China’s gold reserves hit a record $73.5 billion last month. India’s gold reserves reached $70.9 billion, also an all-time high.

Meanwhile, global gold demand jumped 24% year-over-year in 2024 to a record $382 billion.

It continues to feel like gold is rising due to longer-term macroeconomic concerns. Particularly, the US debt crisis and inflation are in focus. Since the pandemic, US national debt has soared by $13 trillion while the US dollar lost ~25% of its value.

Markets are worried.

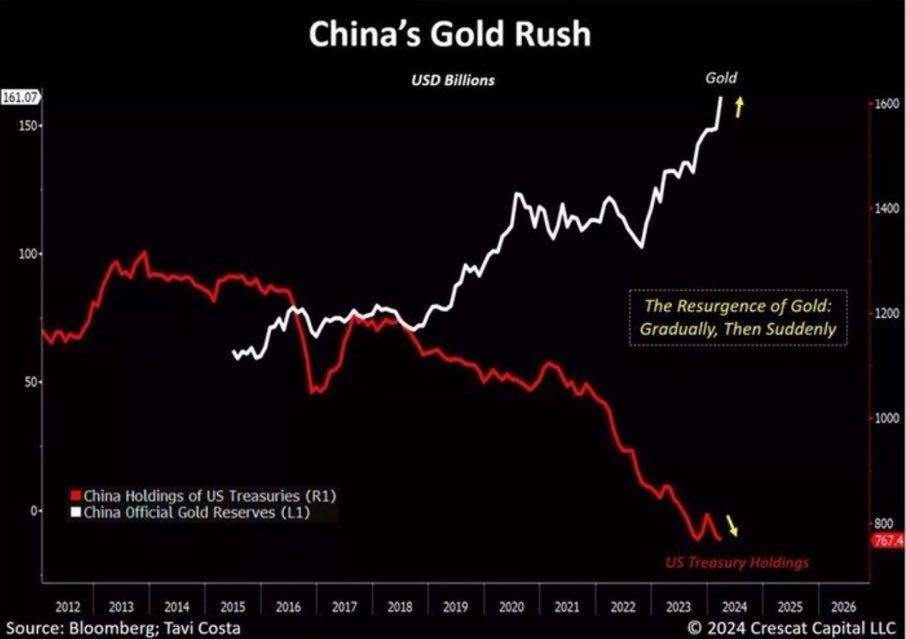

It’s particularly interesting that China is SELLING US Treasuries and buying gold. Due to interest rate instability, inflation, and a soaring $1.8 trillion annual US deficit, gold is shining.

We believe gold has become the global safe haven asset. The divergence is telling.

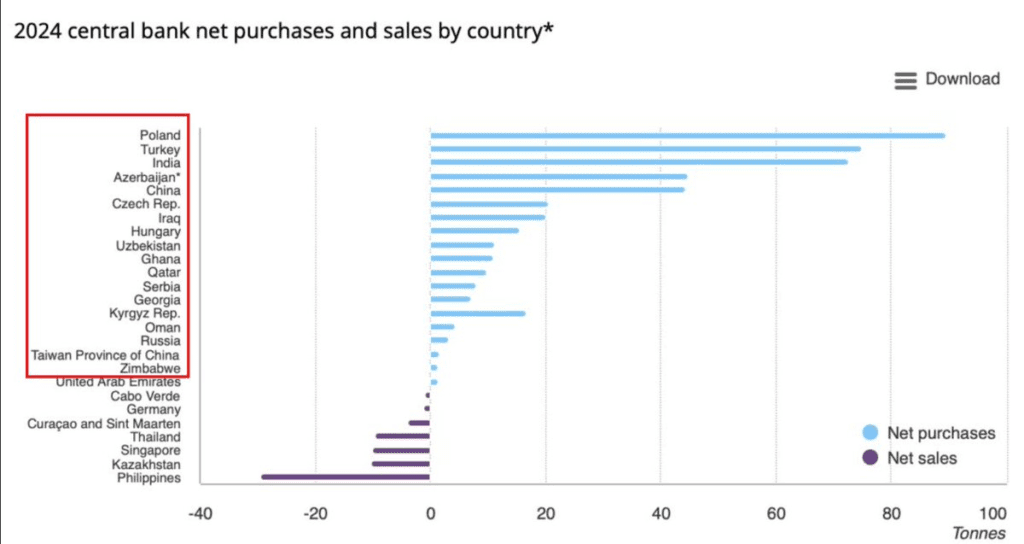

And, the flight to gold hasn’t just been in China. In fact, Poland, Turkey, India and Azerbaijan bought MORE gold than China in 2024.

We have seen 3 consecutive years with 1,000+ tonnes in net gold purchases by central banks. This has never happened before in history.

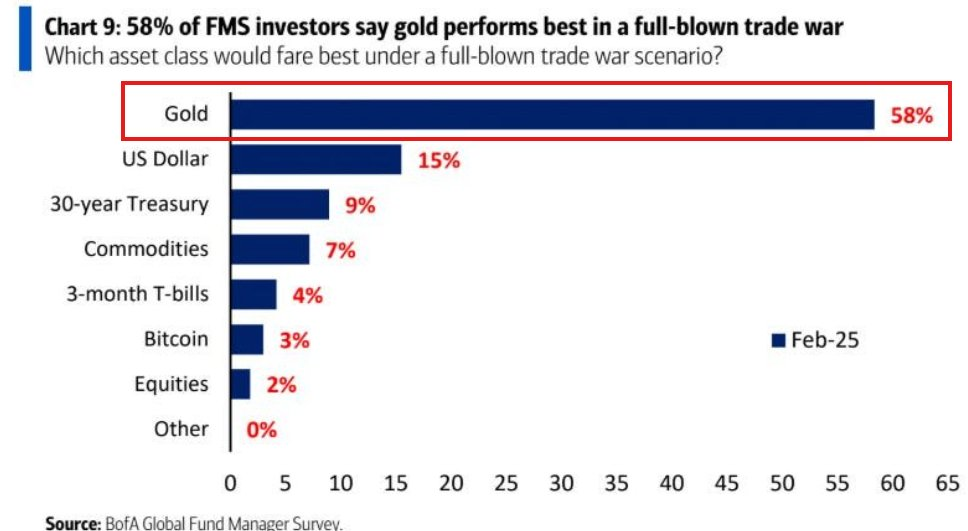

Additionally, as trade war worries have mounted, gold demand has risen.Bank of America’s fund manager survey showed 58% of fund managers saying gold would perform best in a trade war.

Even as a trade war means a stronger US Dollar, fund managers think it rises further.

What’s even more impressive is that gold is rising WITH the S&P 500. In fact, gold has more than DOUBLED the S&P 500’s YTD return. In 2024, gold and the S&P 500 had an unprecedented correlation of ~0.81.

Related:

Intel Turbulent Week: Breakup Rumors, Strategic Deals, and What It Means for $INTC Stock

Trump Joins Musk In Targeting Fort Knox Gold—What We Know About Its $400 Billion Supply

Analysis: Is Kelsier’s $200MM insider trading scandal the next FTX?

How Dirty Money From Fentanyl Sales Is Flowing Through China

Trump plans to impose 25% tariffs on autos, chips and pharmaceuticals – Stock Market Impact

Congressional Stock Trading Scandal: Lawmakers Profit Big on Palantir Stock Surge

Bullish Momentum vs. Financial Reality in Palantir

Is Palantir Proving to be the Dark Horse AI Stock?

China’s Quantum Computing Breakthrough Raises Concerns—Is This Why Quantum Stocks Are Dropping?

The 2025 stock market rally isn’t just about the Magnificent 7

Elon Musk plans to send a Tesla Bot with Grok AI to Mars by late 2026

Elon Musk Unveils “World’s Smartest AI”—Trained on 100K NVIDIA GPUs

Another CEO is speaking out against naked short selling

Key Events to Watch in This Week & Their Market Impact

Earnings Calendar for This Week: Stocks to Watch and Forecast