Amazon.com Inc. (AMZN) is set to release its fourth-quarter earnings report today, February 6, 2025. Investors are keenly focused on the performance of Amazon Web Services (AWS), especially in light of recent underwhelming cloud revenue reports from competitors Microsoft and Google.

Here are Amazon stock estimates and predictions after its Q4 2024 earnings report from 11 leading financial media sources.

Key Predictions for Amazon’s Q4 Performance

- Anticipated Revenue and Earnings Growth

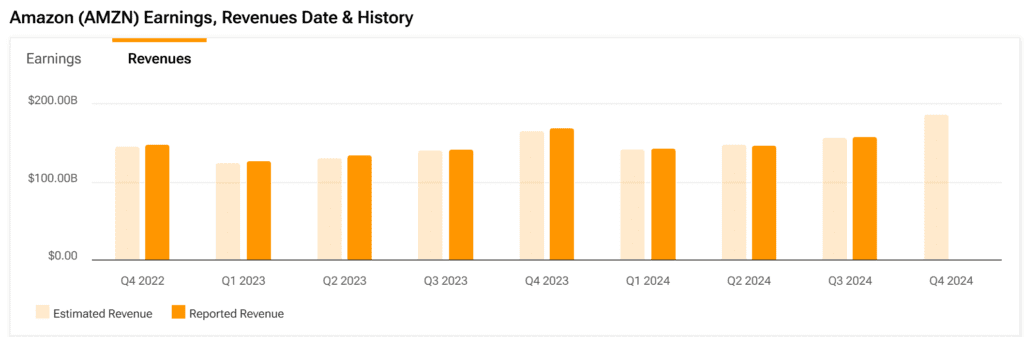

- Overall Revenue: Analysts project Amazon’s total revenue to reach $187.3 billion, marking a 10% increase from the same quarter last year.

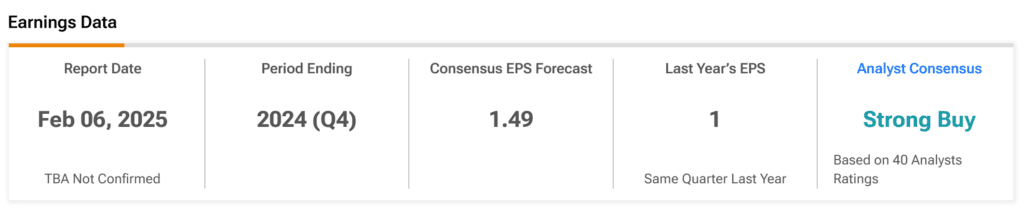

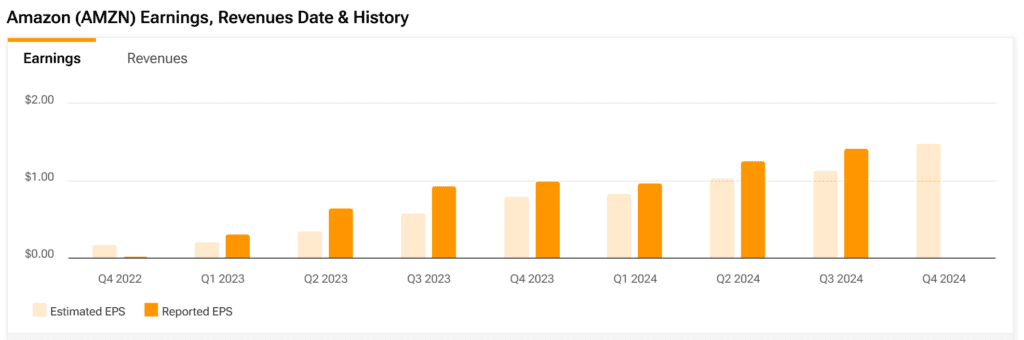

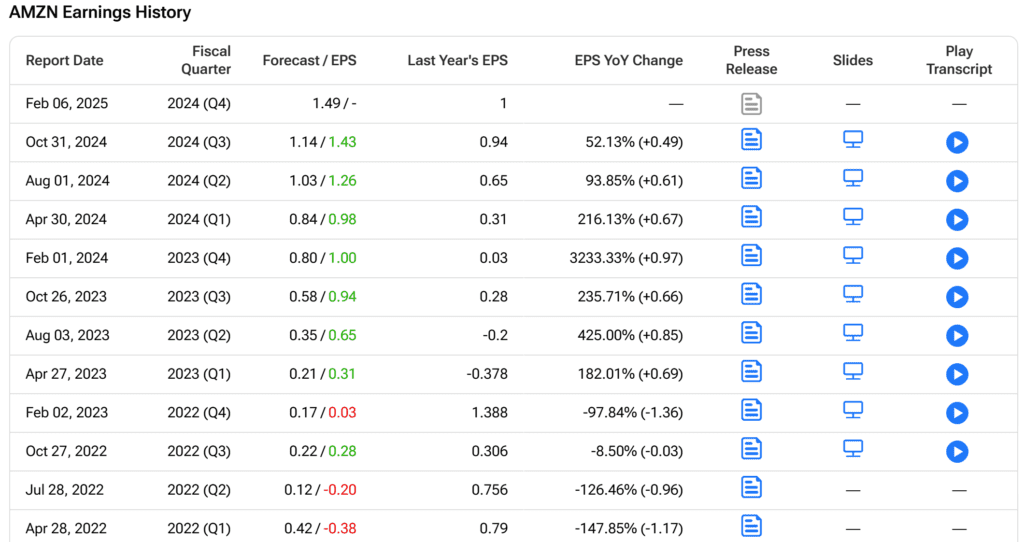

- Earnings Per Share (EPS): The consensus estimate for EPS is $1.49, up from $1.00 in the prior year, reflecting a 48% year-over-year growth.

- AWS Performance Under the Microscope

- Revenue Expectations: AWS is expected to generate $28.8 billion in revenue, a 19% increase from the previous year.

- Operating Income: Projections indicate AWS’s operating income could rise by 46% to $10.45 billion.

- Analyst Sentiment and Stock Performance

- Analyst Ratings: All 27 analysts tracked by Visible Alpha have given Amazon a “buy” rating, with a consensus price target of $259, suggesting a potential upside of approximately 7% from its recent closing price.

- Stock Movement: Year-to-date, Amazon shares have risen by 7.7%, outperforming the S&P 500’s 3% gain.

Bullish Arguments: Why Amazon Stock Could Surge

- Strong AWS Growth: Despite challenges faced by competitors, AWS is anticipated to report robust growth, reinforcing its market leadership.

- E-commerce Resilience: A successful holiday shopping season is expected to bolster Amazon’s retail segment, contributing significantly to overall revenue.

- AI Investments: Amazon’s substantial investments in artificial intelligence and cloud infrastructure position it favourably to capitalize on emerging AI-driven opportunities.

Bearish Arguments: Potential Challenges Ahead

- Competitive Pressures: The emergence of cost-effective AI solutions from competitors like Chinese startup DeepSeek could intensify market competition.

- Regulatory Concerns: Potential new tariffs and regulatory changes may impact Amazon’s future revenue growth and operational costs.

Conclusion: Mixed Sentiment on Amazon’s Q4 Earnings

After analyzing 11 sources, the overall sentiment on Amazon’s Q4 earnings is cautiously optimistic, but there are notable concerns.

- 7 sources were optimistic about Amazon’s prospects, highlighting AWS growth, AI expansion, strong holiday sales, and cost efficiency improvements as major bullish factors.

- Sources: Motley Fool, Yahoo Finance, Pune News, Business Insider, TipRanks (earnings overview), Quartz, and Investor’s Business Daily.

- Key Arguments: AI investment could drive long-term gains, AWS remains a dominant player, and holiday sales provided strong revenue momentum.

- 4 sources were more cautious or neutral, emphasizing cloud growth concerns, competition from Microsoft and Google, and potential slowing consumer spending as risks.

- Sources: Investing.com, INKL, YouTube analysis, and TipRanks (investment strategy).

- Key Arguments: AWS growth is slowing, competition is heating up, and macroeconomic conditions could limit upside.

Final Analyst Consensus: Cautiously Bullish

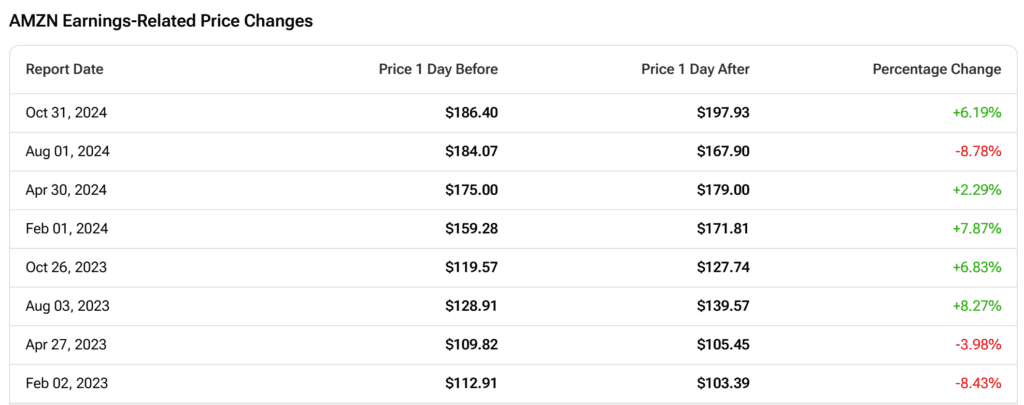

Most experts believe Amazon’s long-term AI and cloud growth remain strong, but short-term volatility is expected depending on AWS performance and guidance for 2025. While an earnings beat could fuel another stock rally, any signs of slowing AWS revenue could lead to a sell-off.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

What Analysts Think of Amazon Stock Ahead of Earnings: Prediction

After quietly hit a record high, Gold is telling us something

Trumpiverse: Ranking Trump’s Inner Circle

Is AMD is next Intel? An In-Depth Analysis

Is Palantir Proving to be the Dark Horse AI Stock?

Here is why stock market will be HIGHLY tradable: More volatility is coming

Markets are in one of their greatest trading environments of all time. Want to capitalize on it?

Has a new era begun? Investors have never been so optimistic…

Does Billionaire Warren Buffett Know Something Wall Street Doesn’t?

Earnings Calendar for This Week For Biotechs, Pharma And Econ, Plus Amazon And Alphabet

Sources:

Buy Amazon Ahead of Earnings Today? – Yahoo Finance

Amazon Earnings Preview: Big Tech’s Cloud Slowdown Puts AWS Under the Microscope – Investing.com

Amazon Earnings on Deck as AI Spending Plans Test Big Tech Rivals – INKL

Amazon’s AI and Cloud Strategy Could Outshine Rivals in Q4 Earnings – Pune News

3 Reasons to Buy Amazon Stock Like There’s No Tomorrow – The Motley Fool

Amazon Q4 2024 Earnings: AI, Retail, and Cloud Under the Spotlight – Quartz

Amazon Q4 Earnings Preview: AWS Cloud, AI, and Holiday Consumer Spending – Business Insider

Amazon (AMZN) Earnings: Revenue, Profit Expectations and Market Predictions – TipRanks

How Investors Can Capitalize on Amazon’s Q4 Earnings This Thursday – TipRanks