How much is Amazon stock? Amazon’s stock price keeps changing. Lots of things affect it, like how people feel about the market, the economy, and also how well Amazon is doing.

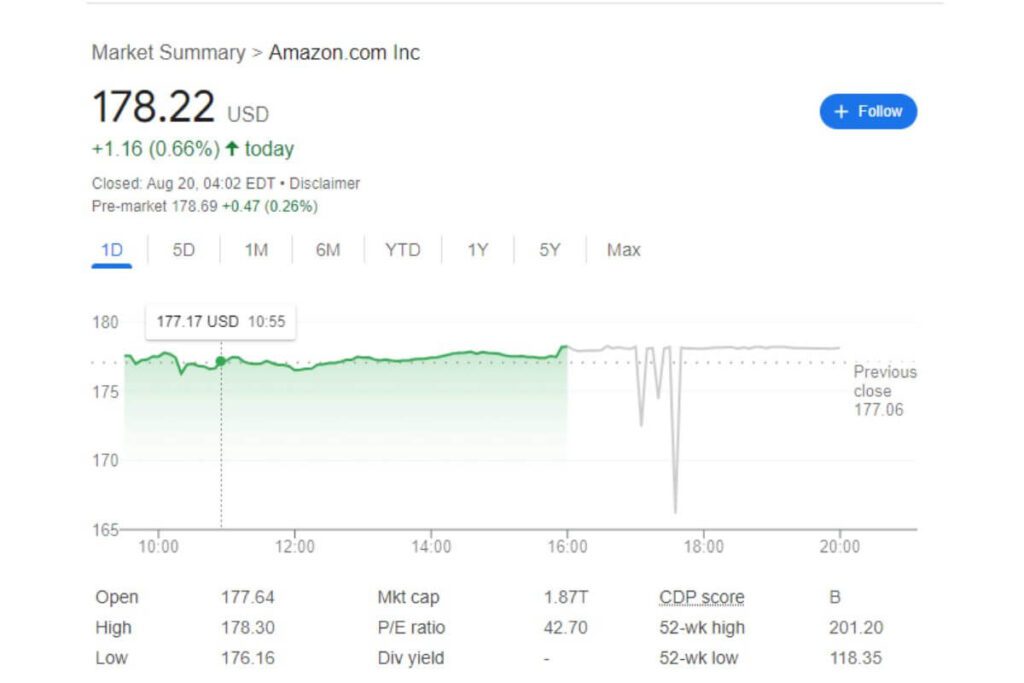

Right now, Amazon stock is worth $178.22. But this number changes all the time. To find the latest price, check a website like Google Finance or Yahoo Finance. You can also use a stock app or just type Amazon stock right in Google search.

The History of Amazon

Amazon (AMZN) is a giant company known for two things: online shopping and cloud computing.

For shopping, Amazon has a huge online marketplace where you can find almost anything, from electronics to furniture to food. They mostly sell things from other companies, but they also have their own stuff.

Amazon is also big in cloud computing. Their cloud service, called Amazon Web Services (AWS), helps other companies store information and run their websites.

Amazon started in 1994 selling books online. But the founder, Jeff Bezos, always wanted it to be more than that. He wanted Amazon to be a tech leader that makes online shopping super easy.

Amazon started selling shares to the public in 1997. Its main office is in Seattle, but they started building another big office in Virginia in 2018. Jeff Bezos used to be the boss, but now Andy Jassy is in charge.

Even though people think of Amazon as a store, it’s also a big part of many investments because of its cloud business called AWS.

Amazon’s biggest rivals are stores like Walmart, online stores like eBay, and also other tech companies that do cloud stuff like Microsoft and Google.

How Much is Amazon Stock Through the Years?

Amazon’s stock has gone way up since it started selling shares in 1997. Each share used to cost $18, but Amazon changed how many shares there were, so the price looks lower now.

Today, Amazon is one of the biggest and most valuable companies in the world. The price of each Amazon share is higher than ever before.

Key Milestones in Amazon’s Stock History:

- IPO in 1997: Amazon debuted at $18 per share, marking the beginning of its journey as a publicly traded company.

- Dot-com Bubble: In the early 2000s, Amazon’s stock price plummeted, like many other tech stocks, but the company managed to survive and recover.

- Growth Phase: From 2010 onwards, Amazon’s stock price began to rise rapidly, because it was driven by its dominance in e-commerce and expansion into cloud computing with Amazon Web Services (AWS).

- Recent Performance: In the past five years, Amazon’s stock price has seen significant volatility but overall upward momentum, especially during the COVID-19 pandemic, when online shopping surged.

Factors Influencing Amazon’s Stock Price

Several factors impact Amazon’s stock price, making it essential for investors to consider these elements when evaluating the stock’s potential.

1. Company Performance and Earnings Reports

Everyone watches closely when Amazon says how much money it made. These reports tell us how much Amazon earned, how much it spent, and how fast it’s growing in places like online shopping, cloud computing, and advertising. If Amazon does well, its stock price goes up. But if it doesn’t, the price goes down.

2. Market Sentiment and Economic Indicators

The mood of the market is a major factor in stock pricing because investor confidence can be impacted by economic indices including GDP growth, inflation rates, and unemployment rates. Consequently, in times of economic uncertainty, even strong companies like Amazon can see their stock prices decline.

3. Competitive Landscape

Amazon does a lot of different things, like selling online, storing data for other companies, and showing movies and TV shows. But there are other big companies that do the same things, and they’re always trying to be better. So, if a new company gets really popular, or if an old one does something smart, it could mean less money for Amazon.

4. Technological Innovations

Amazon is a tech company, so coming up with new ideas is really important. Things like artificial intelligence, better ways to move stuff around, and cloud computing can help Amazon grow and make more money.

5. Global Events

Big things happening in the world can affect Amazon. Things like wars, new trade rules, and even a big sickness spreading can change how Amazon works and how much its stock costs. For example, when lots of people were sick and stayed home during COVID-19, more people bought things online from Amazon, so the price of Amazon stock went up.

Is Amazon Stock a Good Investment?

Deciding if Amazon stock is a good buy depends on a few things. You need to think about how much money you want to make, how much risk you can handle, and also how long you plan to invest. Let’s look at some things to help you decide.

1. Long-Term Growth Potential

Amazon has grown really fast over the years. They have big plans to make even more money with things like cloud computing, selling ads, and selling stuff in other countries.

If you want to invest for a long time, investing in Amazon could yield substantial financial returns. But remember, the price can go up and down a lot in the short term.

2. Diversification

Amazon is a diversified company with multiple revenue streams, including e-commerce, AWS, advertising, and subscription services like Prime. This diversification can help mitigate risks associated with reliance on a single market or product.

3. Valuation

To figure out if Amazon stock is a good deal, you need to check its price compared to how much it makes. There are special numbers like P/E, P/S, and P/B that help you see if the stock costs too much, too little, or just right for how much Amazon is worth and how much it’s growing.

4. Dividends

One aspect that may deter some income-focused investors is that Amazon does not currently pay dividends. The company reinvests its profits to fuel growth and innovation. So, if you’re looking for income from your investments, you may need to consider this factor.

5. Risk Factors

Investing in Amazon stock has risks. Things like the stock market going up and down, new rules, and other companies trying to compete can affect how well Amazon does. It’s important to think about how much risk you can handle before buying Amazon stock or any other single company’s stock.

How to Buy Amazon Stock

Want to own a piece of Amazon? Here’s a guide to buying its shares:

- Choose a Brokerage Account: Select a reputable brokerage platform that allows you to trade stocks. Popular options include Robinhood, E*TRADE, TD Ameritrade, and Fidelity.

- Fund Your Account: Deposit funds into your brokerage account to have the capital needed to buy Amazon stock.

- Search for Amazon Stock: Use the platform’s search function to find Amazon by its ticker symbol, AMZN.

- Decide on the Number of Shares: Determine how many shares you want to buy based on your budget and investment strategy.

- Place Your Order: Choose the type of order you want to place—market order (buy at the current price) or limit order (set a specific price at which you want to buy).

- Review and Confirm: Double-check the details of your order and confirm the purchase.

- Monitor Your Investment: Once you buy Amazon stock, it’s important to watch it closely. Keep an eye on how Amazon is doing and what’s happening in the market.

Conclusion of How Much is Amazon stock

Amazon stock has been a strong performer over the years, driven by the company’s innovation, diversification, and dominance in several markets.

While the stock’s price fluctuates daily, understanding the factors that influence its value can help you make informed investment decisions.

Sources:

- https://www.investopedia.com/amazon-stock-amzn-5094245

- https://www.caknowledge.org/amazon-net-worth/#:~:text=Amazon%20total%20assets%20for%202023,for%202019%20were%20%24225.248%20Billion.

- https://www.forbes.com/advisor/investing/how-to-buy-amazon-stock/

- https://www.marketwatch.com/investing/stock/amzn