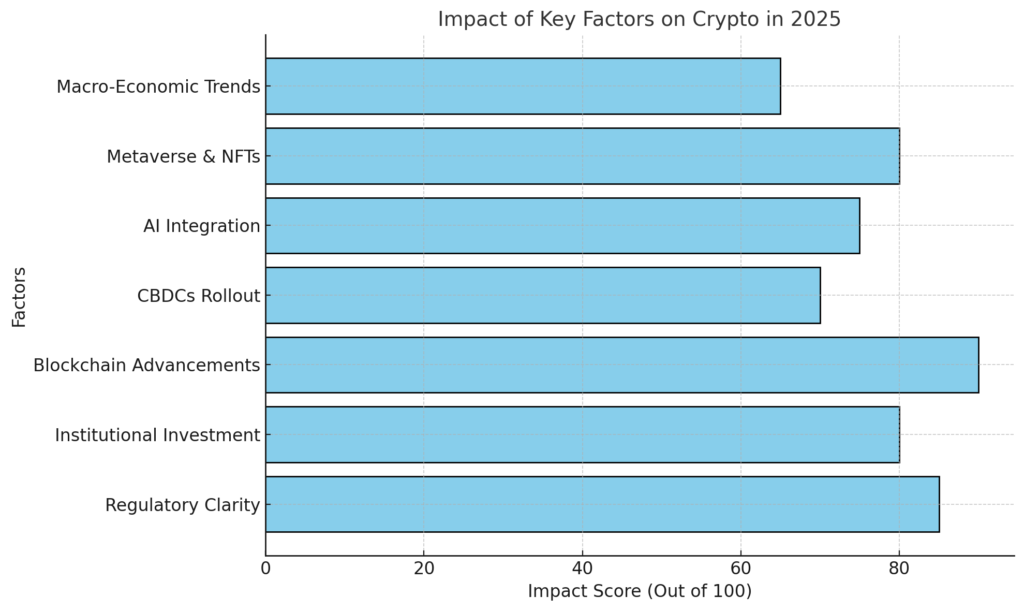

The crypto market is poised for a transformative year in 2025, driven by regulatory shifts, technological advancements, and mainstream adoption. As outlined by Forbes, seven key factors could reshape the crypto ecosystem, making it a defining year for digital assets.

Key Reasons Why 2025 Could Be a Game-Changer

1. Regulatory Clarity and Adoption

- U.S. and EU Legislation: New laws, such as the EU’s MiCA regulations and potential U.S. crypto-specific legislation, are expected to provide clearer guidelines for the industry.

- Global Collaboration: International cooperation on crypto taxation and anti-money laundering measures will create a more secure and stable environment for investors.

2. Institutional Investment Growth

- Mainstream Adoption: Financial institutions are increasingly offering crypto-based products, such as ETFs and custody solutions.

- Rising Confidence: Improved regulation and infrastructure are attracting long-term investors.

3. Advancements in Blockchain Technology

- Scalability: Layer 2 solutions like Polygon and Optimism are enhancing blockchain efficiency, reducing fees, and enabling broader adoption.

- Interoperability: Projects focused on cross-chain capabilities are expected to gain traction, improving ecosystem connectivity.

4. Central Bank Digital Currencies (CBDCs)

- Global Rollout: Countries such as China, the EU, and India are set to launch or expand their CBDC programs in 2025.

- Impact on Crypto: While offering competition, CBDCs also validate the broader digital asset space.

5. Integration with AI

- Crypto-AI Synergy: Artificial intelligence is being used to optimize crypto trading, enhance security protocols, and create smarter decentralized applications.

6. Growth of the Metaverse and NFTs

- Metaverse Economies: Cryptocurrencies and NFTs will power virtual economies, with major companies investing in digital real estate and virtual goods.

- NFT Maturation: The market is expected to shift towards utility-driven NFTs in gaming, art, and business.

7. Macro-Economic Trends

- Geopolitical Uncertainty: Crypto is increasingly seen as a hedge against inflation and geopolitical instability.

- Digital-First Economies: As economies transition to digital payments, cryptocurrencies will play a more significant role.

Challenges for 2025

- Volatility: Despite increased adoption, price volatility remains a challenge for cryptocurrencies.

- Security Concerns: Cyberattacks and scams continue to undermine trust in the industry.

- Regulatory Overreach: Excessive regulation could stifle innovation and limit market growth.

Future Outlook

| Category | 2025 Expectations |

|---|---|

| Bitcoin (BTC) | Likely to solidify as a store of value and inflation hedge. |

| Ethereum (ETH) | Dominance in DeFi and NFTs, with scalability upgrades. |

| Altcoins | Rising interest in utility tokens like Solana, Cardano. |

| Stablecoins | Expanded use in global payments and remittances. |

As highlighted by Forbes, 2025 is shaping up to be a pivotal year for cryptocurrencies, with regulatory clarity, technological innovation, and mainstream adoption driving the industry forward. While challenges persist, the crypto ecosystem is poised to redefine itself and further integrate into the global financial system.