The possibility of a U.S. government shutdown is dominating headlines this week as lawmakers scramble to reach a deal before a critical funding deadline on Friday night, March 15th. With Congress at an impasse, the likelihood of a shutdown appears to be growing by the hour. Here’s what’s going on, why it’s happening, and what it could mean for the economy and stock market.

Why Is a Government Shutdown Happening?

The potential shutdown stems from Congress failing to pass the full budget needed to fund government agencies for the 2025 fiscal year.

- Lawmakers already passed some funding bills, but key areas, including defense, homeland security, and financial services, are still unfunded.

- The Republican-controlled House of Representatives and the Democrat-controlled Senate remain divided over spending levels and policy riders.

- Key sticking points include border security funding, cuts to social programs, and restrictions on government regulations that Republicans are pushing for.

- If a deal isn’t made by 11:59 PM Friday night, parts of the government will run out of funding and shut down.

Current Situation: Last-Minute Talks, but No Deal Yet

- Congress passed six of the twelve required spending bills, avoiding a partial shutdown earlier this month.

- The remaining six bills, covering about 70% of discretionary government funding, remain unresolved.

- Negotiators are running out of time to reach a compromise.

- Speaker of the House Mike Johnson faces pressure from his party’s right flank to demand deep spending cuts, while Democrats resist cuts that could harm social programs and federal worker pay.

- Analysts say there’s still a narrow path to avoid a shutdown, but most agree the odds are high it will happen, at least for a few days.

What Happens If the Government Shuts Down?

If a shutdown begins on Saturday, March 16, here’s what to expect:

- Federal employees (about 800,000) may be furloughed or forced to work without pay.

- National parks, museums, and public services could close or operate with minimal staff.

- Delays in permits, loans, and government services (like passport processing) are likely.

- Defense and national security would be impacted, but essential services typically remain open.

- Federal contractors and small businesses dependent on government contracts could feel financial strain.

How Could It Affect the Economy?

- Economic growth: Prolonged shutdowns tend to drag on GDP. Goldman Sachs estimates a shutdown could shave 0.2% off GDP growth for each week it lasts.

- Consumer confidence: Uncertainty may reduce consumer spending, especially if federal workers and contractors aren’t paid.

- Government services delays: Interruptions in permits, SBA loans, and IRS processing could hit small businesses and delay tax refunds.

Impact on the Stock Market

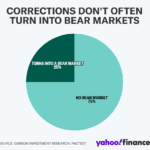

- Short-term volatility: Markets typically react negatively to shutdowns due to uncertainty and political dysfunction.

- Past shutdowns show mixed impact: Stocks often decline initially, but markets can rebound quickly once funding is restored.

- Sectors at risk:

- Defense and contractors (companies like Lockheed Martin, Raytheon) may face contract delays.

- Airlines and travel could see reduced demand if national parks and museums close.

- Consumer goods may dip if confidence weakens.

- Bond markets: Treasury yields might fall as investors seek safe-haven assets like U.S. government debt, although irony remains that the shutdown underscores government instability.

Final Verdict: What Investors Should Watch

- If the shutdown is brief (a few days), market impact will likely be limited.

- If it lasts weeks, expect increased market volatility, drag on GDP, and negative consumer sentiment.

- Investors will watch for Fed reaction, as economic slowdown from a shutdown could influence interest rate decisions later this year.

Bottom line: A shutdown looks likely by Friday night unless a last-minute deal is struck. Markets are bracing for potential disruption, but history shows they tend to recover quickly once political gridlock ends.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Related:

The world is rearming at a pace not seen the since end of World War II

What is Donald Trump’s “short-term pain” worth “long-term gain” Recession PLAN

Donald Trump’s Tesla Sales Script Note Is Going Viral

CPI inflation data cools in February, easing investor fears about health of US economy

Chinese AI team wins global award for replacing Nvidia GPU with industrial chip

Debt Cycles and Their Impact on Markets: In-Depth Look at Long-Term Debt Cycle Theory

Internal Ripple Emails Expose Anti-Bitcoin Smear Campaign

Trump wants to CRASH STOCK MARKET, but It’s All Part of the His Plan

‘I hate to predict things’: Trump doesn’t rule out US recession in 2025

Institutional Investors Bet $1B on These 4 Stocks—Should You?

Nasdaq 100 Crashes After Dimon & Buffett Sell-Off: What Did They Know?

CrowdStrike: Deep Dive into Company Fundamentals & Market Forecast

How Google tracks Android device users before they’ve even opened an app