The stock market is in a new era: As trade wars start and stop, volatility is soaring and the S&P 500 is swinging $1+ trillion PER DAY.

Markets are in one of their greatest trading environments of all time. Want to capitalize on it?

Here’s what the analysts realized. (Source: TKL)

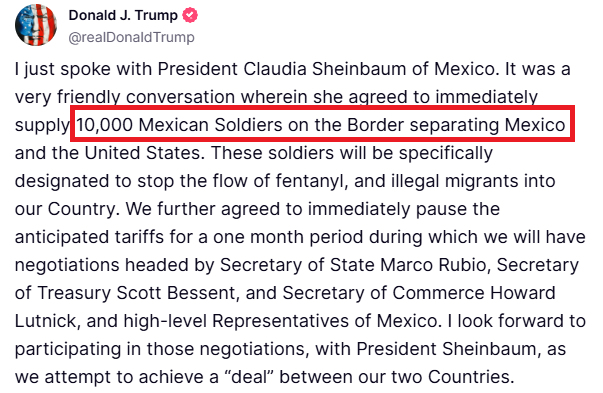

“First, it has become increasingly clear that President Trump’s goal with tariffs is NOT to generate long-term revenue. Rather, it’s to use tariffs as a measure to obtain certain policy outcomes. With Canada and Mexico, his goal is to secure the border as seen in today’s deals.

Here’s a timeline of the S&P 500 move today from open to close. Futures fell sharply into the open until the deal between Mexico and the US was announced at ~10 AM ET. Then, at ~4:30 PM ET, the US-Canada deal was announced. Dow Jones futures are now GREEN on the day.

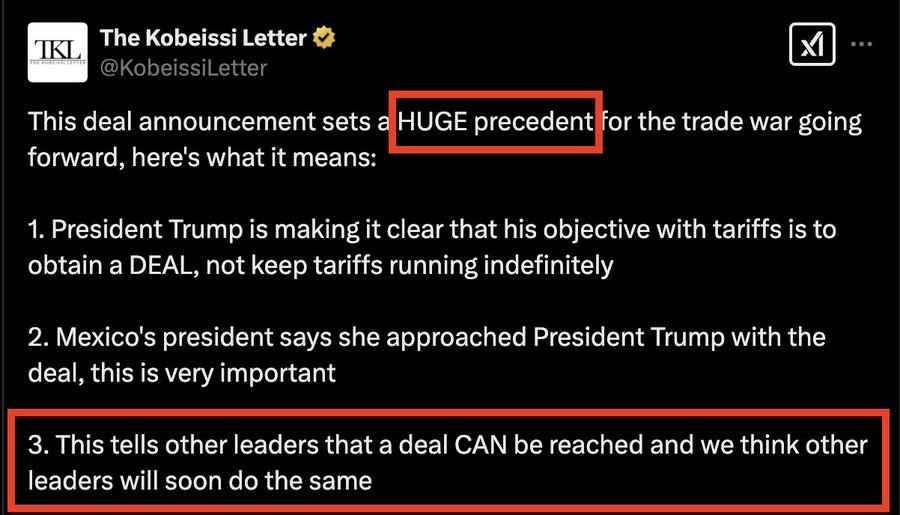

After the announcement of the US-Mexico deal, we made a post calling it “a HUGE precedent.” President Trump is making it clear that his objective with tariffs is to obtain a DEAL, not keep tariffs running indefinitely. We called for a deal with Canada and it came hours later.

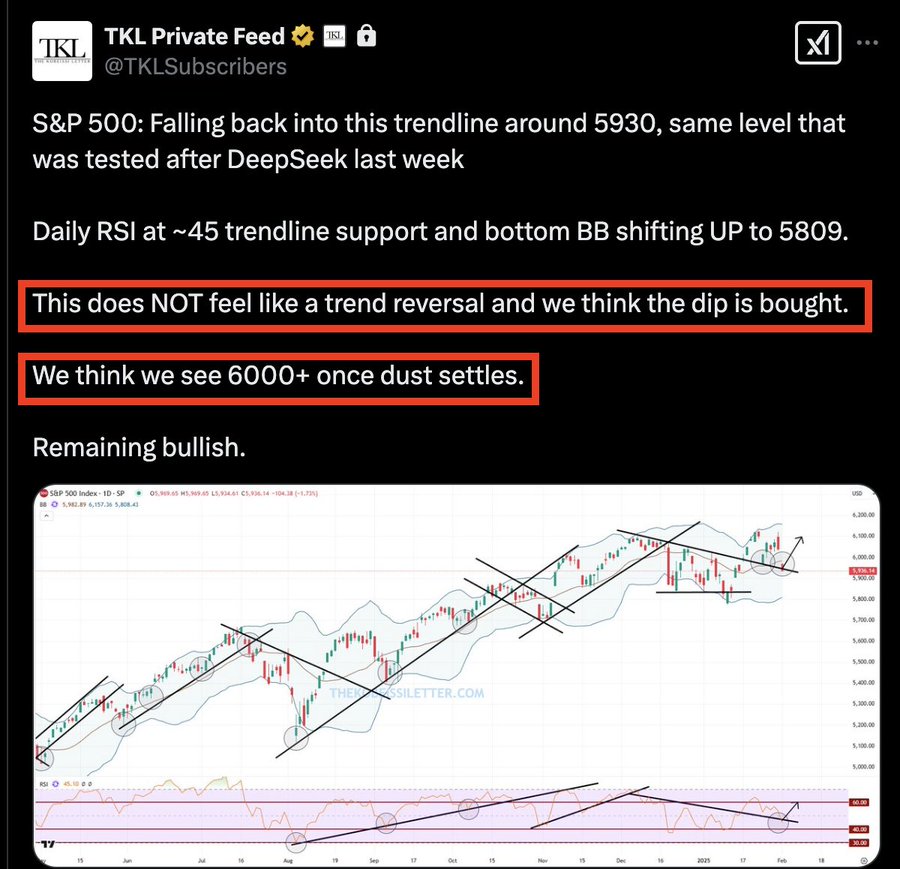

At the open, before the first deal was announced, we posted the below alert for our premium members. We called for the S&P 500 to reclaim 6,000+ once the dust settled. The index is now up +130 POINTS since this post.

The next hot topic will be EU tariffs which are already being discussed, according to Trump Admin officials. 10% tariffs on the EU are likely coming and we expect a similar reaction. President Trump “tested the waters” with Canada and Mexico and it clearly worked for him.

The price swings in commodity markets are even more volatile. Take a look at crude oil prices which surged ABOVE $75 on tariff headlines. After both deals were announced, oil prices fell back near December 2024 levels. The US Dollar is causing MASSIVE swings in commodities.

At the market open today, we posted the below alert for our premium members. We SHORTED the spike in oil prices and called for a retest of sub-$72 levels. Trump wants LOWER energy prices, markets are realizing this.

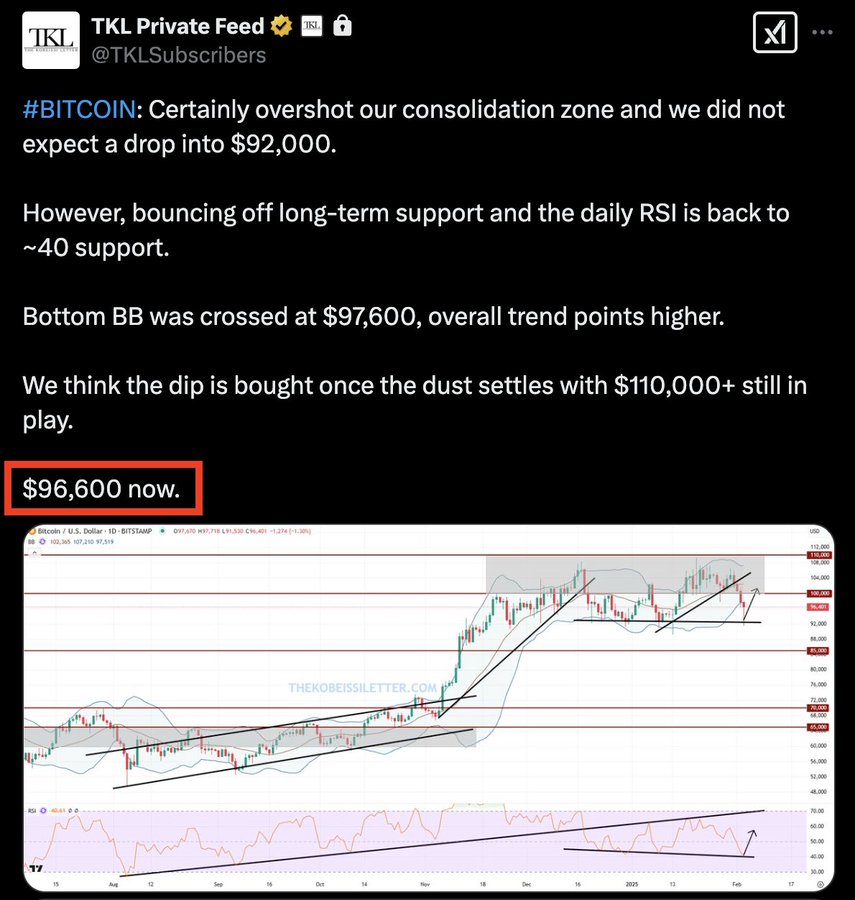

Meanwhile, the volatility in crypto is at a whole new level. Bitcoin rebounded nearly 15% from its low seen just 20 hours ago. That’s a near $500 BILLION swing in market cap in just 48 hours for Bitcoin. These swings will continue to broaden in both directions.

These swings will continue to broaden in both directions.

This was another alert we posted for our premium members at the open. As #Bitcoin fell into $95,000, we called for a move back toward $110,000. $100,000+ came much faster than just about anyone expected.

Going forward, we expect a quick initial reaction to tariff news and a potential equal and opposite reaction just as fast. This is particularly expected in cases where tariffs are being imposed on close allies. Use technical analysis to your advantage and remain OBJECTIVE.

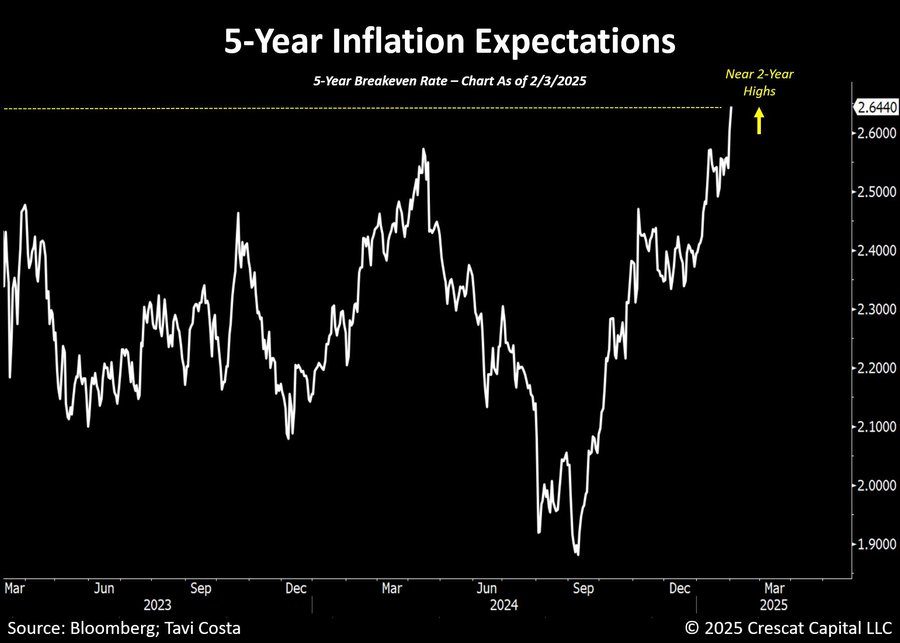

As President Trump has clearly demanded lower interest rates, his advisors are certainly watching inflation expectations. Following the announcement of the US-Mexico deal, 2-year inflation breakevens fell sharply. These intra-day swings are impacting ALL asset classes.

After all, it is not in the US’ best interest to spur a rebound in inflation. As inflation expectations rise, we believe tariffs are more likely to be short-term bargaining chips. It’s one big game of chess.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Earnings Calendar for This Week For Biotechs, Pharma And Econ, Plus Amazon And Alphabet

Has a new era begun? Investors have never been so optimistic…

Does Billionaire Warren Buffett Know Something Wall Street Doesn’t?