President Trump’s plan to impose a 100% tariff on imported semiconductors is sending shockwaves through the tech world. While the policy aims to boost U.S. manufacturing and cut reliance on Asia, it could also disrupt supply chains, raise costs, and reshape the $650 billion semiconductor industry.

Semiconductors: The Brains of Modern Technology

Semiconductors—also known as microchips—are the invisible engine inside almost every modern device.

From smartphones and laptops to cars, medical equipment, satellites, and renewable energy systems, these chips make our digital world possible.

They are typically made from silicon wafers, sliced into thin disks and imprinted with billions of microscopic transistors. Their unique property — the ability to switch between conducting and insulating electricity — allows them to run the binary logic (0s and 1s) that underpins computing.

Global market value (2024): ~$650 billion

Forecast (2030): ~$1 trillion, driven by AI, EVs, and 5G expansion

Global Supply: A Fragile Chain

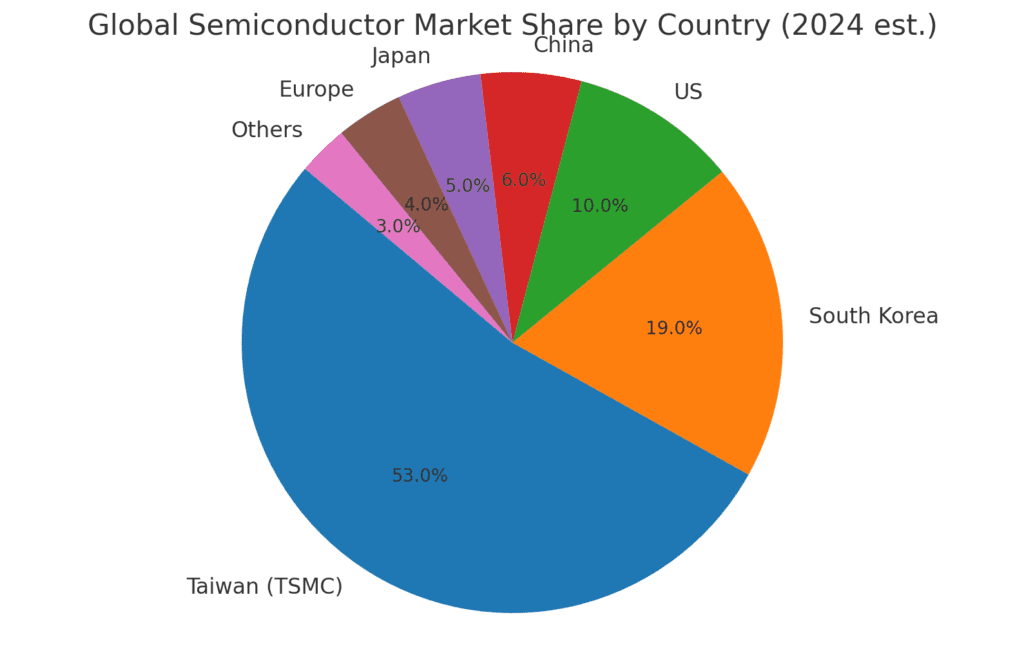

The world’s semiconductor supply is heavily concentrated in Asia, making it vulnerable to geopolitical shocks:

| Country/Region | Key Players | Global Market Share |

|---|---|---|

| Taiwan | TSMC | ~55% of advanced chip production |

| South Korea | Samsung, SK Hynix | ~20% |

| China | SMIC, YMTC | ~7% |

| US | Intel, Texas Instruments, Micron | ~12% |

| Others | Japan, EU | ~6% |

Taiwan’s TSMC is the clear leader, producing chips for Apple, Nvidia, AMD, and more.

Samsung and SK Hynix dominate in memory chips.

The US leads in design but lags in manufacturing capacity.

Trump’s 100% Tariff Threat

President Trump’s proposal is simple on paper but seismic in impact:

All imported semiconductors will face a 100% tariff — unless the company builds manufacturing facilities in the United States.

This is part of a broader push for “reciprocal” trade, aimed at reshoring critical manufacturing, reducing reliance on Asia, and addressing national security concerns.

Who’s Safe, Who’s Not

- Exempt: Apple (due to its new $600B U.S. investment pledge), TSMC (Arizona plant), Samsung & SK Hynix (U.S. fabs under construction) (More about: Apple to invest another $100B in US as Trump applies pressure)

- At Risk: Smaller electronics firms, PC makers, automotive suppliers that rely on imported chips

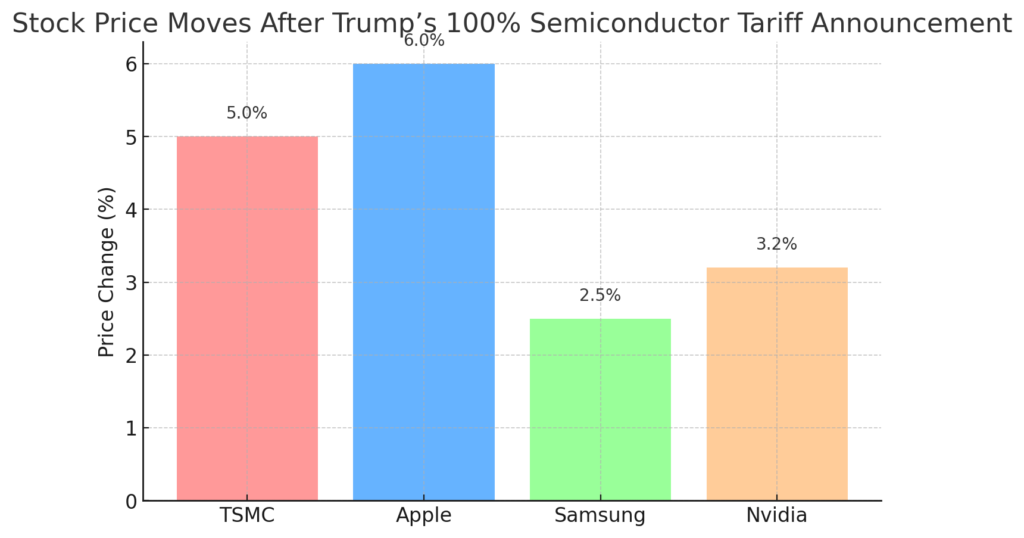

Market Reaction: Relief Rally, Not Panic

Instead of tanking, chip stocks surged after the announcement — investors saw it as a strategic move with built-in escape routes for major players.

Stock Moves After Tariff Announcement (Aug 6, 2025)

The market read Trump’s move as pressure, not punishment — at least for big companies with U.S. expansion plans.

Why This Matters for Consumers

If Trump’s proposed 100% semiconductor tariffs were enforced without exemptions, the impact on everyday consumers could be both significant and immediate. Electronics — from smartphones and laptops to gaming consoles and smart appliances — could see prices rise sharply as manufacturers pass costs directly to buyers.

Possible effects include:

- Electronics price hikes: Many devices could become 10–25% more expensive, especially high-end products that rely on chips made in Taiwan and South Korea.

- Higher car prices: Modern vehicles need over 1,500 chips for navigation, safety, and entertainment systems. Any supply disruption could slow production and push car prices higher, repeating the pain of the 2021–2022 global chip shortage.

- Slower tech upgrades: PC and smartphone replacement cycles might stretch out as companies delay launches or scale back model lineups to avoid higher costs.

However, the impact may be smaller for products from companies like Apple, Samsung, and Nvidia. These firms are already expanding chip production in the U.S., meaning their flagship devices could avoid the steepest tariffs and keep prices relatively stable — at least in the short term.

Production Challenges in the US

Even with strong government incentives under the CHIPS and Science Act, building advanced chip plants in the U.S. is far from simple. The obstacles are financial, logistical, and technological.

Key challenges include:

- Massive costs: Each cutting-edge semiconductor fabrication plant (“fab”) can cost $10–$20 billion to build and equip.

- Skilled labor shortages: TSMC’s Arizona project was delayed until thousands of engineers from Taiwan were brought in — highlighting the lack of experienced domestic talent.

- Supply chain gaps: Many essential chemicals, specialty gases, and high-precision tools still come from Asia and Europe, leaving U.S. fabs dependent on imports.

Without addressing these bottlenecks, U.S.-based production will still face global vulnerabilities, even if the manufacturing footprint increases domestically. Creating a self-sufficient chip ecosystem could take years — and billions more in investment — before the U.S. can rival Asian semiconductor hubs.

Bottom Line

Trump’s 100% semiconductor tariff threat is less about immediate taxation and more about leveraging investment commitments.

It could accelerate America’s long-term goal to bring chip production home — but it’s a high-stakes gamble in a deeply globalized industry.

For now, markets are betting that big tech will adapt, smaller players will struggle, and consumers might dodge the worst price hikes — at least until the tariff talk turns into real trade law.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

Trump Explodes Over Nancy Pelosi Stock Ban

Fed Governor Adriana Kugler Resigns, Opening Door for Trump

Trump Imposes New Global Tariff Rates, Effective August 7

What Happens After Tariff Deadline and What Next 72 Hours Look Like for Markets

Trump’s Tariffs Are Real, But Are His Trade Deals Just for Show?

Figma Is Largest VC-Backed American Tech Company IPO in Years