Price changes are one of the most influential factors in consumer decision-making. Whether it’s a slight discount, a sudden price surge, or a seasonal sale, price changes can significantly impact how consumers perceive value, make purchasing decisions, and even develop brand loyalty.

Understanding the psychology behind these behaviors can help businesses strategically adjust prices to optimize sales, maintain customer satisfaction, and sustain long-term profitability.

The Psychology of Pricing

To understand why people buy things when prices change, we need to know how people think about money.

People don’t always make smart choices about prices. Instead, their decisions are often based on how they feel about the price, not just the numbers.

- Perceived Value: The price of something isn’t always the most important thing. People also think about what they get for their money. People may be willing to pay more for products that they believe are of higher quality or will enhance their image. However, lower prices can sometimes lead to perceptions of lower quality, potentially deterring purchases.

- Price Anchoring: This is a cognitive bias where consumers rely heavily on the first piece of information they receive (the “anchor”) when making decisions. For example, if a product is introduced at a high price and later discounted, the original price serves as an anchor, making the discounted price seem like a great deal even if it’s still relatively high.

- Price Sensitivity: Some people are really bothered by price changes. When prices go up, they often switch to a different brand or wait to buy. But other people aren’t as worried about the price. They’ll keep buying their favorite stuff even if it costs more, especially if they really like it.

The Impact of Price Increases on Consumer Behavior

Raising prices can be a strategic decision for businesses, but it also carries risks. Increased production costs or broader economic inflation can necessitate price adjustments. Additionally, some businesses may strategically raise prices to enhance their brand’s perceived value and premium positioning.

When prices go up, people might change how they buy things.

- Reduced Demand: When prices go up, people usually buy less. This is a basic rule in business. But how much less people buy depends on the thing. For things we really need, like food or medicine, people will still buy them even if the price goes up. But for things we want but don’t need, like fancy cars or vacations, people might buy less if the price is too high.

- Brand Loyalty: Raising prices can be risky. If people really like a brand, they might pay more. But if the price goes up too much, even loyal customers might look for cheaper options. This can hurt the brand in the long run.

- Perception of Value: How you tell people about a price hike matters. If you say the price went up because you made your product better or faster, people might understand. But if you just suddenly charge more without explaining why, people will be upset and might stop buying from you.

The Impact of Price Decreases on Consumer Behavior

Lowering prices can attract new customers, increase sales volumes, and clear out old inventory, but it can also have unintended consequences:

- Lowering prices can help you sell more: When you make your stuff cheaper, more people will buy it. This can help you beat your competitors, especially if people choose products based on price.

- Too many sales can hurt your brand: While sales can help you sell more stuff in the short term, having too many sales or really low prices can make people think your stuff isn’t worth much. This can make it hard to charge more later. Plus, people might wait for the next sale instead of buying now, which is bad for business.

- Price Wars: Price wars happen when stores try to beat each other’s prices. When one retailer initiates a price reduction, its competitors often feel compelled to follow suit to maintain market share. This competitive pressure can result in lower prices for consumers but can also lead to decreased profitability for businesses. If this trend persists, it could have a detrimental impact on the overall business landscape.

The Role of Discounts, Promotions, and Dynamic Pricing

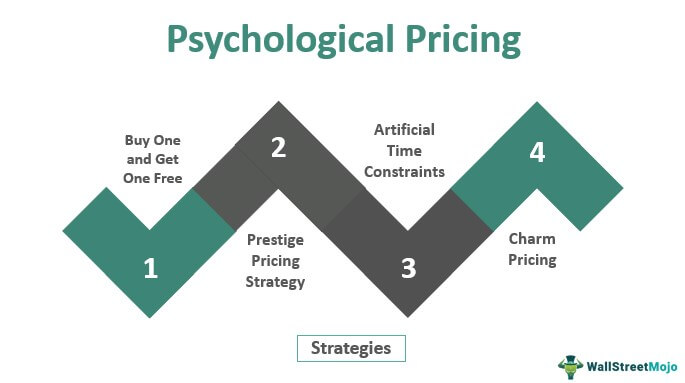

Beyond simple price increases or decreases, many businesses use discounts, promotions, and dynamic pricing strategies to influence consumer behavior.

For example, limited-time deals, buy-one-get-one-free offers, and seasonal sales can make people want to buy right away. This helps stores sell old stuff, find new customers, and reward loyal ones.

However, if stores have too many sales, people will expect low prices all the time. This makes it hard to sell things at the normal price.

But there’s also dynamic pricing. This strategy involves adjusting prices in real-time based on demand, competition, and other factors. It’s commonly used in industries like travel, hospitality, and e-commerce.

Dynamic pricing can maximize revenue by charging higher prices during peak demand periods and offering discounts during slow periods. However, it can also lead to consumer dissatisfaction if they perceive the pricing as unfair or unpredictable.

Long-Term Effects of Price Changes

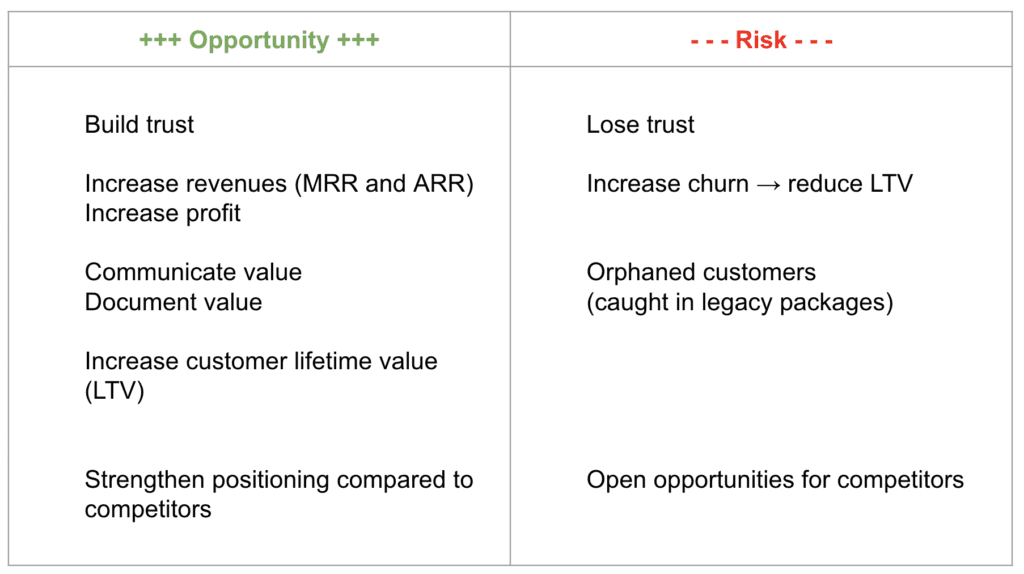

While immediate sales impact is a critical consideration, the long-term effects of price changes on consumer behavior and brand health are equally important.

Consistent pricing builds consumer trust, while erratic pricing can lead to skepticism and dissatisfaction. Consumers want to feel they are getting a fair deal, and unpredictable price changes can undermine that trust.

Changing your prices can affect how much money a customer spends with you over time. For example, a well-executed price increase that is perceived as fair can enhance customer loyalty and increase lifetime value. Conversely, poorly managed price increases or decreases can lead to churn, reducing the overall lifetime value of the customer base.

Strategic price changes can help a brand reposition itself in the market. For example, premium pricing can elevate a brand’s status, while competitive pricing can position a brand as a value leader. However, these strategies require careful execution to avoid alienating existing customers.

Case Studies: Real-World Examples of Price Changes

To further illustrate the impact of price changes on consumer behavior, let’s consider a few real-world examples:

- Apple: Apple is known for its premium pricing strategy. Despite regular price increases with new product launches, Apple maintains a loyal customer base that perceives high value in its products. The brand’s ability to command higher prices is largely due to its strong brand equity, consistent innovation, and effective communication of value.

- Amazon: Amazon frequently uses dynamic pricing to optimize sales and profitability. By adjusting prices based on factors like demand, competition, and inventory levels, Amazon can maximize revenue while remaining competitive. However, this strategy has sometimes led to consumer frustration when prices change rapidly.

As an example, Al- Hassa Case Study notes that while favorable pricing of well-known brands can negatively impact the purchasing process, it is particularly challenging for young consumers.

Although they are eager to purchase these brands, their limited income often prevents them from doing so. In the marketing mix, price stands out as the sole element that generates revenue, whereas the other components primarily incur costs.

Sources:

- https://upnify.com/blog-en/price-influences-the-perception.html#:~:text=Price%20can%20influence%20the%20type,of%20product%20and%20target%20audience.

- https://hbr.org/2023/01/research-how-price-changes-influence-consumers-buying-decisions

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC8710754/

- https://www.researchgate.net/profile/Jalal-Albaqshi/publication/289096036_Behavioral_Measurement_of_Young_Generation_towards_Brand_Products_in_Saudi_Arabia_Al-Hassa_Case_Study/links/597bb3a80f7e9b8802997735/Behavioral-Measurement-of-Young-Generation-towards-Brand-Products-in-Saudi-Arabia-Al-Hassa-Case-Study.pdf

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC8710754/#B3