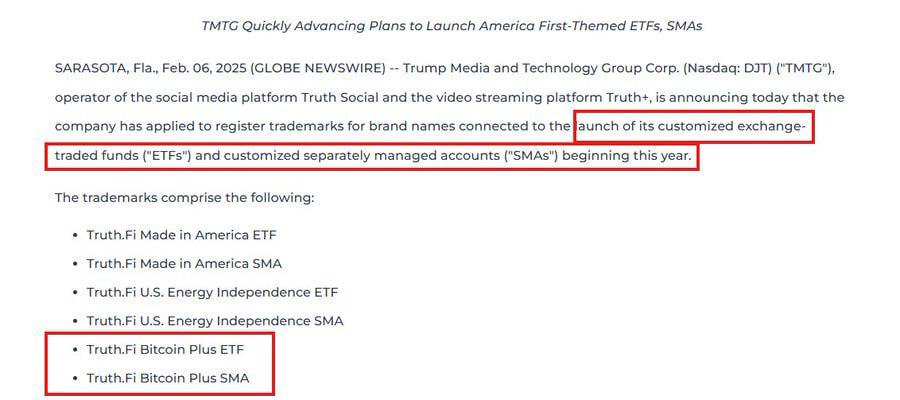

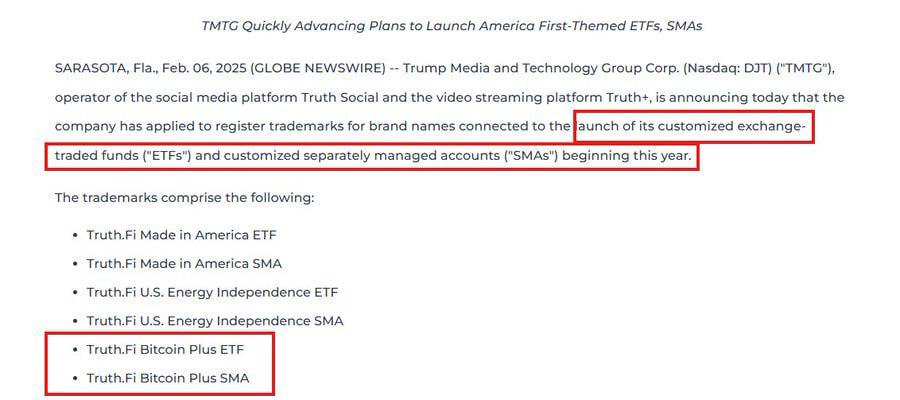

In a groundbreaking move, Trump Media and Technology Group (TMTG), the company behind Truth Social, has officially applied to launch multiple exchange-traded funds (ETFs) and separately managed accounts (SMAs) under the Truth.Fi branding. Among the new filings, the Truth.Fi Bitcoin Plus ETF stands out, marking the first time a U.S. president—current or former—has directly been involved in launching a Bitcoin ETF.

What This Means: A Political and Financial Statement

Former President Donald Trump’s involvement in the crypto space via TMTG signals a major shift in how politics, media, and finance intersect. While Bitcoin ETFs have gained significant traction in 2024, with institutions like BlackRock and Fidelity leading the market, Trump’s direct entry into this sector could bring a political edge to the Bitcoin ETF narrative.

This move aligns with Trump’s pro-business stance, potentially appealing to both retail investors and crypto enthusiasts who view Bitcoin as an alternative to traditional finance. Additionally, it reinforces Trump’s efforts to position himself as a leader in financial innovation, particularly in contrast to regulatory skepticism toward crypto under the Biden administration.

Impact on Trump Media’s Stock (DJT)

Trump Media’s stock, trading under DJT on the Nasdaq, could experience high volatility following this announcement. Here’s what investors should watch for:

Bullish Catalysts for DJT:

✅ Increased investor interest – The ETF launch could drive more retail and institutional investments into DJT.

✅ Crypto enthusiasm – The Bitcoin ETF aligns DJT with the booming crypto sector, which has seen record inflows.

✅ Trump’s political influence – As election season heats up, Trump’s endorsement of Bitcoin-related financial products may fuel DJT’s stock momentum.

✅ Potential new revenue streams – If the ETF attracts strong inflows, TMTG could monetize Bitcoin-related financial services.

Bearish Risks for DJT:

❌ Regulatory challenges – The SEC may scrutinize these ETF filings, particularly given Trump’s political connections.

❌ Market competition – The ETF space is already dominated by BlackRock, Fidelity, and Ark Invest, making it challenging for Truth.Fi to gain market share.

❌ Volatility concerns – DJT’s stock has been highly speculative, and crypto-related news can trigger wild swings.

What to Expect Moving Forward

- Short-term: Expect DJT stock to experience a surge in trading volume and volatility, especially as investors react to the ETF news.

- Medium-term: If the SEC approves the Bitcoin ETF, DJT could benefit from mainstream credibility and increased investor demand.

- Long-term: The success of Truth.Fi ETFs will depend on institutional adoption, regulatory approvals, and competition with established financial giants.

Final Thoughts

Trump’s entry into the Bitcoin ETF market is more than just a financial move—it’s a political and economic statement. If successful, it could redefine DJT’s position in the stock market and reshape the narrative around crypto regulation in the U.S.. Investors should closely monitor SEC developments, trading trends, and Trump’s own rhetoric on crypto policies as election season approaches.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

What Analysts Think of Amazon Stock Ahead of Earnings: Prediction

After quietly hit a record high, Gold is telling us something

Trumpiverse: Ranking Trump’s Inner Circle

Is AMD is next Intel? An In-Depth Analysis

Is Palantir Proving to be the Dark Horse AI Stock?

Here is why stock market will be HIGHLY tradable: More volatility is coming

Markets are in one of their greatest trading environments of all time. Want to capitalize on it?

Has a new era begun? Investors have never been so optimistic…

Does Billionaire Warren Buffett Know Something Wall Street Doesn’t?

Earnings Calendar for This Week For Biotechs, Pharma And Econ, Plus Amazon And Alphabet