Bitcoin’s record-breaking run has finally hit turbulence. After touching highs above $120,000 in October, the world’s largest cryptocurrency has slid roughly 13% over the past month and briefly dropped back below the $100,000 mark, rattling a market that had grown used to “Uptober” rallies and relentless ETF inflows.

What just happened?

- BTC fell about 4% on Thursday from an intraday high near $103,700 to below $99,000, tracking a broader risk-off move in equities, especially tech and AI stocks.

- The pullback comes as investors digest the fallout from the US government’s record shutdown, missing macro data, and growing doubts about Fed rate cuts this year.

“The market is really looking for certainty to gain strength, but it is not clear where that is going to come from right now,” said Ryan McMillin of Merkle Tree Capital.

Heavy selling from long-term holders

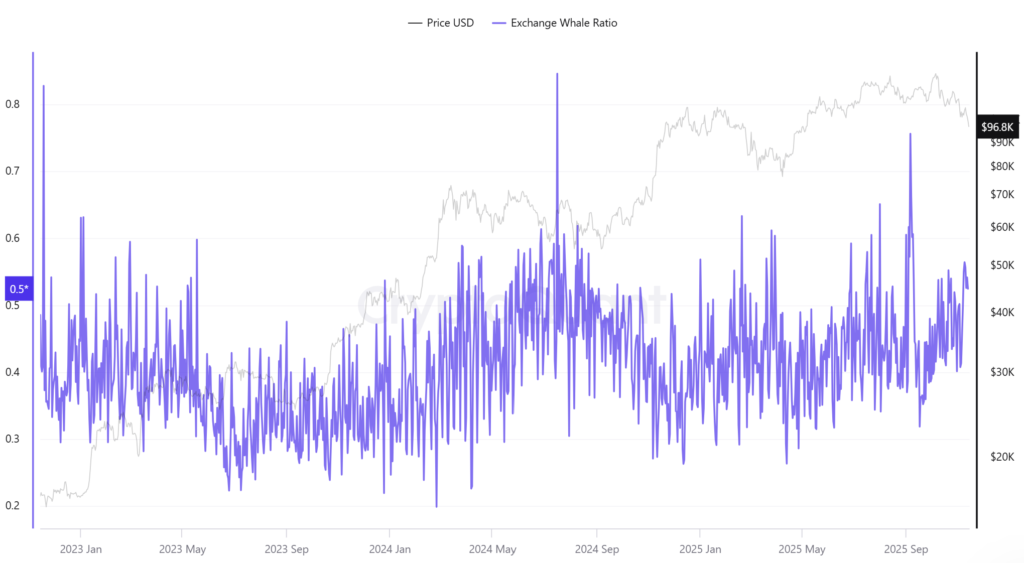

On-chain data shows that this is not just noise from short-term traders:

- Long-term holders have sold around 815,000 BTC over the past month, the highest level of distribution since early 2024.

- Glassnode and CryptoQuant both flag sharp negative changes in long-term holder supply, meaning older coins are finally hitting the market as prices remain near all-time highs.

- That selling has collided with weaker spot demand:

- Net outflows from spot Bitcoin ETFs in recent days

- A negative Coinbase premium, pointing to softer US buying

- Less “bid support” from whales and corporate buyers than earlier in the cycle

“Whales selling in isolation isn’t usually significant,” noted BTC Markets’ Charlie Shery. “What makes it notable now is the lack of meaningful bid support on the buy side to absorb that selling.”

Macro: shutdown fallout, tariffs and higher-for-longer fears

The crypto pullback is also tied directly to macro headlines:

- The US shutdown ended, but left a “data blackout” – with October inflation and unemployment figures potentially never released.

- That leaves the Fed flying partially blind, just as rate-cut expectations are being repriced. Hopes for a December cut have faded to a coin-flip.

- Trump’s threat of 100% tariffs on Chinese rare earths last month triggered a wave of $19 billion in crypto liquidations, as investors used BTC as the easiest risk hedge when traditional markets were closed.

- Repricing of rate-cut odds and trade-war fears have pushed investors out of risk assets broadly – Nasdaq, AI stocks and Bitcoin all rolled over together.

Is this the start of another “crypto winter”?

So far, most analysts say no:

- Bitcoin is down about 20% from its 2025 peak, far less than the 70–80% drawdowns seen in past crypto winters.

- Leverage appears lower than in previous cycle tops, and altcoins haven’t shown the classic euphoric blow-off behaviour.

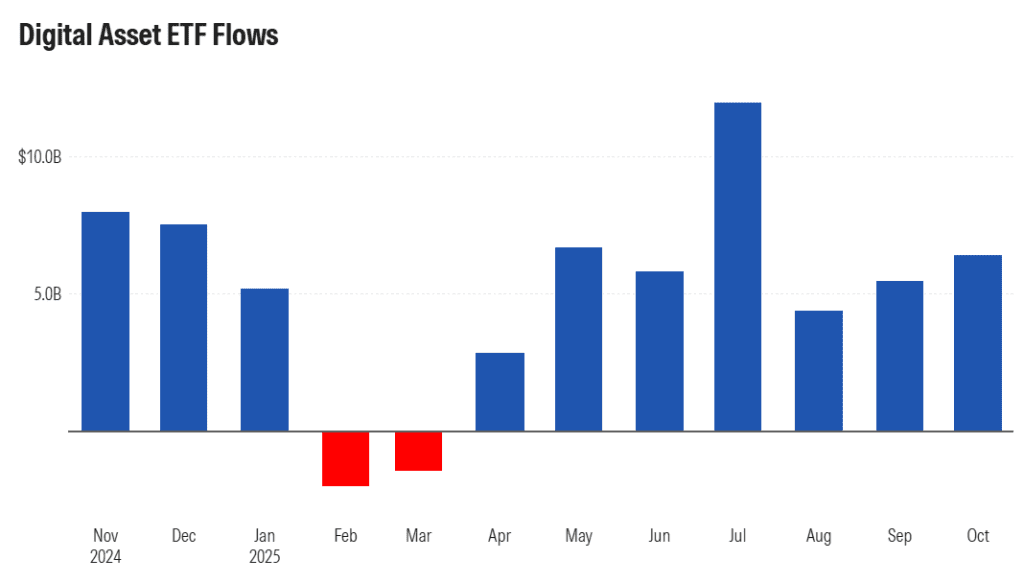

- Crucially, institutional ETF flows remain positive:

- Digital-asset ETFs saw around $6.4 billion of inflows in October, up from $5.5 billion in September.

- Analysts say professional investors are cautious but not capitulating – a full exit would likely show up as large ETF outflows, which we haven’t seen yet.

“The selloff has been driven primarily by short-term positioning and derivatives unwinds, rather than fundamental shifts in conviction,” said WisdomTree’s Dovile Silenskyte. Long-term cohorts, she argues, are “still holding through volatility.”

What’s next for Bitcoin?

Right now, BTC is trading in a wide range around $100,000, with:

- Downside risk: if the $98k–$100k zone breaks decisively, some traders see scope for a retest of the low-$90k area, similar to June.

- Supportive forces:

- Ongoing institutional adoption and ETF demand

- Expectations that monetary policy eventually eases

- Bitcoin increasingly trading like a macro asset tied to real yields, liquidity and global risk appetite.

“As long as BTC holds above $100,000, the structural uptrend remains intact,” said 21Shares’ Eliézer Ndinga, framing the move as a “cyclical reset” rather than the start of a deep freeze.

For now, Bitcoin’s message is simple: The bull market might not be over, but easy mode is gone.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related: Markets no longer view December rate cut as a sure bet