What started as a “guaranteed” opportunity in a quiet Chinese tech stock turned into one of the biggest coordinated pump-and-dump scams of the decade. Ostin Technology Group Co. Ltd (ticker: OST), a real Nasdaq-listed company, became the center of a complex fraud that used private WhatsApp and Telegram groups, deep fake legitimacy, and mass psychology to drain millions from unsuspecting retail investors — many of whom invested their life savings, borrowed funds, or even emergency money.

What Actually Happened?

In early June 2025, OST — a little-known display module company from Nanjing, China — began showing unusual trading activity. With no major news, no earnings releases, and no fundamental improvement, the stock skyrocketed from $0.48 to over $9 in less than two weeks.

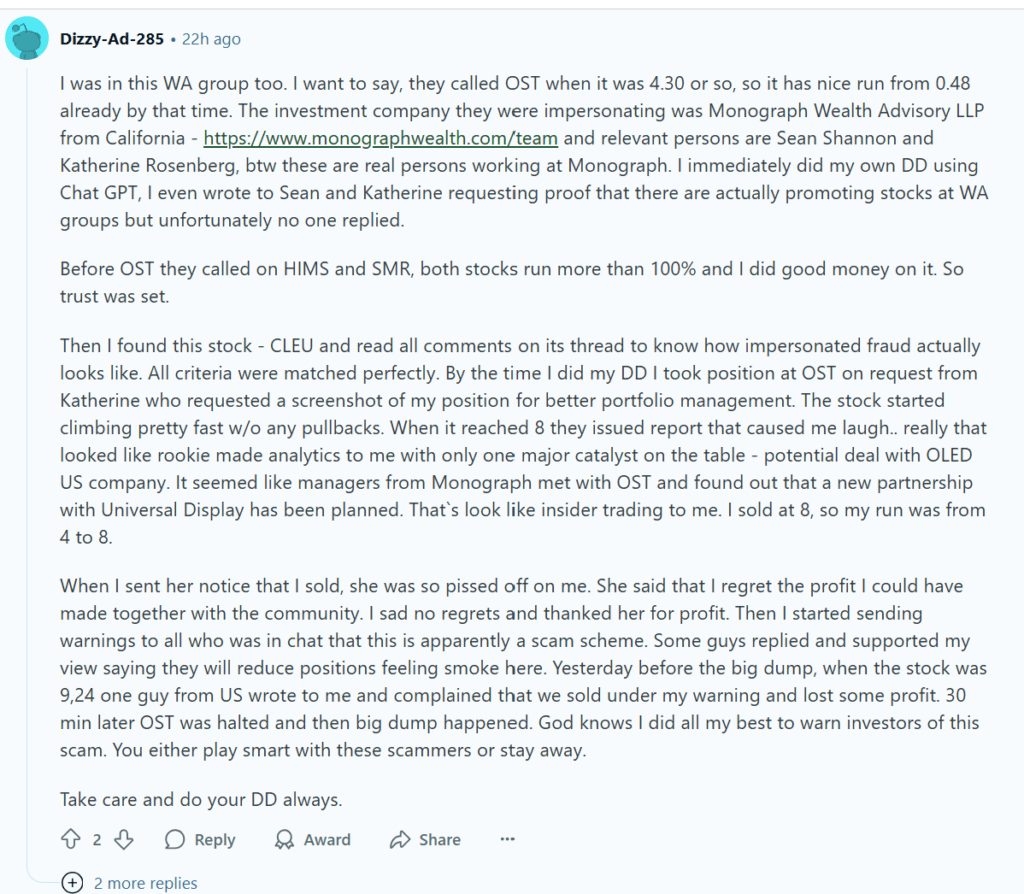

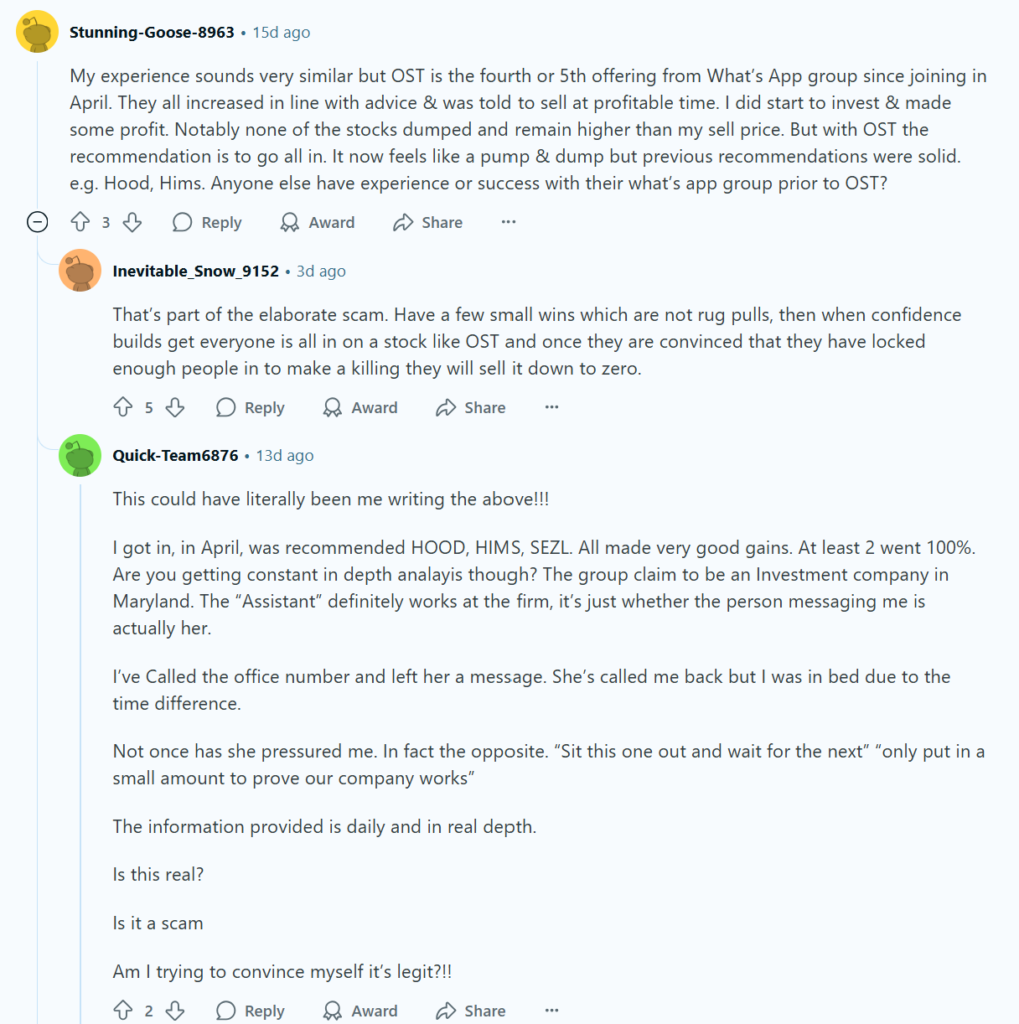

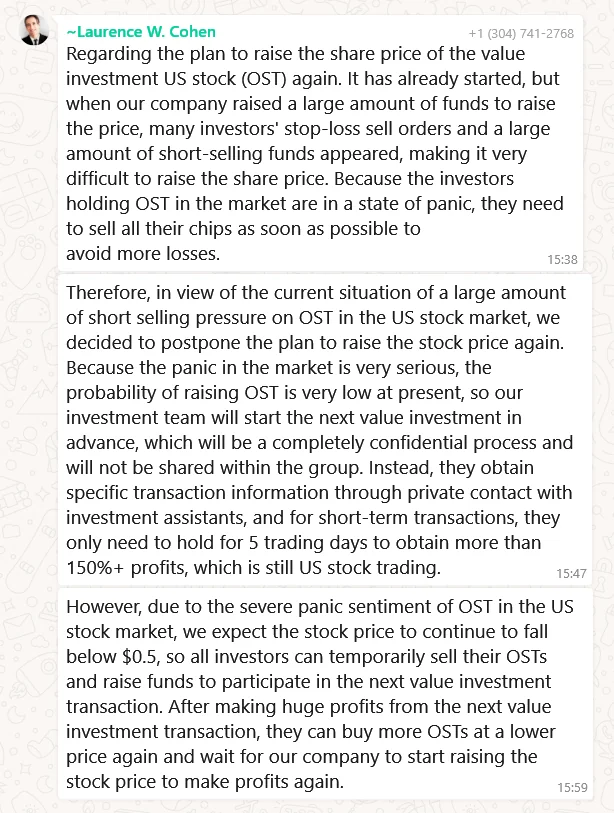

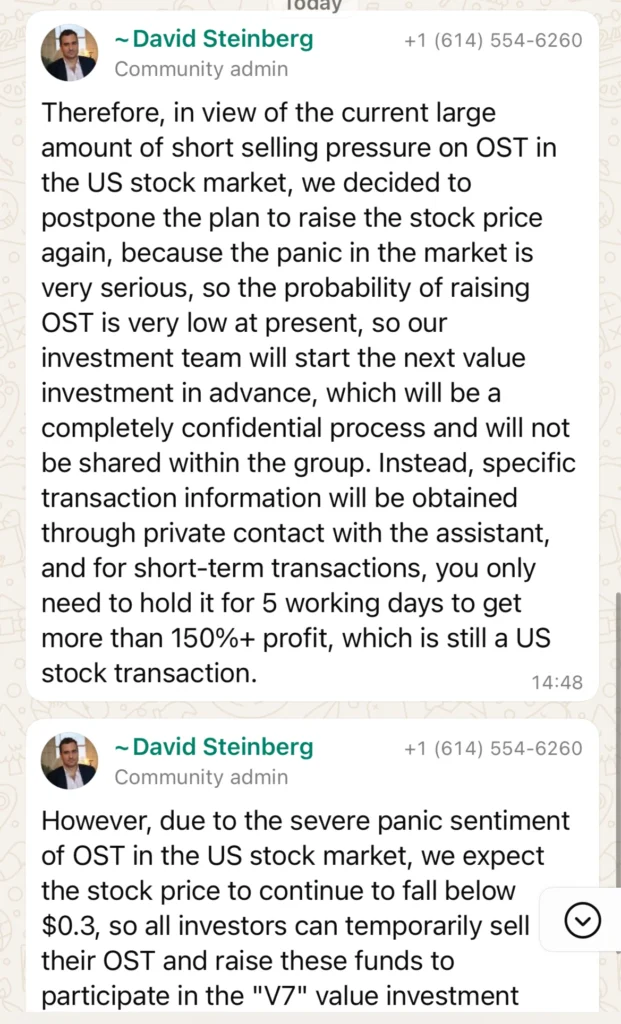

At the same time, dozens of WhatsApp and Telegram groups were actively encouraging users to “buy and hold” OST, promising a “confidential institutional plan” to raise the price within 5 days. Victims were told not to worry about price dips — that volatility was “planned,” and that they’d soon receive profits of 150% or more.

But just as the hype reached its peak, OST’s price suddenly collapsed, falling from nearly $9 to under $0.50 in a matter of hours. Many investors were caught in the drop, unable to sell, frozen by hope — or worse, pressured by group admins to keep holding.

How the Scam Was Orchestrated

This was not your typical “Reddit meme stock” movement. It was a well-organized, international pump-and-dump scheme designed to manipulate small investors into buying heavily diluted shares at the worst possible time.

Here’s how it worked:

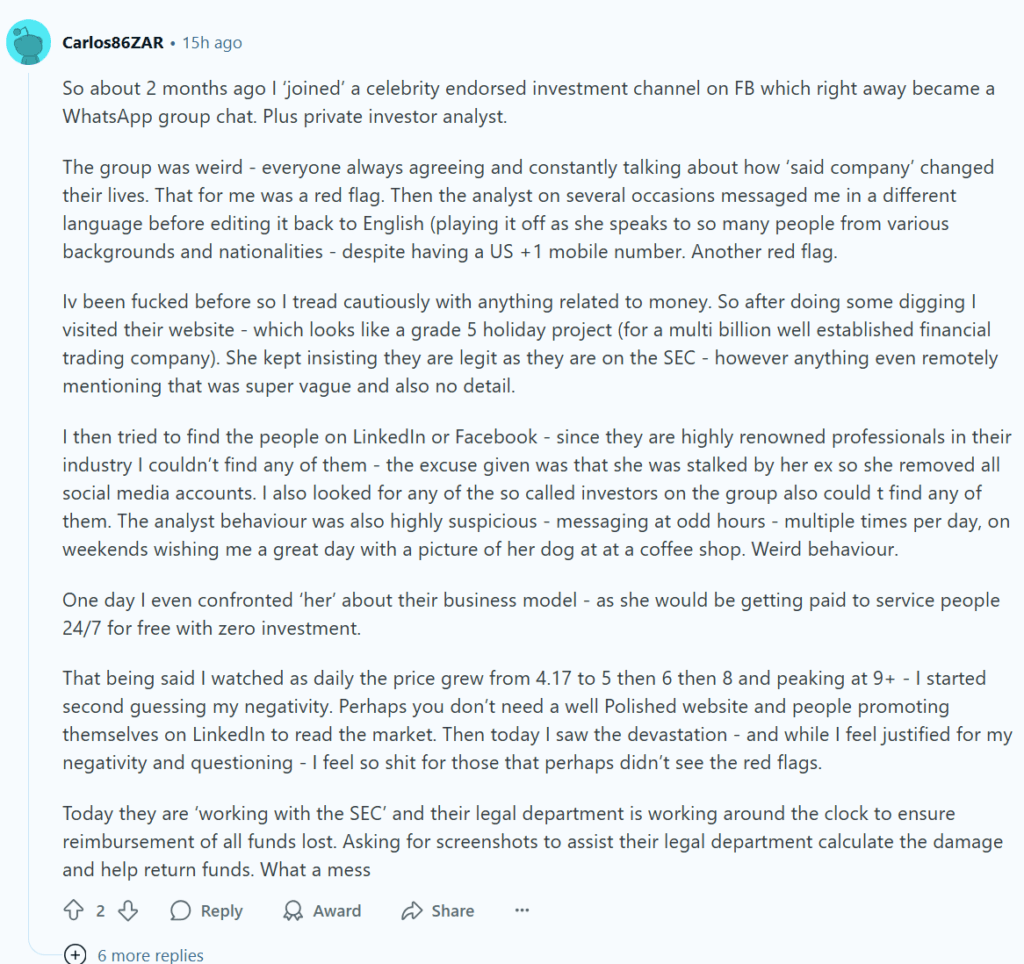

- Recruitment: Investors were added to private WhatsApp and Telegram groups with names like “Premium US Equity Picks” or “Wall Street Investment Circle.” The admins often claimed to be investment bankers or senior analysts from firms like “Monograph Wealth” or “North River Partners.”

- Emotional Manipulation: Group leaders used fake identities (like David Steinberg, Davis Clayson Jr., and Laurence Cohen) and polished grammar to look legitimate. They even created fake investor conversations — dozens of group members repeatedly claimed they were “buying more,” “up 2x,” or “waiting for the 150% profit.”

- Fake Exclusivity: They insisted the strategy was a “confidential institutional plan” and told users not to share the group’s info publicly, reinforcing the idea that this was an elite financial opportunity. If someone questioned the plan, they were silenced or removed from the group.

- Mass Dilution via Warrants: Between April and May, OST issued millions of shares and warrants:

- On April 15, they offered 9.09 million Class A shares, each paired with two warrants — enabling the creation of nearly 91 million more shares.

- By May 3, 18.18 million warrants were exchanged for over 70 million new shares.

- In total, this brought potential dilution of over 1,200%, an astronomical figure that guaranteed existing shareholders would be wiped out as new shares flooded the market.

The Company’s Official Statement

After the stock’s collapse, Ostin Technology issued a press release on June 27, 2025, saying:

“The Company does not have any undisclosed material matters, nor is it aware of the specific reasons for the abnormal stock price fluctuations… We urge investors to rely solely on filings with the U.S. Securities and Exchange Commission.”

In simple terms: they’re denying any involvement in the stock pump and reminding investors that they are only responsible for what’s published officially on SEC channels.

While the company itself may not have initiated the scam, the timing of their stock offerings, share issuances, and lack of transparency during the price surge — combined with how easily their shares were manipulated — raises serious concerns about corporate governance, regulatory oversight, and investor protection.

What Went Wrong: The Fundamentals Behind OST

Despite the technical excitement and social media buzz, Ostin Technology was never a strong company to begin with. A simple look at the financial statements reveals deep red flags that any investor could have spotted — if they weren’t misled by hype.

- Declining Revenue: Over recent quarters, OST’s top-line sales figures have been steadily decreasing. For a hardware manufacturer, especially one competing in a low-margin space like display modules, declining revenue often signals deteriorating demand or failed expansion strategies.

- Negative Net Income: The company has been consistently unprofitable, bleeding cash even in quarters when market sentiment was strong. This means no matter how much they sell, they still spend more than they earn — often a sign of weak management and a broken business model.

- Poor Cash Flow: Most alarmingly, OST has been operating with negative cash flows, meaning it’s not generating enough real money to cover operations. To survive, it must continuously raise funds through new share offerings, which heavily dilutes shareholder value.

Put simply: even without the scam, OST was never a strong investment — and the financials prove it.

Real People, Real Losses

This wasn’t just an investment gone bad. It was a life-shattering event for many.

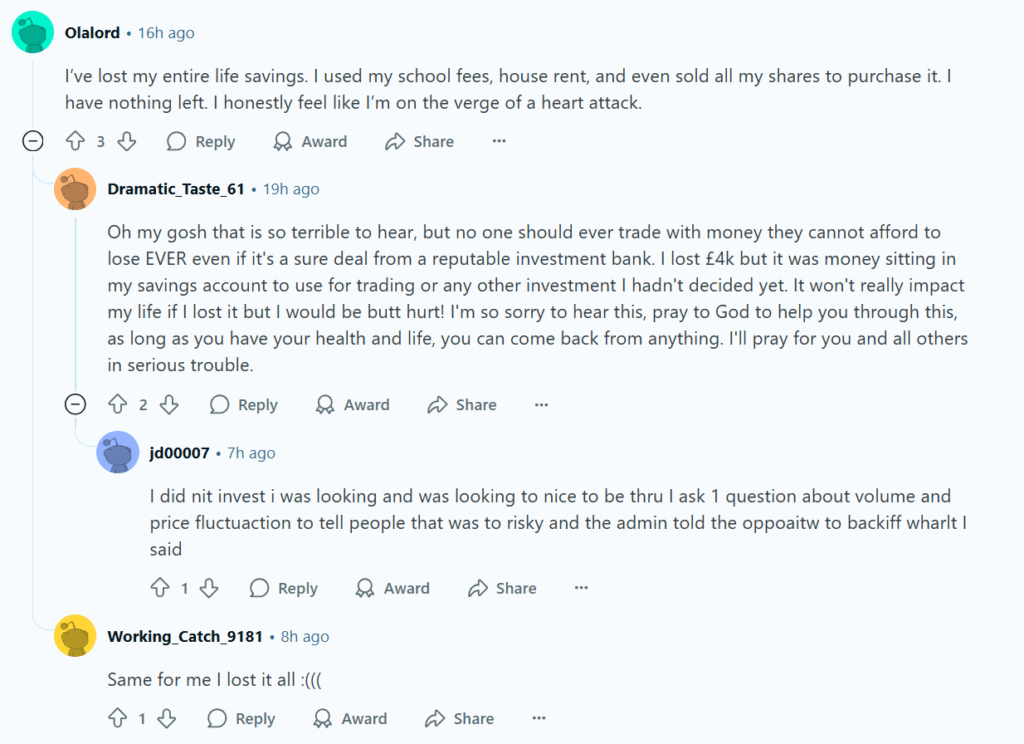

Dozens of victims have come forward on Reddit, Twitter, and stock forums, sharing gut-wrenching stories:

“I used my school fees, my rent money, even borrowed from my parents to buy OST… I have nothing left. I feel like I’m on the verge of a heart attack.”

“I lost 21k today. I needed that to pay for school. I’m so mad at myself. I didn’t trust my gut.”

“I sold my car and used the insurance payout thinking I would double it. I can’t even explain to my family what happened.”

“They kept saying ‘just hold for 5 days’ — I lost everything. I feel so stupid. But they sounded so real.”

Others lost $50,000+, their emergency funds, or money set aside for medical bills, family support, and housing. For some, this was not just money lost — it was safety, trust, and emotional security destroyed.

What’s Still Going On?

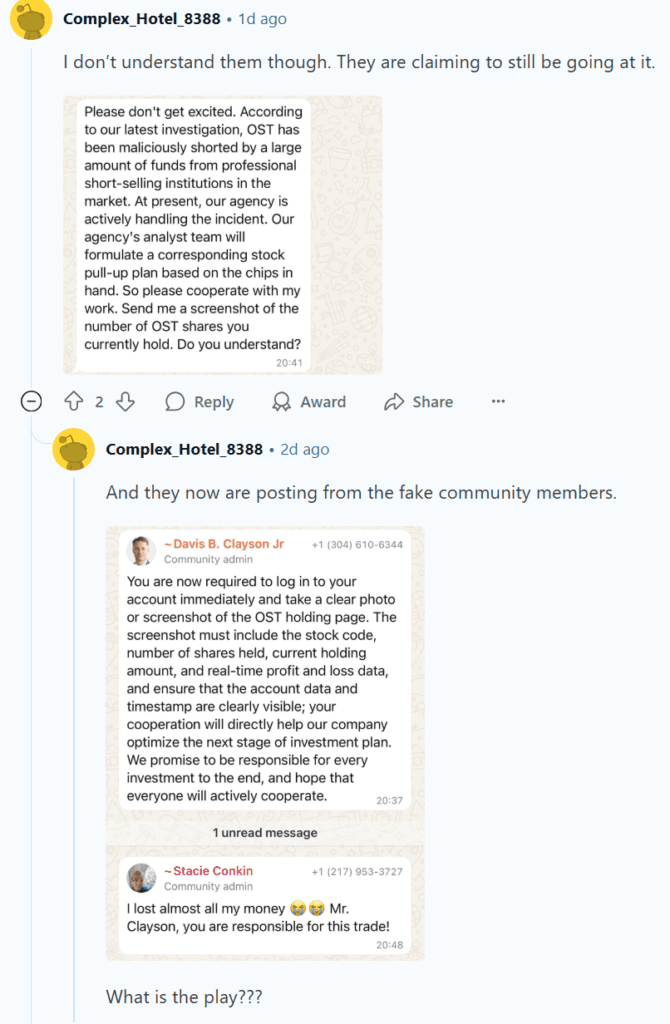

Many of the same WhatsApp admins are still active, now pushing other “value investment phases” and claiming a new plan is coming. Some are even faking recovery promises, trying to convince victims to send more money or hold their shares longer “to recover.”

This is a second wave of manipulation — what’s known as a “recovery scam.”

What Is a Recovery Scam?

Recovery scams target people who’ve already been scammed once. They typically take two forms:

- Fake Recovery Agents: Someone contacts you saying they can retrieve your lost funds — often claiming to be a lawyer, law enforcement agent, or hacker. They ask for a small upfront “fee” or “verification cost.” Then another. Then another.

- They’ll say:

- “I work with the SEC/FBI/Interpol and can recover your funds.”

- “I’m a hacker/lawyer/investigator and found your lost investment.”

- “Just pay a small fee, tax, insurance, or deposit and we’ll release your funds.” – These are fake. Every penny you send them will also be lost.

- Fake “Next Investment Phase”: You’re told that your losses can be recovered by joining a new secret plan — and all you need to do is buy more shares or send crypto for validation. Again, it’s a lie.

Scammers will exploit your desperation, offer hope, and then rob you again. Once you’re a victim, you’re on their list.

The golden rule:

No real recovery agent will contact you on social media, WhatsApp, or via DMs. Never trust unsolicited advice — especially in private.

How to Protect Yourself

1. Always check the fundamentals.

Before buying any stock, look at:

- Revenue trends

- Profit margins

- Cash flow

- Share dilution history

- SEC filings

If the company is burning cash and issuing millions of new shares, you are not investing — you are subsidizing their survival.

2. Avoid private investment chats.

If someone invites you to a secret Telegram or WhatsApp group about stocks — run. Real financial opportunities are public, transparent, and regulated. Not hidden behind aliases and fake smiles.

3. Never take investment advice from strangers online.

This includes Reddit DMs, Instagram influencers, “assistants” claiming they work for funds, or anyone who won’t show their regulatory credentials.

4. Set stop-losses — but understand their limits.

One victim placed a stop-loss at $6.10 — but because the price crashed so fast, it executed at $1.08. That’s the reality of low-volume penny stocks: you often can’t exit in time.

If You Were a Victim — What Now?

- Report your case to:

- Block all WhatsApp or Telegram contacts involved in the scam.

- Don’t try to “win it back” by rebuying OST. Any rally now is likely another trap designed to lure back desperate investors.

- Talk to others. Join support communities. Whether it’s Reddit, Stocktwits, or even real-world investor circles — you are absolutely not alone in this. Thousands of others were misled in the same way, with the same messages, from the same fake advisors

And to anyone reading this who was affected:

I’m so, so sorry for your loss.

Whether you lost your rent, your savings, your car fund, your student loans, or your family’s emergency money — you did not deserve this.

These scams are cruel. They are engineered with precision to break your trust, use your hope against you, and shame you into silence.

But let this be clear:

You are not dumb. You are not weak. And this loss does not define your future.

The people who got hurt in this scam were smart, hardworking individuals who simply wanted to do better — for themselves, for their families, for their futures. And that’s never something to be ashamed of.

You can rebuild. You can recover. And most importantly — you can help others avoid the same mistake by sharing your experience.

Let your next step be one of strength, not guilt.

You’re not alone — and you’re not broken.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Sources

Stock Scam Revealed – Herb Greenberg

Obscure Chinese Stock Scams – WSJ

Learn from My Mistake – Barchart

OST $5M Offering – AInvest

OST Company Statement – GlobeNewswire

Reddit Thread – r/QueenStreetBets

Recovery Scam Guide – SEON

SEC Whistleblower Portal

Report Fraud – FINRA

Report to IC3 – FB

Related:

Why Palantir Stock Is Sinking Today

Trump’s Tariff Deadline? ‘Not Critical,’ Says White House

Nike Reports After the Bell: Here’s Why Wall Street Expects a Weak Quarter

US IPOs Soar 53% in 2025, Led by Circle and CoreWeave — But Can the Boom Last?

In a First-of-Its-Kind Decision, Anthropic and Meta Win Copyright Lawsuits Brought by Authors